Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

<strong>Stock</strong> Profile: ICBC<br />

BUY HK$5.04 HSI : 24,599<br />

Price Target : 12-mth HK$ 6.0<br />

Potential Catalyst: Fur<strong>the</strong>r relaxation of QDII & announcement of<br />

“HK <strong>Stock</strong> Direct Train” program<br />

ANALYST<br />

Jasmine Lai +852 2971 1926<br />

jasmine_lai@hk.dbsvickers.com<br />

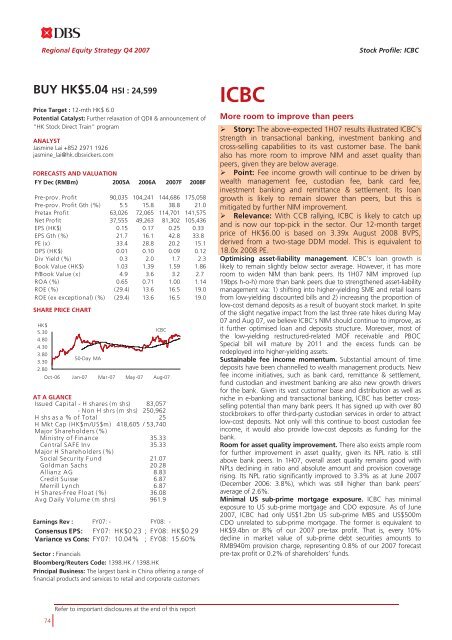

FORECASTS AND VALUATION<br />

FY Dec (RMBm) 2005A 2006A 2007F 2008F<br />

Pre-prov. Profit 90,035 104,241 144,686 175,058<br />

Pre-prov. Profit Gth (%) 5.5 15.8 38.8 21.0<br />

Pretax Profit 63,026 72,065 114,701 141,575<br />

Net Profit 37,555 49,263 81,302 105,436<br />

EPS (HK$) 0.15 0.17 0.25 0.33<br />

EPS Gth (%) 21.7 16.1 42.8 33.8<br />

PE (x) 33.4 28.8 20.2 15.1<br />

DPS (HK$) 0.01 0.10 0.09 0.12<br />

Div Yield (%) 0.3 2.0 1.7 2.3<br />

Book Value (HK$) 1.03 1.39 1.59 1.86<br />

P/Book Value (x) 4.9 3.6 3.2 2.7<br />

ROA (%) 0.65 0.71 1.00 1.14<br />

ROE (%) (29.4) 13.6 16.5 19.0<br />

ROE (ex exceptional) (%) (29.4) 13.6 16.5 19.0<br />

SHARE PRICE CHART<br />

HK$<br />

5.30<br />

4.80<br />

4.30<br />

3.80<br />

3.30<br />

2.80<br />

50-Day MA<br />

ICBC<br />

Oct-06 Jan-07 Mar-07 May-07 Aug-07<br />

AT A GLANCE<br />

Issued <strong>Cap</strong>ital - H shares (m shs) 83,057<br />

- Non H shrs (m shs) 250,962<br />

H shs as a % of Total 25<br />

H Mkt <strong>Cap</strong> (HK$m/US$m) 418,605 / 53,740<br />

Major Shareholders (%)<br />

Ministry of Finance 35.33<br />

Central SAFE Inv 35.33<br />

Major H Shareholders (%)<br />

Social Security Fund 21.07<br />

Goldman Sachs 20.28<br />

Allianz AG 8.83<br />

Credit Suisse 6.87<br />

Merrill Lynch 6.87<br />

H Shares-Free Float (%) 36.08<br />

Avg Daily Volume (m shrs) 961.9<br />

Earnings Rev : FY07: - FY08: -<br />

Consensus EPS: FY07: HK$0.23 ; FY08: HK$0.29<br />

Variance vs Cons: FY07: 10.04% ; FY08: 15.60%<br />

Sector : Financials<br />

Bloomberg/Reuters Code: 1398.HK / 1398.HK<br />

Principal Business: The largest bank in China offering a range of<br />

financial products <strong>and</strong> services to retail <strong>and</strong> corporate customers<br />

ICBC<br />

More room to improve than peers<br />

Story: The above-expected 1H07 results illustrated ICBC’s<br />

strength in transactional banking, investment banking <strong>and</strong><br />

cross-selling capabilities to its vast customer base. The bank<br />

also has more room to improve NIM <strong>and</strong> asset quality than<br />

peers, given <strong>the</strong>y are below average.<br />

Point: Fee income growth will continue to be driven by<br />

wealth management fee, custodian fee, bank card fee,<br />

investment banking <strong>and</strong> remittance & settlement. Its loan<br />

growth is likely to remain slower than peers, but this is<br />

mitigated by fur<strong>the</strong>r NIM improvement.<br />

Relevance: With CCB rallying, ICBC is likely to catch up<br />

<strong>and</strong> is now our top-pick in <strong>the</strong> sector. Our 12-month target<br />

price of HK$6.00 is based on 3.39x August 2008 BVPS,<br />

derived from a two-stage DDM model. This is equivalent to<br />

18.0x 2008 PE.<br />

Optimising asset-liability management. ICBC’s loan growth is<br />

likely to remain slightly below sector average. However, it has more<br />

room to widen NIM than bank peers. Its 1H07 NIM improved (up<br />

19bps h-o-h) more than bank peers due to streng<strong>the</strong>ned asset-liability<br />

management via: 1) shifting into higher-yielding SME <strong>and</strong> retail loans<br />

from low-yielding discounted bills <strong>and</strong> 2) increasing <strong>the</strong> proportion of<br />

low-cost dem<strong>and</strong> deposits as a result of buoyant stock market. In spite<br />

of <strong>the</strong> slight negative impact from <strong>the</strong> last three rate hikes during May<br />

07 <strong>and</strong> Aug 07, we believe ICBC’s NIM should continue to improve, as<br />

it fur<strong>the</strong>r optimised loan <strong>and</strong> deposits structure. Moreover, most of<br />

<strong>the</strong> low-yielding restructured-related MOF receivable <strong>and</strong> PBOC<br />

Special bill will mature by 2011 <strong>and</strong> <strong>the</strong> excess funds can be<br />

redeployed into higher-yielding assets.<br />

Sustainable fee income momentum. Substantial amount of time<br />

deposits have been channelled to wealth management products. New<br />

fee income initiatives, such as bank card, remittance & settlement,<br />

fund custodian <strong>and</strong> investment banking are also new growth drivers<br />

for <strong>the</strong> bank. Given its vast customer base <strong>and</strong> distribution as well as<br />

niche in e-banking <strong>and</strong> transactional banking, ICBC has better crossselling<br />

potential than many bank peers. It has signed up with over 80<br />

stockbrokers to offer third-party custodian services in order to attract<br />

low-cost deposits. Not only will this continue to boost custodian fee<br />

income, it would also provide low-cost deposits as funding for <strong>the</strong><br />

bank.<br />

Room for asset quality improvement. There also exists ample room<br />

for fur<strong>the</strong>r improvement in asset quality, given its NPL ratio is still<br />

above bank peers. In 1H07, overall asset quality remains good with<br />

NPLs declining in ratio <strong>and</strong> absolute amount <strong>and</strong> provision coverage<br />

rising. Its NPL ratio significantly improved to 3.3% as at June 2007<br />

(December 2006: 3.8%), which was still higher than bank peers’<br />

average of 2.6%.<br />

Minimal US sub-prime mortgage exposure. ICBC has minimal<br />

exposure to US sub-prime mortgage <strong>and</strong> CDO exposure. As of June<br />

2007, ICBC had only US$1.2bn US sub-prime MBS <strong>and</strong> US$500m<br />

CDO unrelated to sub-prime mortgage. The former is equivalent to<br />

HK$9.4bn or 8% of our 2007 pre-tax profit. That is, every 10%<br />

decline in market value of sub-prime debt securities amounts to<br />

RMB940m provision charge, representing 0.8% of our 2007 forecast<br />

pre-tax profit or 0.2% of shareholders’ funds.<br />

Refer to important disclosures at <strong>the</strong> end of this report<br />

74