Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

<strong>Stock</strong> Profile: SembCorp Industries<br />

BUY S$6.00 STI : 3,476.31<br />

Price Target : 12-month S$ 7.50<br />

Potential Catalyst: Contract wins<br />

ANALYST<br />

Jesvinder S<strong>and</strong>hu +65 6398 7965<br />

jesvinder@dbsvickers.com<br />

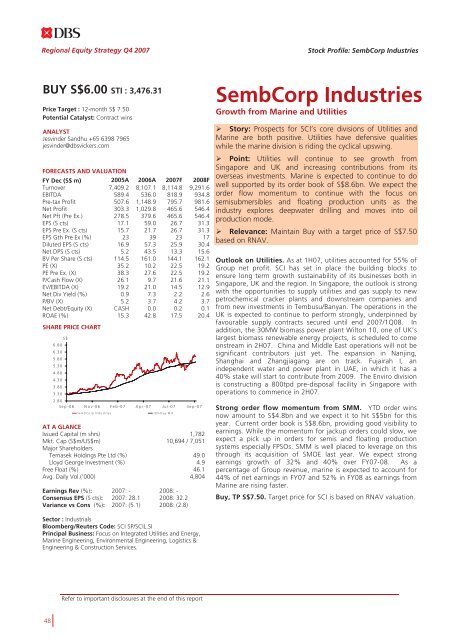

FORECASTS AND VALUATION<br />

FY Dec (S$ m) 2005A 2006A 2007F 2008F<br />

Turnover 7,409.2 8,107.1 8,114.8 9,291.6<br />

EBITDA 589.4 536.0 818.9 934.8<br />

Pre-tax Profit 507.6 1,148.9 795.7 981.6<br />

Net Profit 303.3 1,029.8 465.6 546.4<br />

Net Pft (Pre Ex.) 278.5 379.6 465.6 546.4<br />

EPS (S cts) 17.1 59.0 26.7 31.3<br />

EPS Pre Ex. (S cts) 15.7 21.7 26.7 31.3<br />

EPS Gth Pre Ex (%) 23 39 23 17<br />

Diluted EPS (S cts) 16.9 57.3 25.9 30.4<br />

Net DPS (S cts) 5.2 43.5 13.3 15.6<br />

BV Per Share (S cts) 114.5 161.0 144.1 162.1<br />

PE (X) 35.2 10.2 22.5 19.2<br />

PE Pre Ex. (X) 38.3 27.6 22.5 19.2<br />

P/Cash Flow (X) 26.1 9.7 21.6 21.1<br />

EV/EBITDA (X) 19.2 21.0 14.5 12.9<br />

Net Div Yield (%) 0.9 7.3 2.2 2.6<br />

P/BV (X) 5.2 3.7 4.2 3.7<br />

Net Debt/Equity (X) CASH 0.0 0.2 0.1<br />

ROAE (%) 15.3 42.8 17.5 20.4<br />

SHARE PRICE CHART<br />

S$<br />

6.80<br />

6.30<br />

5.80<br />

5.30<br />

4.80<br />

4.30<br />

3.80<br />

3.30<br />

2.80<br />

Sep-06 Nov-06 Feb-07 Apr-07 Jul-07 Sep-07<br />

SembCorp Industries<br />

100-Day M A<br />

AT A GLANCE<br />

Issued <strong>Cap</strong>ital (m shrs) 1,782<br />

Mkt. <strong>Cap</strong> (S$m/US$m) 10,694 / 7,051<br />

Major Shareholders<br />

Temasek Holdings Pte Ltd (%) 49.0<br />

Lloyd George Investment (%) 4.9<br />

Free Float (%) 46.1<br />

Avg. Daily Vol.(‘000) 4,804<br />

Earnings Rev (%): 2007: - 2008: -<br />

Consensus EPS (S cts): 2007: 28.1 2008: 32.2<br />

Variance vs Cons (%): 2007: (5.1) 2008: (2.8)<br />

Sector : Industrials<br />

Bloomberg/Reuters Code: SCI SP/SCIL.SI<br />

Principal Business: Focus on Integrated Utilities <strong>and</strong> Energy,<br />

Marine Engineering, Environmental Engineering, Logistics &<br />

Engineering & Construction Services.<br />

SembCorp Industries<br />

Growth from Marine <strong>and</strong> Utilities<br />

Story: Prospects for SCI’s core divisions of Utilities <strong>and</strong><br />

Marine are both positive. Utilities have defensive qualities<br />

while <strong>the</strong> marine division is riding <strong>the</strong> cyclical upswing.<br />

Point: Utilities will continue to see growth from<br />

Singapore <strong>and</strong> UK <strong>and</strong> increasing contributions from its<br />

overseas investments. Marine is expected to continue to do<br />

well supported by its order book of S$8.6bn. We expect <strong>the</strong><br />

order flow momentum to continue with <strong>the</strong> focus on<br />

semisubmersibles <strong>and</strong> floating production units as <strong>the</strong><br />

industry explores deepwater drilling <strong>and</strong> moves into oil<br />

production mode.<br />

Relevance: Maintain Buy with a target price of S$7.50<br />

based on RNAV.<br />

Outlook on Utilities. As at 1H07, utilities accounted for 55% of<br />

Group net profit. SCI has set in place <strong>the</strong> building blocks to<br />

ensure long term growth sustainability of its businesses both in<br />

Singapore, UK <strong>and</strong> <strong>the</strong> region. In Singapore, <strong>the</strong> outlook is strong<br />

with <strong>the</strong> opportunities to supply utilities <strong>and</strong> gas supply to new<br />

petrochemical cracker plants <strong>and</strong> downstream companies <strong>and</strong><br />

from new investments in Tembusu/Banyan. The operations in <strong>the</strong><br />

UK is expected to continue to perform strongly, underpinned by<br />

favourable supply contracts secured until end 2007/1Q08. In<br />

addition, <strong>the</strong> 30MW biomass power plant Wilton 10, one of UK’s<br />

largest biomass renewable energy projects, is scheduled to come<br />

onstream in 2H07. China <strong>and</strong> Middle East operations will not be<br />

significant contributors just yet. The expansion in Nanjing,<br />

Shanghai <strong>and</strong> Zhangjiagang are on track. Fujairah I, an<br />

independent water <strong>and</strong> power plant in UAE, in which it has a<br />

40% stake will start to contribute from 2009. The Enviro division<br />

is constructing a 800tpd pre-disposal facility in Singapore with<br />

operations to commence in 2H07.<br />

Strong order flow momentum from SMM. YTD order wins<br />

now amount to S$4.8bn <strong>and</strong> we expect it to hit S$5bn for this<br />

year. Current order book is S$8.6bn, providing good visibility to<br />

earnings. While <strong>the</strong> momentum for jackup orders could slow, we<br />

expect a pick up in orders for semis <strong>and</strong> floating production<br />

systems especially FPSOs. SMM is well placed to leverage on this<br />

through its acquisition of SMOE last year. We expect strong<br />

earnings growth of 32% <strong>and</strong> 40% over FY07-08. As a<br />

percentage of Group revenue, marine is expected to account for<br />

44% of net earnings in FY07 <strong>and</strong> 52% in FY08 as earnings from<br />

Marine are rising faster.<br />

Buy, TP S$7.50. Target price for SCI is based on RNAV valuation.<br />

Refer to important disclosures at <strong>the</strong> end of this report<br />

48