Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

<strong>Strategy</strong> Overview: Asian Equity<br />

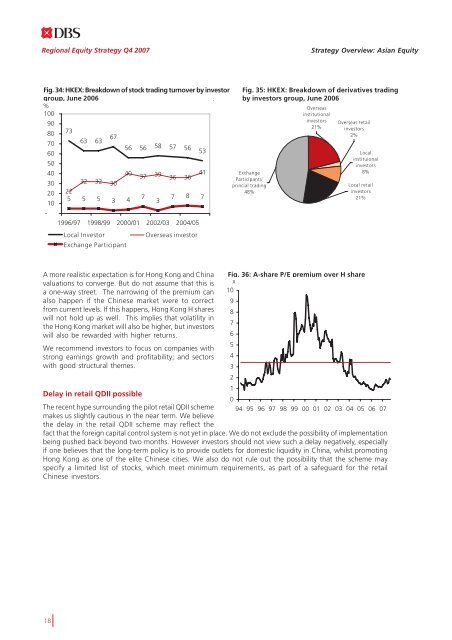

Fig. 34: HKEX: Breakdown of stock trading turnover by investor<br />

group, June 2006<br />

%<br />

100<br />

-<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

73<br />

63 63<br />

67<br />

32 32 30<br />

22<br />

5 5 5 3 4<br />

56 56 58 57 56<br />

40<br />

37 39<br />

7<br />

3<br />

36 36<br />

53<br />

41<br />

7 8 7<br />

1996/97 1998/99 2000/01 2002/03 2004/05<br />

Local Investor<br />

Exchange Participant<br />

Overseas investor<br />

Fig. 35: HKEX: Breakdown of derivatives trading<br />

by investors group, June 2006<br />

Exchange<br />

Participants'<br />

princial trading<br />

48%<br />

Overseas<br />

institutional<br />

investors<br />

21%<br />

Overseas retail<br />

investors<br />

2%<br />

Local<br />

instituional<br />

investors<br />

8%<br />

Local retail<br />

investors<br />

21%<br />

A more realistic expectation is for Hong Kong <strong>and</strong> China<br />

valuations to converge. But do not assume that this is<br />

a one-way street. The narrowing of <strong>the</strong> premium can<br />

also happen if <strong>the</strong> Chinese market were to correct<br />

from current levels. If this happens, Hong Kong H shares<br />

will not hold up as well. This implies that volatility in<br />

<strong>the</strong> Hong Kong market will also be higher, but investors<br />

will also be rewarded with higher returns.<br />

We recommend investors to focus on companies with<br />

strong earnings growth <strong>and</strong> profitability; <strong>and</strong> sectors<br />

with good structural <strong>the</strong>mes.<br />

Fig. 36: A-share P/E premium over H share<br />

x<br />

10<br />

2<br />

1<br />

Delay in retail QDII possible<br />

0<br />

The recent hype surrounding <strong>the</strong> pilot retail QDII scheme 94 95 96 97 98 99 00 01 02 03 04 05 06 07<br />

makes us slightly cautious in <strong>the</strong> near term. We believe<br />

<strong>the</strong> delay in <strong>the</strong> retail QDII scheme may reflect <strong>the</strong><br />

fact that <strong>the</strong> foreign capital control system is not yet in place. We do not exclude <strong>the</strong> possibility of implementation<br />

being pushed back beyond two months. However investors should not view such a delay negatively, especially<br />

if one believes that <strong>the</strong> long-term policy is to provide outlets for domestic liquidity in China, whilst promoting<br />

Hong Kong as one of <strong>the</strong> elite Chinese cities. We also do not rule out <strong>the</strong> possibility that <strong>the</strong> scheme may<br />

specify a limited list of stocks, which meet minimum requirements, as part of a safeguard for <strong>the</strong> retail<br />

Chinese investors.<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

18