Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

<strong>Strategy</strong> Overview: Asian Equity<br />

Asian Equity: Fire walk<br />

with me<br />

• Fire walking, it is said, transforms fear into power. Investors in Asian<br />

equities should walk through <strong>the</strong> US' sub-prime-related volatility <strong>and</strong><br />

stay focused on <strong>the</strong> region's underlying fundamentals. Investors around<br />

<strong>the</strong> globe are fixated with three main concerns – <strong>the</strong> risks to <strong>the</strong> US<br />

economy, a global liquidity crunch <strong>and</strong> a contagion impact from US subprime<br />

problems to o<strong>the</strong>r asset classes. We believe that <strong>the</strong> volatility offers<br />

good opportunities for accumulation, in anticipation of a year-end rally<br />

commencing in November<br />

• The bond market has factored in <strong>the</strong> latest Fed rate cut to alleviate <strong>the</strong><br />

liquidity problems in <strong>the</strong> financial system. This was less so for equity<br />

markets. Equities markets had cheered <strong>the</strong> latest rate cut, as expected.<br />

We now look for ano<strong>the</strong>r 25bps cut in October. But if <strong>the</strong> Fed cut does<br />

not transpire because credit conditions have stabilized <strong>and</strong> US growth<br />

outlook is intact, <strong>the</strong>re should be more reasons to buy equities.<br />

• We recommend Hong Kong / China for liquidity, Singapore for valuations<br />

<strong>and</strong> earnings quality, <strong>and</strong> Thail<strong>and</strong> for accelerating growth in 2008. We<br />

downgrade Korea <strong>and</strong> continue to avoid Taiwan due to exposure to <strong>the</strong><br />

US consumer. As for sectors, we recommend specialised small caps<br />

leveraged to Asia's structural growth <strong>and</strong> global business spending, <strong>and</strong><br />

diversified large caps for all-round economic expansion. There are also<br />

opportunities to buy Asian financials on lower prices as <strong>the</strong>y become<br />

oversold on <strong>the</strong> back of current sub-prime concerns<br />

• In our regional allocation, we have upgraded Hong Kong / China <strong>and</strong><br />

Thail<strong>and</strong> at <strong>the</strong> expense of Malaysia <strong>and</strong> Korea. We are underweight<br />

Korea <strong>and</strong> Taiwan, benchmark-weighted in Malaysia, Indonesia <strong>and</strong> India,<br />

<strong>and</strong> overweight in Hong Kong /China, Thail<strong>and</strong> <strong>and</strong> Singapore<br />

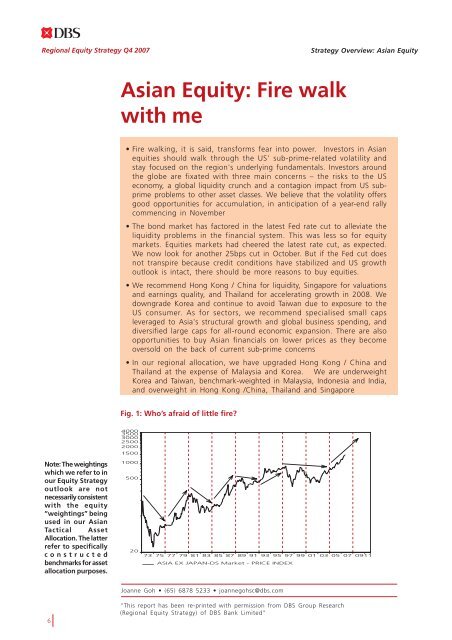

Fig. 1: Who’s afraid of little fire?<br />

Note: The weightings<br />

which we refer to in<br />

our Equity <strong>Strategy</strong><br />

outlook are not<br />

necessarily consistent<br />

with <strong>the</strong> equity<br />

“weightings” being<br />

used in our Asian<br />

Tactical Asset<br />

Allocation. The latter<br />

refer to specifically<br />

constructed<br />

benchmarks for asset<br />

allocation purposes.<br />

4000<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

20<br />

73 75 77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 07 0911<br />

ASIA EX JAPAN-DS Market - PRICE INDEX<br />

Source: DATASTREAM<br />

Joanne Goh • (65) 6878 5233 • joannegohsc@dbs.com<br />

6<br />

"This report has been re-printed with permission from <strong>DBS</strong> Group Research<br />

(Regional Equity <strong>Strategy</strong>) of <strong>DBS</strong> Bank Limited"