Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

<strong>Strategy</strong> Overview: Asian Equity<br />

Malaysia (<strong>Down</strong>grade to Benchmark weight) vs Thail<strong>and</strong> (Upgrade to Overweight)<br />

We are downgrading Malaysia in favour of a Thail<strong>and</strong> upgrade. The trade off is based<br />

on <strong>the</strong> following changes in <strong>the</strong> past three months: -<br />

a. Both countries will probably have elections within <strong>the</strong> next six months. Thail<strong>and</strong> has<br />

announced <strong>the</strong> elections date on December 23, but Malaysia has still yet to decide<br />

on one. Our ground checks suggest that Malaysia's elections will probably be next<br />

year. Although we do no rule out <strong>the</strong> possibility of Thail<strong>and</strong>'s elections to be delayed<br />

due to <strong>the</strong> King's birthday, <strong>and</strong> Asian games in December, <strong>the</strong> elections should be<br />

held in January at <strong>the</strong> latest.<br />

b. The sentiments toward <strong>the</strong> elections were different in <strong>the</strong>se two countries; Thail<strong>and</strong><br />

is for a change <strong>and</strong> Malaysia for goodies, or ra<strong>the</strong>r, more goodies. Hence elections<br />

in Thail<strong>and</strong> will be <strong>the</strong> earlier <strong>the</strong> better <strong>and</strong> Malaysia <strong>the</strong> later <strong>the</strong> better. As such<br />

we feel that market impact from elections will be greater in Thail<strong>and</strong> than in Malaysia.<br />

c. Economic <strong>and</strong> corporate earnings growth in Thail<strong>and</strong> hit ano<strong>the</strong>r low in <strong>the</strong> second<br />

quarter. Meanwhile upgrades for 2008 has emerged. <strong>DBS</strong> Economics has upgraded<br />

2008 GDP from 5.1% to 5.5% in anticipation of more investment spending to come.<br />

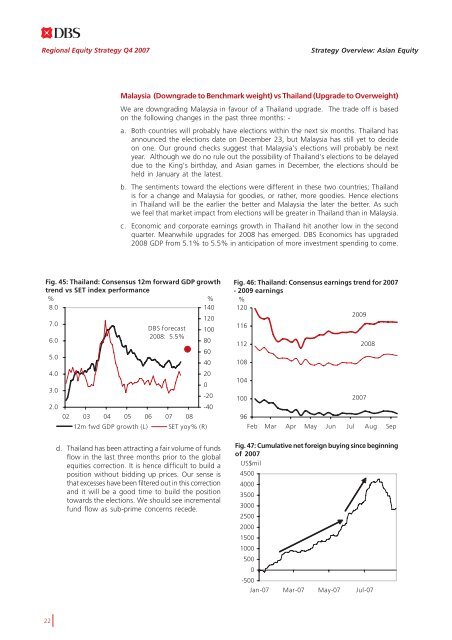

Fig. 45: Thail<strong>and</strong>: Consensus 12m forward GDP growth<br />

trend vs SET index performance<br />

%<br />

%<br />

8.0<br />

140<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

02 03 04 05 06 07 08<br />

12m fwd GDP growth (L)<br />

<strong>DBS</strong> forecast<br />

2008: 5.5%<br />

120<br />

100<br />

-20<br />

-40<br />

d. Thail<strong>and</strong> has been attracting a fair volume of funds<br />

flow in <strong>the</strong> last three months prior to <strong>the</strong> global<br />

equities correction. It is hence difficult to build a<br />

position without bidding up prices. Our sense is<br />

that excesses have been filtered out in this correction<br />

<strong>and</strong> it will be a good time to build <strong>the</strong> position<br />

towards <strong>the</strong> elections. We should see incremental<br />

fund flow as sub-prime concerns recede.<br />

80<br />

60<br />

40<br />

20<br />

0<br />

SET yoy% (R)<br />

Fig. 46: Thail<strong>and</strong>: Consensus earnings trend for 2007<br />

- 2009 earnings<br />

%<br />

120<br />

2009<br />

116<br />

112<br />

2008<br />

108<br />

104<br />

100<br />

2007<br />

96<br />

Feb Mar Apr May Jun Jul Aug Sep<br />

Fig. 47: Cumulative net foreign buying since beginning<br />

of 2007<br />

US$mil<br />

4500<br />

4000<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

-500<br />

Jan-07 Mar-07 May-07 Jul-07<br />

22