Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

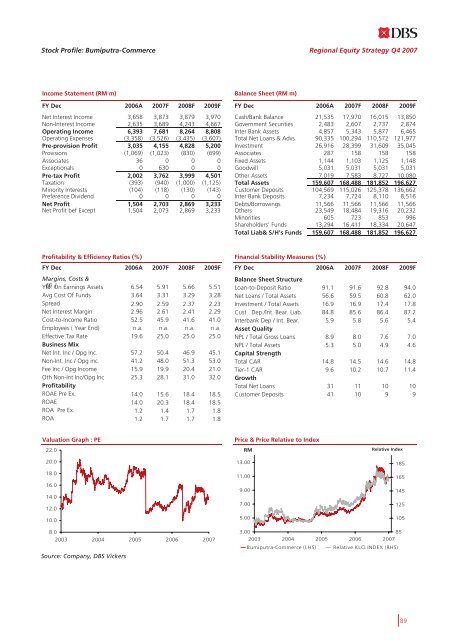

<strong>Stock</strong> Profile: Bumiputra-Commerce<br />

Regional Equity <strong>Strategy</strong> Q4 2007<br />

Income Statement (RM m) Balance Sheet (RM m)<br />

FY Dec 2006A 2007F 2008F 2009F FY Dec 2006A 2007F 2008F 2009F<br />

Net Interest Income 3,658 3,873 3,879 3,970 Cash/Bank Balance 21,535 17,970 16,015 13,850<br />

Non-Interest Income 2,635 3,689 4,243 4,667 Government Securities 2,483 2,607 2,737 2,874<br />

Operating Income 6,393 7,681 8,264 8,808 Inter Bank Assets 4,857 5,343 5,877 6,465<br />

Operating Expenses (3,358) (3,526) (3,435) (3,607) Total Net Loans & Advs. 90,335 100,294 110,572 121,977<br />

Pre-provision Profit 3,035 4,155 4,828 5,200 Investment 26,916 28,399 31,609 35,045<br />

Provisions (1,069) (1,023) (830) (699) Associates 287 158 158 158<br />

Associates 36 0 0 0 Fixed Assets 1,144 1,103 1,125 1,148<br />

Exceptionals 0 630 0 0 Goodwill 5,031 5,031 5,031 5,031<br />

Pre-tax Profit 2,002 3,762 3,999 4,501 O<strong>the</strong>r Assets 7,019 7,583 8,727 10,080<br />

Taxation (393) (940) (1,000) (1,125) Total Assets 159,607 168,488 181,852 196,627<br />

Minority Interests (104) (118) (130) (143) Customer Deposits 104,569 115,026 125,378 136,662<br />

Preference Dividend 0 0 0 0 Inter Bank Deposits 7,234 7,724 8,110 8,516<br />

Net Profit 1,504 2,703 2,869 3,233 Debts/Borrowings 11,566 11,566 11,566 11,566<br />

Net Profit bef Except 1,504 2,073 2,869 3,233 O<strong>the</strong>rs 23,549 18,484 19,316 20,232<br />

Minorities 605 723 853 996<br />

Shareholders' Funds 13,294 16,411 18,334 20,647<br />

Total Liab& S/H’s Funds 159,607 168,488 181,852 196,627<br />

Profitability & Efficiency Ratios (%) Financial Stability Measures (%)<br />

FY Dec 2006A 2007F 2008F 2009F FY Dec 2006A 2007F 2008F 2009F<br />

Margins, Costs &<br />

Balance Sheet Structure<br />

Yld. ffi On i Earnings Assets 6.54 5.91 5.66 5.51 Loan-to-Deposit Ratio 91.1 91.6 92.8 94.0<br />

Avg Cost Of Funds 3.64 3.31 3.29 3.28 Net Loans / Total Assets 56.6 59.5 60.8 62.0<br />

Spread 2.90 2.59 2.37 2.23 Investment / Total Assets 16.9 16.9 17.4 17.8<br />

Net Interest Margin 2.96 2.61 2.41 2.29 Cust . Dep./Int. Bear. Liab. 84.8 85.6 86.4 87.2<br />

Cost-to-Income Ratio 52.5 45.9 41.6 41.0 Interbank Dep / Int. Bear. 5.9 5.8 5.6 5.4<br />

Employees ( Year End) n.a. n.a. n.a. n.a. Asset Quality<br />

Effective Tax Rate 19.6 25.0 25.0 25.0 NPL / Total Gross Loans 8.9 8.0 7.6 7.0<br />

Business Mix NPL / Total Assets 5.3 5.0 4.9 4.6<br />

Net Int. Inc / Opg Inc. 57.2 50.4 46.9 45.1 <strong>Cap</strong>ital Strength<br />

Non-Int. Inc / Opg inc. 41.2 48.0 51.3 53.0 Total CAR 14.8 14.5 14.6 14.8<br />

Fee Inc / Opg Income 15.9 19.9 20.4 21.0 Tier-1 CAR 9.6 10.2 10.7 11.4<br />

Oth Non-Int Inc/Opg Inc 25.3 28.1 31.0 32.0 Growth<br />

Profitability Total Net Loans 31 11 10 10<br />

ROAE Pre Ex. 14.0 15.6 18.4 18.5 Customer Deposits 41 10 9 9<br />

ROAE 14.0 20.3 18.4 18.5<br />

ROA Pre Ex. 1.2 1.4 1.7 1.8<br />

ROA 1.2 1.7 1.7 1.8<br />

Valuation Graph : PE<br />

22.0<br />

20.0<br />

18.0<br />

16.0<br />

14.0<br />

12.0<br />

10.0<br />

Price & Price Relative to Index<br />

RM<br />

13.00<br />

11.00<br />

9.00<br />

7.00<br />

5.00<br />

Relative Index<br />

185<br />

165<br />

145<br />

125<br />

105<br />

8.0<br />

2003 2004 2005 2006 2007<br />

Source: Company, <strong>DBS</strong> <strong>Vickers</strong><br />

3.00<br />

85<br />

2003 2004 2005 2006 2007<br />

Bumiputra-Commerce (LHS) Relative KLCI INDEX (RHS)<br />

89