Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

<strong>Strategy</strong> Overview: Asian Equity<br />

Index Target<br />

Most market indices had surpassed our previous Dec 07 target, despite a mid-quarter<br />

correction. We are upgrading our index targets to reflect our still positive outlook for<br />

Asian markets. We are looking for volatility in <strong>the</strong> next one month before a year<br />

end rally in November. Event risk surrounding <strong>the</strong> 3rd quarter results season is quite<br />

high in our view, but markets should not find ano<strong>the</strong>r bottom as sentiments have<br />

improved after <strong>the</strong> stock market recovery. Our recommendation is to accumulate<br />

on weak days in order to position for a year end rally.<br />

Chinese retail QDII scheme <strong>and</strong> 17th National Congress should provide positive<br />

sentiments in Hong Kong in <strong>the</strong> near term, <strong>and</strong> we believe our index target<br />

for HSI <strong>and</strong> H-share for 2008 should have more upside with 2008 being <strong>the</strong><br />

China’s Olympics year. Elsewhere sentiments should remain positive as elections<br />

in Thail<strong>and</strong>, Malaysia, Korea, <strong>and</strong> Taiwan are occurring by end of this year or<br />

by early next year. Singapore should see 2008 as ano<strong>the</strong>r construction boom<br />

year <strong>and</strong> tourist arrivals for <strong>the</strong> Formula One event, new tourist attraction<br />

<strong>the</strong> Singapore Flyer; <strong>and</strong> visitors <strong>and</strong> training teams for Olympics are transiting<br />

here while enroute to Beijing. Indonesia should also be benefiting from rising<br />

commodity prices <strong>and</strong> India’s domestic dem<strong>and</strong> continue to soar. Near term<br />

risks we are seeing volatility from subprime concerns but complacency should<br />

see indices surging by early next year before we see ano<strong>the</strong>r bull market<br />

correction.<br />

Our preference in terms of market ranking are Hong Kong / China, Thail<strong>and</strong>,<br />

Singapore, Malaysia, India, indonesia, Korea <strong>and</strong> Taiwan.<br />

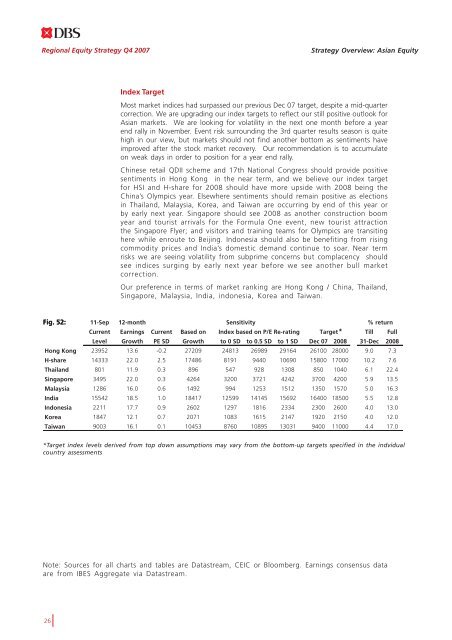

Fig. 52: 11-Sep 12-month<br />

Sensitivity<br />

% return<br />

Current Earnings Current Based on Index based on P/E Re-rating Target*<br />

Till Full<br />

Level Growth PE SD Growth to 0 SD to 0.5 SD to 1 SD Dec 07 2008 31-Dec 2008<br />

Hong Kong 23952 13.6 -0.2 27209 24813 26989 29164 26100 28000 9.0 7.3<br />

H-share 14333 22.0 2.5 17486 8191 9440 10690 15800 17000 10.2 7.6<br />

Thail<strong>and</strong> 801 11.9 0.3 896 547 928 1308 850 1040 6.1 22.4<br />

Singapore 3495 22.0 0.3 4264 3200 3721 4242 3700 4200 5.9 13.5<br />

Malaysia 1286 16.0 0.6 1492 994 1253 1512 1350 1570 5.0 16.3<br />

India 15542 18.5 1.0 18417 12599 14145 15692 16400 18500 5.5 12.8<br />

Indonesia 2211 17.7 0.9 2602 1297 1816 2334 2300 2600 4.0 13.0<br />

Korea 1847 12.1 0.7 2071 1083 1615 2147 1920 2150 4.0 12.0<br />

Taiwan 9003 16.1 0.1 10453 8760 10895 13031 9400 11000 4.4 17.0<br />

*Target index levels derived from top down assumptions may vary from <strong>the</strong> bottom-up targets specified in <strong>the</strong> indvidual<br />

country assessments<br />

Note: Sources for all charts <strong>and</strong> tables are Datastream, CEIC or Bloomberg. Earnings consensus data<br />

are from IBES Aggregate via Datastream.<br />

26