Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

<strong>Stock</strong> Profile: CDL Hospitality Trusts<br />

BUY S$2.35 STI : 3,476.31<br />

Price Target : 12-Month S$ 2.90<br />

Potential Catalyst: Strong domestic <strong>and</strong> regional play<br />

ANALYST<br />

Singapore Research Team<br />

research@dbsvickers.com<br />

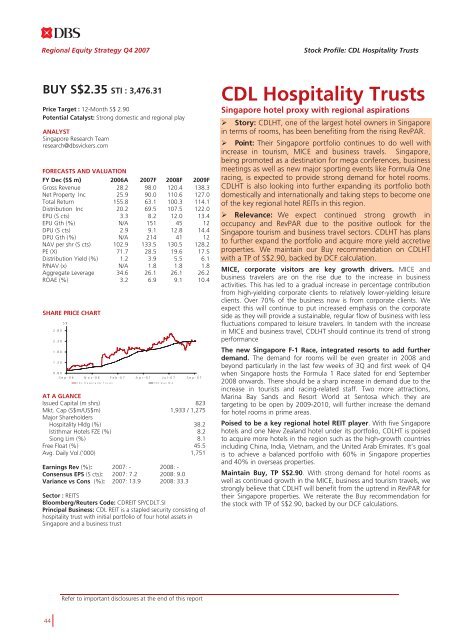

FORECASTS AND VALUATION<br />

FY Dec (S$ m) 2006A 2007F 2008F 2009F<br />

Gross Revenue 28.2 98.0 120.4 138.3<br />

Net Property Inc 25.9 90.0 110.6 127.0<br />

Total Return 155.8 63.1 100.3 114.1<br />

Distribution Inc 20.2 69.5 107.5 122.0<br />

EPU (S cts) 3.3 8.2 12.0 13.4<br />

EPU Gth (%) N/A 151 45 12<br />

DPU (S cts) 2.9 9.1 12.8 14.4<br />

DPU Gth (%) N/A 214 41 12<br />

NAV per shr (S cts) 102.9 133.5 130.5 128.2<br />

PE (X) 71.7 28.5 19.6 17.5<br />

Distribution Yield (%) 1.2 3.9 5.5 6.1<br />

P/NAV (x) N/A 1.8 1.8 1.8<br />

Aggregate Leverage 34.6 26.1 26.1 26.2<br />

ROAE (%) 3.2 6.9 9.1 10.4<br />

SHARE PRICE CHART<br />

2.80<br />

2.30<br />

1.80<br />

1.30<br />

S$<br />

0.80<br />

Sep-06 N ov-06 Feb-07 A pr-07 Jul-07 Sep-07<br />

CD L H o sp ita lity T ru sts 100-D ay M A<br />

AT A GLANCE<br />

Issued <strong>Cap</strong>ital (m shrs) 823<br />

Mkt. <strong>Cap</strong> (S$m/US$m) 1,933 / 1,275<br />

Major Shareholders<br />

Hospitality Hldg (%) 38.2<br />

Istithmar Hotels FZE (%) 8.2<br />

Siong Lim (%) 8.1<br />

Free Float (%) 45.5<br />

Avg. Daily Vol.(‘000) 1,751<br />

Earnings Rev (%): 2007: - 2008: -<br />

Consensus EPS (S cts): 2007: 7.2 2008: 9.0<br />

Variance vs Cons (%): 2007: 13.9 2008: 33.3<br />

Sector : REITS<br />

Bloomberg/Reuters Code: CDREIT SP/CDLT.SI<br />

Principal Business: CDL REIT is a stapled security consisting of<br />

hospitality trust with initial portfolio of four hotel assets in<br />

Singapore <strong>and</strong> a business trust<br />

CDL Hospitality Trusts<br />

Singapore hotel proxy with regional aspirations<br />

Story: CDLHT, one of <strong>the</strong> largest hotel owners in Singapore<br />

in terms of rooms, has been benefiting from <strong>the</strong> rising RevPAR.<br />

Point: Their Singapore portfolio continues to do well with<br />

increase in tourism, MICE <strong>and</strong> business travels. Singapore,<br />

being promoted as a destination for mega conferences, business<br />

meetings as well as new major sporting events like Formula One<br />

racing, is expected to provide strong dem<strong>and</strong> for hotel rooms.<br />

CDLHT is also looking into fur<strong>the</strong>r exp<strong>and</strong>ing its portfolio both<br />

domestically <strong>and</strong> internationally <strong>and</strong> taking steps to become one<br />

of <strong>the</strong> key regional hotel REITs in this region.<br />

Relevance: We expect continued strong growth in<br />

occupancy <strong>and</strong> RevPAR due to <strong>the</strong> positive outlook for <strong>the</strong><br />

Singapore tourism <strong>and</strong> business travel sectors. CDLHT has plans<br />

to fur<strong>the</strong>r exp<strong>and</strong> <strong>the</strong> portfolio <strong>and</strong> acquire more yield accretive<br />

properties. We maintain our Buy recommendation on CDLHT<br />

with a TP of S$2.90, backed by DCF calculation.<br />

MICE, corporate visitors are key growth drivers. MICE <strong>and</strong><br />

business travelers are on <strong>the</strong> rise due to <strong>the</strong> increase in business<br />

activities. This has led to a gradual increase in percentage contribution<br />

from high-yielding corporate clients to relatively lower-yielding leisure<br />

clients. Over 70% of <strong>the</strong> business now is from corporate clients. We<br />

expect this will continue to put increased emphasis on <strong>the</strong> corporate<br />

side as <strong>the</strong>y will provide a sustainable, regular flow of business with less<br />

fluctuations compared to leisure travelers. In t<strong>and</strong>em with <strong>the</strong> increase<br />

in MICE <strong>and</strong> business travel, CDLHT should continue its trend of strong<br />

performance<br />

The new Singapore F-1 Race, integrated resorts to add fur<strong>the</strong>r<br />

dem<strong>and</strong>. The dem<strong>and</strong> for rooms will be even greater in 2008 <strong>and</strong><br />

beyond particularly in <strong>the</strong> last few weeks of 3Q <strong>and</strong> first week of Q4<br />

when Singapore hosts <strong>the</strong> Formula 1 Race slated for end September<br />

2008 onwards. There should be a sharp increase in dem<strong>and</strong> due to <strong>the</strong><br />

increase in tourists <strong>and</strong> racing-related staff. Two more attractions,<br />

Marina Bay S<strong>and</strong>s <strong>and</strong> Resort World at Sentosa which <strong>the</strong>y are<br />

targeting to be open by 2009-2010, will fur<strong>the</strong>r increase <strong>the</strong> dem<strong>and</strong><br />

for hotel rooms in prime areas.<br />

Poised to be a key regional hotel REIT player. With five Singapore<br />

hotels <strong>and</strong> one New Zeal<strong>and</strong> hotel under its portfolio, CDLHT is poised<br />

to acquire more hotels in <strong>the</strong> region such as <strong>the</strong> high-growth countries<br />

including China, India, Vietnam, <strong>and</strong> <strong>the</strong> United Arab Emirates. It’s goal<br />

is to achieve a balanced portfolio with 60% in Singapore properties<br />

<strong>and</strong> 40% in overseas properties.<br />

Maintain Buy, TP S$2.90. With strong dem<strong>and</strong> for hotel rooms as<br />

well as continued growth in <strong>the</strong> MICE, business <strong>and</strong> tourism travels, we<br />

strongly believe that CDLHT will benefit from <strong>the</strong> uptrend in RevPAR for<br />

<strong>the</strong>ir Singapore properties. We reiterate <strong>the</strong> Buy recommendation for<br />

<strong>the</strong> stock with TP of S$2.90, backed by our DCF calculations.<br />

Refer to important disclosures at <strong>the</strong> end of this report<br />

44