Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

Top Down Strategy and Large Cap Stock Picks - the DBS Vickers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Regional Equity <strong>Strategy</strong> Q4 2007<br />

Country Assessment<br />

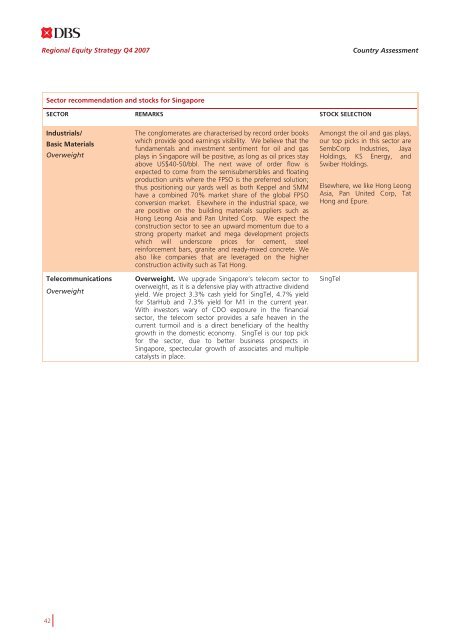

Sector recommendation <strong>and</strong> stocks for Singapore<br />

SECTOR REMARKS STOCK SELECTION<br />

Industrials/<br />

Basic Materials<br />

Overweight<br />

Telecommunications<br />

Overweight<br />

The conglomerates are characterised by record order books<br />

which provide good earnings visibility. We believe that <strong>the</strong><br />

fundamentals <strong>and</strong> investment sentiment for oil <strong>and</strong> gas<br />

plays in Singapore will be positive, as long as oil prices stay<br />

above US$40-50/bbl. The next wave of order flow is<br />

expected to come from <strong>the</strong> semisubmersibles <strong>and</strong> floating<br />

production units where <strong>the</strong> FPSO is <strong>the</strong> preferred solution;<br />

thus positioning our yards well as both Keppel <strong>and</strong> SMM<br />

have a combined 70% market share of <strong>the</strong> global FPSO<br />

conversion market. Elsewhere in <strong>the</strong> industrial space, we<br />

are positive on <strong>the</strong> building materials suppliers such as<br />

Hong Leong Asia <strong>and</strong> Pan United Corp. We expect <strong>the</strong><br />

construction sector to see an upward momentum due to a<br />

strong property market <strong>and</strong> mega development projects<br />

which will underscore prices for cement, steel<br />

reinforcement bars, granite <strong>and</strong> ready-mixed concrete. We<br />

also like companies that are leveraged on <strong>the</strong> higher<br />

construction activity such as Tat Hong.<br />

Overweight. We upgrade Singapore’s telecom sector to<br />

overweight, as it is a defensive play with attractive dividend<br />

yield. We project 3.3% cash yield for SingTel, 4.7% yield<br />

for StarHub <strong>and</strong> 7.3% yield for M1 in <strong>the</strong> current year.<br />

With investors wary of CDO exposure in <strong>the</strong> financial<br />

sector, <strong>the</strong> telecom sector provides a safe heaven in <strong>the</strong><br />

current turmoil <strong>and</strong> is a direct beneficiary of <strong>the</strong> healthy<br />

growth in <strong>the</strong> domestic economy. SingTel is our top pick<br />

for <strong>the</strong> sector, due to better business prospects in<br />

Singapore, spectecular growth of associates <strong>and</strong> multiple<br />

catalysts in place.<br />

Amongst <strong>the</strong> oil <strong>and</strong> gas plays,<br />

our top picks in this sector are<br />

SembCorp Industries, Jaya<br />

Holdings, KS Energy, <strong>and</strong><br />

Swiber Holdings.<br />

Elsewhere, we like Hong Leong<br />

Asia, Pan United Corp, Tat<br />

Hong <strong>and</strong> Epure.<br />

SingTel<br />

42