Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ECONOMIC AND MONETARY<br />

DEVELOPMENTS<br />

1 THE EXTERNAL ENVIRONMENT<br />

OF THE EURO AREA<br />

ECONOMIC<br />

AND MONETARY<br />

DEVELOPMENTS<br />

The external<br />

environment<br />

of the euro area<br />

Although the latest indicators point to a slowdown in the pace of the global economic contraction,<br />

there is not as yet any concrete evi<strong>de</strong>nce of the start of a fi rm recovery. In parallel, global infl ation<br />

rates have been diminishing rapidly in recent months, on account of rising spare capacity and<br />

negative base effects from last year’s commodity price increases. Global economic prospects<br />

remain subject to high levels of uncertainty, but the risks to global activity are balanced.<br />

1.1 DEVELOPMENTS IN THE WORLD ECONOMY<br />

Although the latest indicators point to a<br />

slowdown in the pace of the global economic<br />

contraction, there is not as yet any concrete<br />

evi<strong>de</strong>nce of the start of a firm recovery. In May,<br />

the Global Purchasing Managers’ In<strong>de</strong>x (PMI)<br />

posted its highest reading since last September,<br />

indicating a substantial easing of the rates of<br />

contraction. However, this indicator remains<br />

below the expansion-contraction threshold,<br />

suggesting that firms are continuing to scale back<br />

their activity somewhat. In the manufacturing<br />

sector, some signs of stabilisation in output<br />

emerged in June.<br />

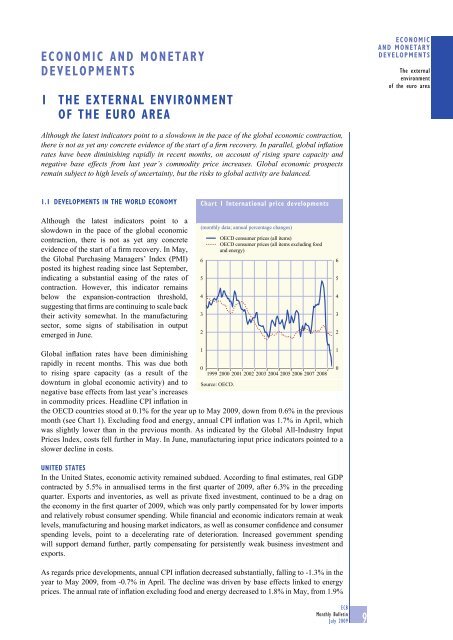

Chart 1 International price <strong>de</strong>velopments<br />

(monthly data; annual percentage changes)<br />

6<br />

5<br />

4<br />

3<br />

2<br />

OECD consumer prices (all items)<br />

OECD consumer prices (all items excluding food<br />

and energy)<br />

6<br />

5<br />

4<br />

3<br />

2<br />

Global inflation rates have been diminishing<br />

rapidly in recent months. This was due both<br />

to rising spare capacity (as a result of the<br />

downturn in global economic activity) and to<br />

negative base effects from last year’s increases<br />

in commodity prices. Headline CPI inflation in<br />

the OECD countries stood at 0.1% for the year up to May <strong>2009</strong>, down from 0.6% in the previous<br />

month (see Chart 1). Excluding food and energy, annual CPI inflation was 1.7% in April, which<br />

was slightly lower than in the previous month. As indicated by the Global All-Industry Input<br />

Prices In<strong>de</strong>x, costs fell further in May. In June, manufacturing input price indicators pointed to a<br />

slower <strong>de</strong>cline in costs.<br />

UNITED STATES<br />

In the United States, economic activity remained subdued. According to final estimates, real GDP<br />

contracted by 5.5% in annualised terms in the first quarter of <strong>2009</strong>, after 6.3% in the preceding<br />

quarter. Exports and inventories, as well as private fixed investment, continued to be a drag on<br />

the economy in the first quarter of <strong>2009</strong>, which was only partly compensated for by lower imports<br />

and relatively robust consumer spending. While financial and economic indicators remain at weak<br />

levels, manufacturing and housing market indicators, as well as consumer confi<strong>de</strong>nce and consumer<br />

spending levels, point to a <strong>de</strong>celerating rate of <strong>de</strong>terioration. Increased government spending<br />

will support <strong>de</strong>mand further, partly compensating for persistently weak business investment and<br />

exports.<br />

As regards price <strong>de</strong>velopments, annual CPI inflation <strong>de</strong>creased substantially, falling to -1.3% in the<br />

year to May <strong>2009</strong>, from -0.7% in April. The <strong>de</strong>cline was driven by base effects linked to energy<br />

prices. The annual rate of inflation excluding food and energy <strong>de</strong>creased to 1.8% in May, from 1.9%<br />

1<br />

0<br />

1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Source: OECD.<br />

2008<br />

1<br />

0<br />

ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>July</strong> <strong>2009</strong><br />

9