Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ECONOMIC<br />

AND MONETARY<br />

DEVELOPMENTS<br />

Monetary and<br />

financial<br />

<strong>de</strong>velopments<br />

April <strong>2009</strong>, following a rebound in the first months of <strong>2009</strong> in the context of government guarantees<br />

for the issuance of bank bonds. A shift from long-term to short-term net <strong>de</strong>bt issuance, in particular<br />

at variable rates, was recor<strong>de</strong>d in April. The seasonally adjusted six-month annualised growth rate<br />

of short-term <strong>de</strong>bt securities issued by MFIs jumped to 19.4%, up from 11.1% in March <strong>2009</strong>,<br />

compared with a relatively small monthly increase of 0.3 percentage point to 4.2% in April <strong>2009</strong><br />

for long-term <strong>de</strong>bt securities.<br />

Turning to non-monetary financial corporations, the annual growth rate of <strong>de</strong>bt securities issued<br />

mo<strong>de</strong>rated to 30.6% in April after 31.1% in March <strong>2009</strong>. Nevertheless, the sector remained by far the<br />

fastest-growing component of overall <strong>de</strong>bt securities issuance and the six-month annualised growth<br />

rate continued to increase, reflecting significant ongoing retained securitisation. In contrast to MFIs,<br />

issuance activity continued to focus on longer-term maturities, in particular at variable rates.<br />

The annual growth rate of <strong>de</strong>bt securities issued by the general government sector remained strong,<br />

rising to 12.5% in April <strong>2009</strong>, well above the average rate of around 4% between 1999 and 2008.<br />

The seasonally adjusted six-month annualised growth rate of <strong>de</strong>bt securities issued in this sector<br />

mo<strong>de</strong>rated to 17.5% in April after 21.3% in March <strong>2009</strong>. Overall, the high level of issuance reflects<br />

substantial funding needs of euro area governments.<br />

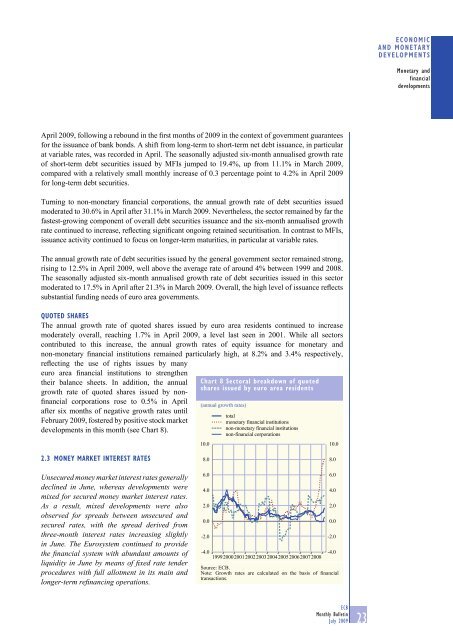

QUOTED SHARES<br />

The annual growth rate of quoted shares issued by euro area resi<strong>de</strong>nts continued to increase<br />

mo<strong>de</strong>rately overall, reaching 1.7% in April <strong>2009</strong>, a level last seen in 2001. While all sectors<br />

contributed to this increase, the annual growth rates of equity issuance for monetary and<br />

non-monetary financial institutions remained particularly high, at 8.2% and 3.4% respectively,<br />

reflecting the use of rights issues by many<br />

euro area financial institutions to strengthen<br />

their balance sheets. In addition, the annual<br />

growth rate of quoted shares issued by nonfinancial<br />

corporations rose to 0.5% in April<br />

after six months of negative growth rates until<br />

February <strong>2009</strong>, fostered by positive stock market<br />

<strong>de</strong>velopments in this month (see Chart 8).<br />

Chart 8 Sectoral breakdown of quoted<br />

shares issued by euro area resi<strong>de</strong>nts<br />

(annual growth rates)<br />

10.0<br />

total<br />

monetary financial institutions<br />

non-monetary financial institutions<br />

non-financial corporations<br />

10.0<br />

2.3 MONEY MARKET INTEREST RATES<br />

8.0<br />

8.0<br />

Unsecured money market interest rates generally<br />

<strong>de</strong>clined in June, whereas <strong>de</strong>velopments were<br />

mixed for secured money market interest rates.<br />

As a result, mixed <strong>de</strong>velopments were also<br />

observed for spreads between unsecured and<br />

secured rates, with the spread <strong>de</strong>rived from<br />

three-month interest rates increasing slightly<br />

in June. The Eurosystem continued to provi<strong>de</strong><br />

the fi nancial system with abundant amounts of<br />

liquidity in June by means of fi xed rate ten<strong>de</strong>r<br />

procedures with full allotment in its main and<br />

longer-term refi nancing operations.<br />

6.0<br />

4.0<br />

2.0<br />

0.0<br />

-2.0<br />

-4.0<br />

1999200020012002200320042005200620072008<br />

6.0<br />

4.0<br />

2.0<br />

0.0<br />

-2.0<br />

-4.0<br />

Source: ECB.<br />

Note: Growth rates are calculated on the basis of financial<br />

transactions.<br />

ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>July</strong> <strong>2009</strong><br />

23