Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ECONOMIC<br />

AND MONETARY<br />

DEVELOPMENTS<br />

Monetary and<br />

financial<br />

<strong>de</strong>velopments<br />

months of <strong>2009</strong>. However, for some countries with credit ratings lower than triple-A, spreads<br />

wi<strong>de</strong>ned again. This might reflect continued elevated risk aversion among investors in the bond<br />

market and concerns about the fiscal sustainability of increasing government <strong>de</strong>bt (for a longerterm<br />

perspective on <strong>de</strong>velopments in intra-euro area government bond spreads and their US<br />

counterparts, see Box 2).<br />

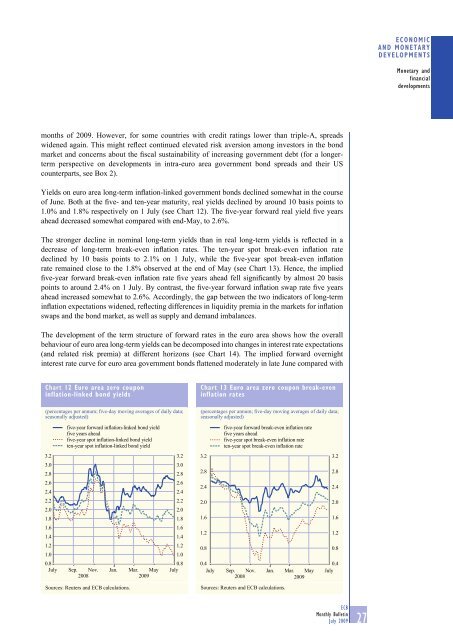

Yields on euro area long-term inflation-linked government bonds <strong>de</strong>clined somewhat in the course<br />

of June. Both at the five- and ten-year maturity, real yields <strong>de</strong>clined by around 10 basis points to<br />

1.0% and 1.8% respectively on 1 <strong>July</strong> (see Chart 12). The five-year forward real yield five years<br />

ahead <strong>de</strong>creased somewhat compared with end-May, to 2.6%.<br />

The stronger <strong>de</strong>cline in nominal long-term yields than in real long-term yields is reflected in a<br />

<strong>de</strong>crease of long-term break-even inflation rates. The ten-year spot break-even inflation rate<br />

<strong>de</strong>clined by 10 basis points to 2.1% on 1 <strong>July</strong>, while the five-year spot break-even inflation<br />

rate remained close to the 1.8% observed at the end of May (see Chart 13). Hence, the implied<br />

five-year forward break-even inflation rate five years ahead fell significantly by almost 20 basis<br />

points to around 2.4% on 1 <strong>July</strong>. By contrast, the five-year forward inflation swap rate five years<br />

ahead increased somewhat to 2.6%. Accordingly, the gap between the two indicators of long-term<br />

inflation expectations wi<strong>de</strong>ned, reflecting differences in liquidity premia in the markets for inflation<br />

swaps and the bond market, as well as supply and <strong>de</strong>mand imbalances.<br />

The <strong>de</strong>velopment of the term structure of forward rates in the euro area shows how the overall<br />

behaviour of euro area long-term yields can be <strong>de</strong>composed into changes in interest rate expectations<br />

(and related risk premia) at different horizons (see Chart 14). The implied forward overnight<br />

interest rate curve for euro area government bonds flattened mo<strong>de</strong>rately in late June compared with<br />

Chart 12 Euro area zero coupon<br />

inflation-linked bond yields<br />

(percentages per annum; five-day moving averages of daily data;<br />

seasonally adjusted)<br />

Chart 13 Euro area zero coupon break-even<br />

inflation rates<br />

(percentages per annum; five-day moving averages of daily data;<br />

seasonally adjusted)<br />

five-year forward inflation-linked bond yield<br />

five years ahead<br />

five-year spot inflation-linked bond yield<br />

ten-year spot inflation-linked bond yield<br />

five-year forward break-even inflation rate<br />

five years ahead<br />

five-year spot break-even inflation rate<br />

ten-year spot break-even inflation rate<br />

3.2<br />

3.0<br />

2.8<br />

3.2<br />

3.0<br />

2.8<br />

3.2<br />

2.8<br />

3.2<br />

2.8<br />

2.6<br />

2.4<br />

2.6<br />

2.4<br />

2.4<br />

2.4<br />

2.2<br />

2.0<br />

1.8<br />

2.2<br />

2.0<br />

1.8<br />

2.0<br />

1.6<br />

2.0<br />

1.6<br />

1.6<br />

1.4<br />

1.6<br />

1.4<br />

1.2<br />

1.2<br />

1.2<br />

1.0<br />

0.8<br />

<strong>July</strong><br />

Sep. Nov. Jan. Mar. May<br />

2008 <strong>2009</strong><br />

1.2<br />

1.0<br />

0.8<br />

<strong>July</strong><br />

0.8<br />

0.4<br />

0.4<br />

<strong>July</strong> Sep. Nov. Jan. Mar. May <strong>July</strong><br />

2008 <strong>2009</strong><br />

0.8<br />

Sources: Reuters and ECB calculations.<br />

Sources: Reuters and ECB calculations.<br />

ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>July</strong> <strong>2009</strong><br />

27