Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2.4 BOND MARKETS<br />

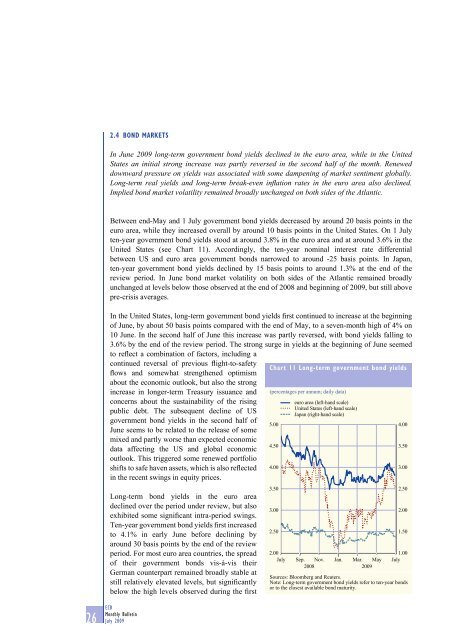

In June <strong>2009</strong> long-term government bond yields <strong>de</strong>clined in the euro area, while in the United<br />

States an initial strong increase was partly reversed in the second half of the month. Renewed<br />

downward pressure on yields was associated with some dampening of market sentiment globally.<br />

Long-term real yields and long-term break-even infl ation rates in the euro area also <strong>de</strong>clined.<br />

Implied bond market volatility remained broadly unchanged on both si<strong>de</strong>s of the Atlantic.<br />

Between end-May and 1 <strong>July</strong> government bond yields <strong>de</strong>creased by around 20 basis points in the<br />

euro area, while they increased overall by around 10 basis points in the United States. On 1 <strong>July</strong><br />

ten-year government bond yields stood at around 3.8% in the euro area and at around 3.6% in the<br />

United States (see Chart 11). Accordingly, the ten-year nominal interest rate differential<br />

between US and euro area government bonds narrowed to around -25 basis points. In Japan,<br />

ten-year government bond yields <strong>de</strong>clined by 15 basis points to around 1.3% at the end of the<br />

review period. In June bond market volatility on both si<strong>de</strong>s of the Atlantic remained broadly<br />

unchanged at levels below those observed at the end of 2008 and beginning of <strong>2009</strong>, but still above<br />

pre-crisis averages.<br />

In the United States, long-term government bond yields first continued to increase at the beginning<br />

of June, by about 50 basis points compared with the end of May, to a seven-month high of 4% on<br />

10 June. In the second half of June this increase was partly reversed, with bond yields falling to<br />

3.6% by the end of the review period. The strong surge in yields at the beginning of June seemed<br />

to reflect a combination of factors, including a<br />

continued reversal of previous flight-to-safety<br />

flows and somewhat strengthened optimism<br />

about the economic outlook, but also the strong<br />

increase in longer-term Treasury issuance and<br />

concerns about the sustainability of the rising<br />

public <strong>de</strong>bt. The subsequent <strong>de</strong>cline of US<br />

government bond yields in the second half of<br />

June seems to be related to the release of some<br />

mixed and partly worse than expected economic<br />

data affecting the US and global economic<br />

outlook. This triggered some renewed portfolio<br />

shifts to safe haven assets, which is also reflected<br />

in the recent swings in equity prices.<br />

Long-term bond yields in the euro area<br />

<strong>de</strong>clined over the period un<strong>de</strong>r review, but also<br />

exhibited some significant intra-period swings.<br />

Ten-year government bond yields first increased<br />

to 4.1% in early June before <strong>de</strong>clining by<br />

around 30 basis points by the end of the review<br />

period. For most euro area countries, the spread<br />

of their government bonds vis-à-vis their<br />

German counterpart remained broadly stable at<br />

still relatively elevated levels, but significantly<br />

below the high levels observed during the first<br />

26 ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>July</strong> <strong>2009</strong><br />

Chart 11 Long-term government bond yields<br />

(percentages per annum; daily data)<br />

5.00<br />

4.50<br />

4.00<br />

3.50<br />

3.00<br />

2.50<br />

2.00<br />

<strong>July</strong><br />

euro area (left-hand scale)<br />

United States (left-hand scale)<br />

Japan (right-hand scale)<br />

Sep. Nov. Jan. Mar. May<br />

2008 <strong>2009</strong><br />

4.00<br />

3.50<br />

3.00<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

<strong>July</strong><br />

Sources: Bloomberg and Reuters.<br />

Note: Long-term government bond yields refer to ten-year bonds<br />

or to the closest available bond maturity.