Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ECONOMIC<br />

AND MONETARY<br />

DEVELOPMENTS<br />

Monetary and<br />

financial<br />

<strong>de</strong>velopments<br />

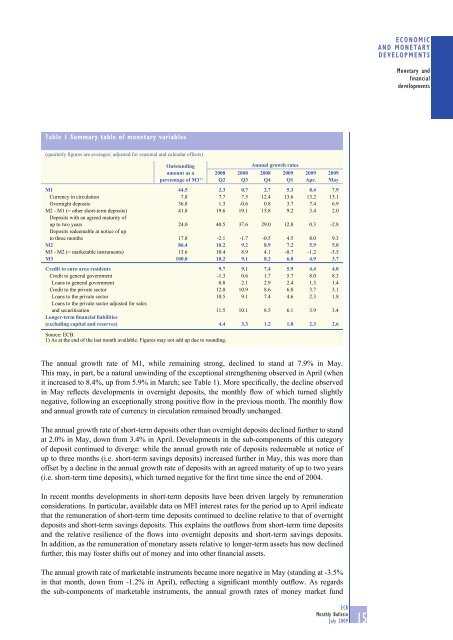

Table 1 Summary table of monetary variables<br />

(quarterly figures are averages; adjusted for seasonal and calendar effects)<br />

Outstanding<br />

amount as a<br />

percentage of M3 1)<br />

2008<br />

Q2<br />

2008<br />

Q3<br />

Annual growth rates<br />

2008<br />

Q4<br />

<strong>2009</strong><br />

Q1<br />

<strong>2009</strong><br />

Apr.<br />

<strong>2009</strong><br />

May<br />

M1 44.5 2.3 0.7 2.7 5.3 8.4 7.9<br />

Currency in circulation 7.8 7.7 7.5 12.4 13.6 13.2 13.1<br />

Overnight <strong>de</strong>posits 36.8 1.3 -0.6 0.8 3.7 7.4 6.9<br />

M2 - M1 (= other short-term <strong>de</strong>posits) 41.8 19.6 19.1 15.8 9.2 3.4 2.0<br />

Deposits with an agreed maturity of<br />

up to two years 24.0 40.5 37.6 29.0 12.8 0.3 -2.8<br />

Deposits re<strong>de</strong>emable at notice of up<br />

to three months 17.8 -2.1 -1.7 -0.5 4.5 8.0 9.3<br />

M2 86.4 10.2 9.2 8.9 7.2 5.9 5.0<br />

M3 - M2 (= marketable instruments) 13.6 10.4 8.9 4.1 -0.7 -1.2 -3.5<br />

M3 100.0 10.2 9.1 8.2 6.0 4.9 3.7<br />

Credit to euro area resi<strong>de</strong>nts 9.7 9.1 7.4 5.9 4.4 4.0<br />

Credit to general government -1.3 0.6 1.7 5.7 8.0 8.3<br />

Loans to general government 0.8 2.1 2.9 2.4 1.3 1.4<br />

Credit to the private sector 12.0 10.9 8.6 6.0 3.7 3.1<br />

Loans to the private sector 10.5 9.1 7.4 4.6 2.3 1.8<br />

Loans to the private sector adjusted for sales<br />

and securitisation 11.5 10.1 8.5 6.1 3.9 3.4<br />

Longer-term financial liabilities<br />

(excluding capital and reserves) 4.4 3.3 1.2 1.8 2.3 2.6<br />

Source: ECB.<br />

1) As at the end of the last month available. Figures may not add up due to rounding.<br />

The annual growth rate of M1, while remaining strong, <strong>de</strong>clined to stand at 7.9% in May.<br />

This may, in part, be a natural unwinding of the exceptional strengthening observed in April (when<br />

it increased to 8.4%, up from 5.9% in March; see Table 1). More specifically, the <strong>de</strong>cline observed<br />

in May reflects <strong>de</strong>velopments in overnight <strong>de</strong>posits, the monthly flow of which turned slightly<br />

negative, following an exceptionally strong positive flow in the previous month. The monthly flow<br />

and annual growth rate of currency in circulation remained broadly unchanged.<br />

The annual growth rate of short-term <strong>de</strong>posits other than overnight <strong>de</strong>posits <strong>de</strong>clined further to stand<br />

at 2.0% in May, down from 3.4% in April. Developments in the sub-components of this category<br />

of <strong>de</strong>posit continued to diverge: while the annual growth rate of <strong>de</strong>posits re<strong>de</strong>emable at notice of<br />

up to three months (i.e. short-term savings <strong>de</strong>posits) increased further in May, this was more than<br />

offset by a <strong>de</strong>cline in the annual growth rate of <strong>de</strong>posits with an agreed maturity of up to two years<br />

(i.e. short-term time <strong>de</strong>posits), which turned negative for the first time since the end of 2004.<br />

In recent months <strong>de</strong>velopments in short-term <strong>de</strong>posits have been driven largely by remuneration<br />

consi<strong>de</strong>rations. In particular, available data on MFI interest rates for the period up to April indicate<br />

that the remuneration of short-term time <strong>de</strong>posits continued to <strong>de</strong>cline relative to that of overnight<br />

<strong>de</strong>posits and short-term savings <strong>de</strong>posits. This explains the outflows from short-term time <strong>de</strong>posits<br />

and the relative resilience of the flows into overnight <strong>de</strong>posits and short-term savings <strong>de</strong>posits.<br />

In addition, as the remuneration of monetary assets relative to longer-term assets has now <strong>de</strong>clined<br />

further, this may foster shifts out of money and into other financial assets.<br />

The annual growth rate of marketable instruments became more negative in May (standing at -3.5%<br />

in that month, down from -1.2% in April), reflecting a significant monthly outflow. As regards<br />

the sub-components of marketable instruments, the annual growth rates of money market fund<br />

ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>July</strong> <strong>2009</strong><br />

15