Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

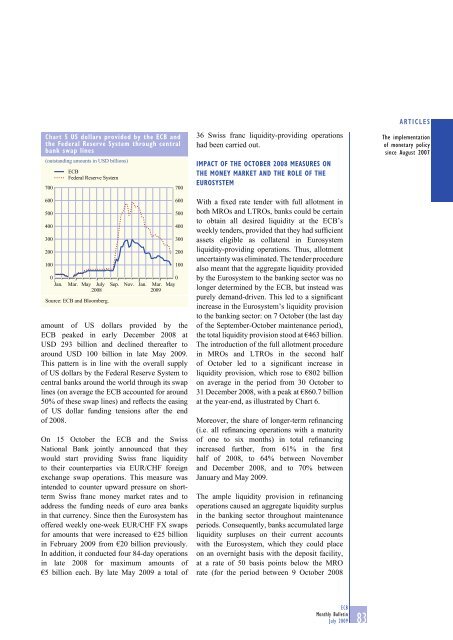

Chart 5 US dollars provi<strong>de</strong>d by the ECB and<br />

the Fe<strong>de</strong>ral Reserve System through central<br />

bank swap lines<br />

(outstanding amounts in USD billions)<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

ECB<br />

Fe<strong>de</strong>ral Reserve System<br />

0<br />

Jan. Mar. May <strong>July</strong> Sep. Nov. Jan. Mar.<br />

2008 <strong>2009</strong><br />

Source: ECB and Bloomberg.<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

May<br />

amount of US dollars provi<strong>de</strong>d by the<br />

ECB peaked in early December 2008 at<br />

USD 293 billion and <strong>de</strong>clined thereafter to<br />

around USD 100 billion in late May <strong>2009</strong>.<br />

This pattern is in line with the overall supply<br />

of US dollars by the Fe<strong>de</strong>ral Reserve System to<br />

central banks around the world through its swap<br />

lines (on average the ECB accounted for around<br />

50% of these swap lines) and reflects the easing<br />

of US dollar funding tensions after the end<br />

of 2008.<br />

On 15 October the ECB and the Swiss<br />

National Bank jointly announced that they<br />

would start providing Swiss franc liquidity<br />

to their counterparties via EUR/CHF foreign<br />

exchange swap operations. This measure was<br />

inten<strong>de</strong>d to counter upward pressure on shortterm<br />

Swiss franc money market rates and to<br />

address the funding needs of euro area banks<br />

in that currency. Since then the Eurosystem has<br />

offered weekly one-week EUR/CHF FX swaps<br />

for amounts that were increased to €25 billion<br />

in February <strong>2009</strong> from €20 billion previously.<br />

In addition, it conducted four 84-day operations<br />

in late 2008 for maximum amounts of<br />

€5 billion each. By late May <strong>2009</strong> a total of<br />

36 Swiss franc liquidity-providing operations<br />

had been carried out.<br />

IMPACT OF THE OCTOBER 2008 MEASURES ON<br />

THE MONEY MARKET AND THE ROLE OF THE<br />

EUROSYSTEM<br />

With a fixed rate ten<strong>de</strong>r with full allotment in<br />

both MROs and LTROs, banks could be certain<br />

to obtain all <strong>de</strong>sired liquidity at the ECB’s<br />

weekly ten<strong>de</strong>rs, provi<strong>de</strong>d that they had sufficient<br />

assets eligible as collateral in Eurosystem<br />

liquidity-providing operations. Thus, allotment<br />

uncertainty was eliminated. The ten<strong>de</strong>r procedure<br />

also meant that the aggregate liquidity provi<strong>de</strong>d<br />

by the Eurosystem to the banking sector was no<br />

longer <strong>de</strong>termined by the ECB, but instead was<br />

purely <strong>de</strong>mand-driven. This led to a significant<br />

increase in the Eurosystem’s liquidity provision<br />

to the banking sector: on 7 October (the last day<br />

of the September-October maintenance period),<br />

the total liquidity provision stood at €463 billion.<br />

The introduction of the full allotment procedure<br />

in MROs and LTROs in the second half<br />

of October led to a significant increase in<br />

liquidity provision, which rose to €802 billion<br />

on average in the period from 30 October to<br />

31 December 2008, with a peak at €860.7 billion<br />

at the year-end, as illustrated by Chart 6.<br />

Moreover, the share of longer-term refinancing<br />

(i.e. all refinancing operations with a maturity<br />

of one to six months) in total refinancing<br />

increased further, from 61% in the first<br />

half of 2008, to 64% between November<br />

and December 2008, and to 70% between<br />

January and May <strong>2009</strong>.<br />

The ample liquidity provision in refinancing<br />

operations caused an aggregate liquidity surplus<br />

in the banking sector throughout maintenance<br />

periods. Consequently, banks accumulated large<br />

liquidity surpluses on their current accounts<br />

with the Eurosystem, which they could place<br />

on an overnight basis with the <strong>de</strong>posit facility,<br />

at a rate of 50 basis points below the MRO<br />

rate (for the period between 9 October 2008<br />

ARTICLES<br />

The implementation<br />

of monetary policy<br />

since August 2007<br />

ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>July</strong> <strong>2009</strong><br />

83