Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Monthly Bulletin July 2009 - Banque de France

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1), 2)<br />

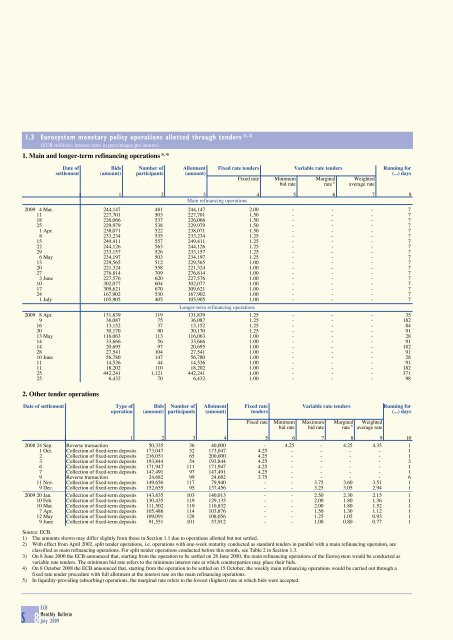

1.3 Eurosystem monetary policy operations allotted through ten<strong>de</strong>rs<br />

(EUR millions; interest rates in percentages per annum)<br />

3), 4)<br />

1. Main and longer-term refinancing operations<br />

Date of Bids Number of Allotment Fixed rate ten<strong>de</strong>rs Variable rate ten<strong>de</strong>rs Running for<br />

settlement (amount) participants (amount) (...) days<br />

Fixed rate Minimum Marginal Weighted<br />

bid rate rate 5) average rate<br />

1 2 3 4 5 6 7 8<br />

Main refinancing operations<br />

<strong>2009</strong> 4 Mar. 244,147 481 244,147 2.00 - - - 7<br />

11 227,701 503 227,701 1.50 - - - 7<br />

18 226,066 537 226,066 1.50 - - - 7<br />

25 229,979 538 229,979 1.50 - - - 7<br />

1 Apr. 238,071 522 238,071 1.50 - - - 7<br />

8 233,234 535 233,234 1.25 - - - 7<br />

15 249,411 557 249,411 1.25 - - - 7<br />

22 244,126 563 244,126 1.25 - - - 7<br />

29 233,157 526 233,157 1.25 - - - 7<br />

6 May 234,197 503 234,197 1.25 - - - 7<br />

13 229,565 512 229,565 1.00 - - - 7<br />

20 221,324 558 221,324 1.00 - - - 7<br />

27 276,814 709 276,814 1.00 - - - 7<br />

3 June 227,576 620 227,576 1.00 - - - 7<br />

10 302,077 604 302,077 1.00 - - - 7<br />

17 309,621 670 309,621 1.00 - - - 7<br />

24 167,902 530 167,902 1.00 - - - 7<br />

1 <strong>July</strong> 105,905 405 105,905 1.00 - - - 7<br />

Longer-term refinancing operations<br />

<strong>2009</strong> 8 Apr. 131,839 119 131,839 1.25 - - - 35<br />

9 36,087 75 36,087 1.25 - - - 182<br />

16 13,152 37 13,152 1.25 - - - 84<br />

30 30,170 90 30,170 1.25 - - - 91<br />

13 May 116,063 113 116,063 1.00 - - - 28<br />

14 33,666 56 33,666 1.00 - - - 91<br />

14 20,695 97 20,695 1.00 - - - 182<br />

28 27,541 104 27,541 1.00 - - - 91<br />

10 June 56,780 147 56,780 1.00 - - - 28<br />

11 14,536 44 14,536 1.00 - - - 91<br />

11 18,202 110 18,202 1.00 - - - 182<br />

25 442,241 1,121 442,241 1.00 - - - 371<br />

25 6,432 70 6,432 1.00 - - - 98<br />

2. Other ten<strong>de</strong>r operations<br />

Date of settlement Type of Bids Number of Allotment Fixed rate Variable rate ten<strong>de</strong>rs Running for<br />

operation (amount) participants (amount) ten<strong>de</strong>rs (...) days<br />

Fixed rate Minimum Maximum Marginal Weighted<br />

bid rate bid rate rate 5) average rate<br />

1 2 3 4 5 6 7 8 9 10<br />

2008 24 Sep. Reverse transaction 50,335 36 40,000 - 4.25 - 4.25 4.35 1<br />

1 Oct. Collection of fixed-term <strong>de</strong>posits 173,047 52 173,047 4.25 - - - - 1<br />

2 Collection of fixed-term <strong>de</strong>posits 216,051 65 200,000 4.25 - - - - 1<br />

3 Collection of fixed-term <strong>de</strong>posits 193,844 54 193,844 4.25 - - - - 3<br />

6 Collection of fixed-term <strong>de</strong>posits 171,947 111 171,947 4.25 - - - - 1<br />

7 Collection of fixed-term <strong>de</strong>posits 147,491 97 147,491 4.25 - - - - 1<br />

9 Reverse transaction 24,682 99 24,682 3.75 - - - - 6<br />

11 Nov. Collection of fixed-term <strong>de</strong>posits 149,656 117 79,940 - - 3.75 3.60 3.51 1<br />

9 Dec. Collection of fixed-term <strong>de</strong>posits 152,655 95 137,456 - - 3.25 3.05 2.94 1<br />

<strong>2009</strong> 20 Jan. Collection of fixed-term <strong>de</strong>posits 143,835 103 140,013 - - 2.50 2.30 2.15 1<br />

10 Feb. Collection of fixed-term <strong>de</strong>posits 130,435 119 129,135 - - 2.00 1.80 1.36 1<br />

10 Mar. Collection of fixed-term <strong>de</strong>posits 111,502 119 110,832 - - 2.00 1.80 1.52 1<br />

7 Apr. Collection of fixed-term <strong>de</strong>posits 105,486 114 103,876 - - 1.50 1.30 1.12 1<br />

12 May Collection of fixed-term <strong>de</strong>posits 109,091 128 108,056 - - 1.25 1.05 0.93 1<br />

9 June Collection of fixed-term <strong>de</strong>posits 91,551 101 57,912 - - 1.00 0.80 0.77 1<br />

Source: ECB.<br />

1) The amounts shown may differ slightly from those in Section 1.1 due to operations allotted but not settled.<br />

2) With effect from April 2002, split ten<strong>de</strong>r operations, i.e. operations with one-week maturity conducted as standard ten<strong>de</strong>rs in parallel with a main refinancing operation, are<br />

classified as main refinancing operations. For split ten<strong>de</strong>r operations conducted before this month, see Table 2 in Section 1.3.<br />

3) On 8 June 2000 the ECB announced that, starting from the operation to be settled on 28 June 2000, the main refinancing operations of the Eurosystem would be conducted as<br />

variable rate ten<strong>de</strong>rs. The minimum bid rate refers to the minimum interest rate at which counterparties may place their bids.<br />

4) On 8 October 2008 the ECB announced that, starting from the operation to be settled on 15 October, the weekly main refinancing operations would be carried out through a<br />

fixed rate ten<strong>de</strong>r procedure with full allotment at the interest rate on the main refinancing operations.<br />

5) In liquidity-providing (absorbing) operations, the marginal rate refers to the lowest (highest) rate at which bids were accepted.<br />

ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

S 8 <strong>July</strong> <strong>2009</strong>