COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

COMMERZBANK AKTIENGESELLSCHAFT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

To our Shareholders Corporate Responsibility Management Report Risk Report Group Financial Statements Further Information 225 281<br />

258 202 Statement of comprehensive income<br />

260 204 Balance sheet<br />

262 206 Statement of changes in equity<br />

264 208 Cash flow statement<br />

266 210 Notes<br />

409 353 Auditors’ report<br />

(16) Fixed assets<br />

The land and buildings, and also office furniture and equipment,<br />

shown under this item are recognised at cost, less regular<br />

depreciation. Impairments are made in an amount by which the<br />

carrying value exceeds the higher of fair value less costs to sell<br />

and the value in use of the asset.<br />

Where the reason for recognising an impairment in previous<br />

financial years ceases to apply, the impairment is reversed to no<br />

more than amortised cost.<br />

In determining the useful life, the likely physical wear and<br />

tear, technical obsolescence and legal and contractual<br />

restrictions are taken into consideration. All fixed assets are<br />

depreciated or written off over the following periods, using the<br />

straight-line method:<br />

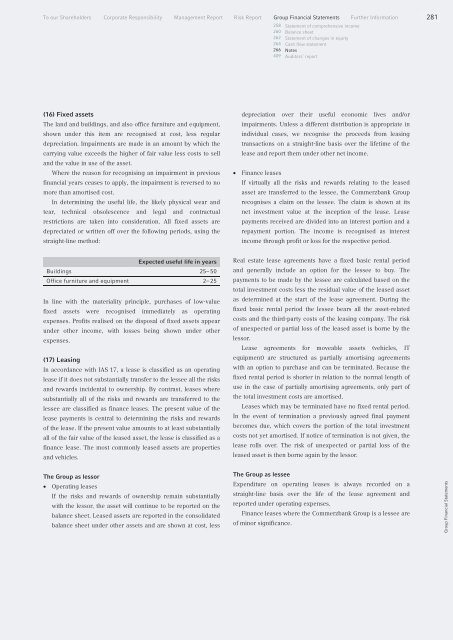

Buildings<br />

Expected useful life in years<br />

25– 50<br />

Office furniture and equipment 2– 25<br />

In line with the materiality principle, purchases of low-value<br />

fixed assets were recognised immediately as operating<br />

expenses. Profits realised on the disposal of fixed assets appear<br />

under other income, with losses being shown under other<br />

expenses.<br />

(17) Leasing<br />

In accordance with IAS 17, a lease is classified as an operating<br />

lease if it does not substantially transfer to the lessee all the risks<br />

and rewards incidental to ownership. By contrast, leases where<br />

substantially all of the risks and rewards are transferred to the<br />

lessee are classified as finance leases. The present value of the<br />

lease payments is central to determining the risks and rewards<br />

of the lease. If the present value amounts to at least substantially<br />

all of the fair value of the leased asset, the lease is classified as a<br />

finance lease. The most commonly leased assets are properties<br />

and vehicles.<br />

The Group as lessor<br />

• Operating leases<br />

If the risks and rewards of ownership remain substantially<br />

with the lessor, the asset will continue to be reported on the<br />

balance sheet. Leased assets are reported in the consolidated<br />

balance sheet under other assets and are shown at cost, less<br />

depreciation over their useful economic lives and/or<br />

impairments. Unless a different distribution is appropriate in<br />

individual cases, we recognise the proceeds from leasing<br />

transactions on a straight-line basis over the lifetime of the<br />

lease and report them under other net income.<br />

• Finance leases<br />

If virtually all the risks and rewards relating to the leased<br />

asset are transferred to the lessee, the Commerzbank Group<br />

recognises a claim on the lessee. The claim is shown at its<br />

net investment value at the inception of the lease. Lease<br />

payments received are divided into an interest portion and a<br />

repayment portion. The income is recognised as interest<br />

income through profit or loss for the respective period.<br />

Real estate lease agreements have a fixed basic rental period<br />

and generally include an option for the lessee to buy. The<br />

payments to be made by the lessee are calculated based on the<br />

total investment costs less the residual value of the leased asset<br />

as determined at the start of the lease agreement. During the<br />

fixed basic rental period the lessee bears all the asset-related<br />

costs and the third-party costs of the leasing company. The risk<br />

of unexpected or partial loss of the leased asset is borne by the<br />

lessor.<br />

Lease agreements for moveable assets (vehicles, IT<br />

equipment) are structured as partially amortising agreements<br />

with an option to purchase and can be terminated. Because the<br />

fixed rental period is shorter in relation to the normal length of<br />

use in the case of partially amortising agreements, only part of<br />

the total investment costs are amortised.<br />

Leases which may be terminated have no fixed rental period.<br />

In the event of termination a previously agreed final payment<br />

becomes due, which covers the portion of the total investment<br />

costs not yet amortised. If notice of termination is not given, the<br />

lease rolls over. The risk of unexpected or partial loss of the<br />

leased asset is then borne again by the lessor.<br />

The Group as lessee<br />

Expenditure on operating leases is always recorded on a<br />

straight-line basis over the life of the lease agreement and<br />

reported under operating expenses.<br />

Finance leases where the Commerzbank Group is a lessee are<br />

of minor significance.<br />

Group Financial Statements