Agenda - Byron Shire Council - NSW Government

Agenda - Byron Shire Council - NSW Government

Agenda - Byron Shire Council - NSW Government

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BYRON SHIRE COUNCIL<br />

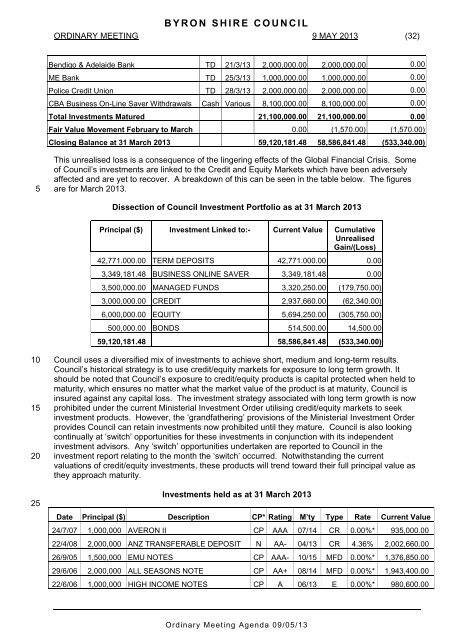

ORDINARY MEETING 9 MAY 2013 (32)<br />

Bendigo & Adelaide Bank TD 21/3/13 2,000,000.00 2,000,000.00 0.00<br />

ME Bank TD 25/3/13 1,000,000.00 1,000,000.00 0.00<br />

Police Credit Union TD 28/3/13 2,000,000.00 2,000,000.00 0.00<br />

CBA Business On-Line Saver Withdrawals Cash Various 8,100,000.00 8,100,000.00 0.00<br />

Total Investments Matured 21,100,000.00 21,100,000.00 0.00<br />

Fair Value Movement February to March 0.00 (1,570.00) (1,570.00)<br />

Closing Balance at 31 March 2013 59,120,181.48 58,586,841.48 (533,340.00)<br />

5<br />

This unrealised loss is a consequence of the lingering effects of the Global Financial Crisis. Some<br />

of <strong>Council</strong>’s investments are linked to the Credit and Equity Markets which have been adversely<br />

affected and are yet to recover. A breakdown of this can be seen in the table below. The figures<br />

are for March 2013.<br />

Dissection of <strong>Council</strong> Investment Portfolio as at 31 March 2013<br />

Principal ($) Investment Linked to:- Current Value Cumulative<br />

Unrealised<br />

Gain/(Loss)<br />

42,771.000.00 TERM DEPOSITS 42,771.000.00 0.00<br />

3,349,181.48 BUSINESS ONLINE SAVER 3,349,181.48 0.00<br />

3,500,000.00 MANAGED FUNDS 3,320,250.00 (179,750.00)<br />

3,000,000.00 CREDIT 2,937,660.00 (62,340.00)<br />

6,000,000.00 EQUITY 5,694,250.00 (305,750.00)<br />

500,000.00 BONDS 514,500.00 14,500.00<br />

59,120,181.48 58,586,841.48 (533,340.00)<br />

10<br />

15<br />

20<br />

25<br />

<strong>Council</strong> uses a diversified mix of investments to achieve short, medium and long-term results.<br />

<strong>Council</strong>’s historical strategy is to use credit/equity markets for exposure to long term growth. It<br />

should be noted that <strong>Council</strong>’s exposure to credit/equity products is capital protected when held to<br />

maturity, which ensures no matter what the market value of the product is at maturity, <strong>Council</strong> is<br />

insured against any capital loss. The investment strategy associated with long term growth is now<br />

prohibited under the current Ministerial Investment Order utilising credit/equity markets to seek<br />

investment products. However, the ‘grandfathering’ provisions of the Ministerial Investment Order<br />

provides <strong>Council</strong> can retain investments now prohibited until they mature. <strong>Council</strong> is also looking<br />

continually at ‘switch’ opportunities for these investments in conjunction with its independent<br />

investment advisors. Any ‘switch’ opportunities undertaken are reported to <strong>Council</strong> in the<br />

investment report relating to the month the ‘switch’ occurred. Notwithstanding the current<br />

valuations of credit/equity investments, these products will trend toward their full principal value as<br />

they approach maturity.<br />

Investments held as at 31 March 2013<br />

Date Principal ($) Description CP* Rating M’ty Type Rate Current Value<br />

24/7/07 1,000,000 AVERON II CP AAA 07/14 CR 0.00%* 935,000.00<br />

22/4/08 2,000,000 ANZ TRANSFERABLE DEPOSIT N AA- 04/13 CR 4.36% 2,002,660.00<br />

26/9/05 1,500,000 EMU NOTES CP AAA- 10/15 MFD 0.00%* 1,376,850.00<br />

29/6/06 2,000,000 ALL SEASONS NOTE CP AA+ 08/14 MFD 0.00%* 1,943,400.00<br />

22/6/06 1,000,000 HIGH INCOME NOTES CP A 06/13 E 0.00%* 980,600.00<br />

Ordinary Meeting <strong>Agenda</strong> 09/05/13