Agenda - Byron Shire Council - NSW Government

Agenda - Byron Shire Council - NSW Government

Agenda - Byron Shire Council - NSW Government

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BYRON SHIRE COUNCIL<br />

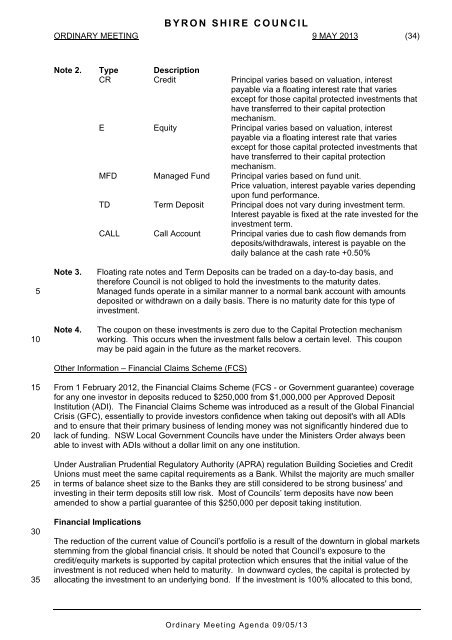

ORDINARY MEETING 9 MAY 2013 (34)<br />

Note 2. Type Description<br />

CR Credit Principal varies based on valuation, interest<br />

payable via a floating interest rate that varies<br />

except for those capital protected investments that<br />

have transferred to their capital protection<br />

mechanism.<br />

E Equity Principal varies based on valuation, interest<br />

payable via a floating interest rate that varies<br />

except for those capital protected investments that<br />

have transferred to their capital protection<br />

mechanism.<br />

MFD Managed Fund Principal varies based on fund unit.<br />

Price valuation, interest payable varies depending<br />

upon fund performance.<br />

TD Term Deposit Principal does not vary during investment term.<br />

Interest payable is fixed at the rate invested for the<br />

investment term.<br />

CALL Call Account Principal varies due to cash flow demands from<br />

deposits/withdrawals, interest is payable on the<br />

daily balance at the cash rate +0.50%<br />

5<br />

10<br />

Note 3.<br />

Note 4.<br />

Floating rate notes and Term Deposits can be traded on a day-to-day basis, and<br />

therefore <strong>Council</strong> is not obliged to hold the investments to the maturity dates.<br />

Managed funds operate in a similar manner to a normal bank account with amounts<br />

deposited or withdrawn on a daily basis. There is no maturity date for this type of<br />

investment.<br />

The coupon on these investments is zero due to the Capital Protection mechanism<br />

working. This occurs when the investment falls below a certain level. This coupon<br />

may be paid again in the future as the market recovers.<br />

Other Information – Financial Claims Scheme (FCS)<br />

15<br />

20<br />

25<br />

30<br />

35<br />

From 1 February 2012, the Financial Claims Scheme (FCS - or <strong>Government</strong> guarantee) coverage<br />

for any one investor in deposits reduced to $250,000 from $1,000,000 per Approved Deposit<br />

Institution (ADI). The Financial Claims Scheme was introduced as a result of the Global Financial<br />

Crisis (GFC), essentially to provide investors confidence when taking out deposit's with all ADIs<br />

and to ensure that their primary business of lending money was not significantly hindered due to<br />

lack of funding. <strong>NSW</strong> Local <strong>Government</strong> <strong>Council</strong>s have under the Ministers Order always been<br />

able to invest with ADIs without a dollar limit on any one institution.<br />

Under Australian Prudential Regulatory Authority (APRA) regulation Building Societies and Credit<br />

Unions must meet the same capital requirements as a Bank. Whilst the majority are much smaller<br />

in terms of balance sheet size to the Banks they are still considered to be strong business' and<br />

investing in their term deposits still low risk. Most of <strong>Council</strong>s’ term deposits have now been<br />

amended to show a partial guarantee of this $250,000 per deposit taking institution.<br />

Financial Implications<br />

The reduction of the current value of <strong>Council</strong>’s portfolio is a result of the downturn in global markets<br />

stemming from the global financial crisis. It should be noted that <strong>Council</strong>’s exposure to the<br />

credit/equity markets is supported by capital protection which ensures that the initial value of the<br />

investment is not reduced when held to maturity. In downward cycles, the capital is protected by<br />

allocating the investment to an underlying bond. If the investment is 100% allocated to this bond,<br />

Ordinary Meeting <strong>Agenda</strong> 09/05/13