FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

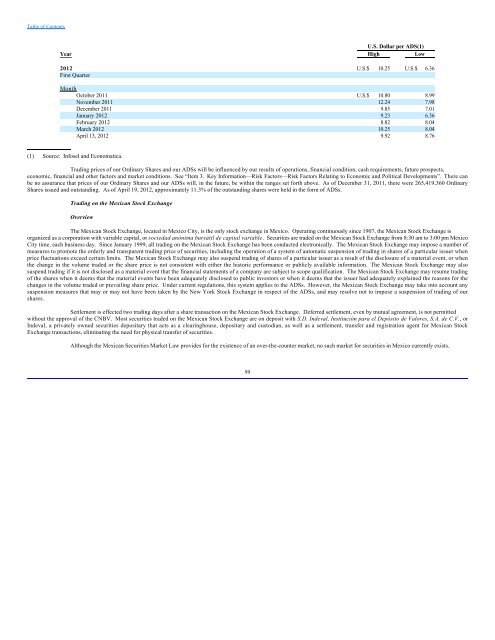

U.S. Dollar per ADS(1)<br />

Year High Low<br />

<strong>20</strong>12 U.S.$ 10.25 U.S.$ 6.36<br />

First Quarter<br />

Month<br />

October <strong>20</strong>11 U.S.$ 10.80 8.99<br />

November <strong>20</strong>11 12.24 7.98<br />

December <strong>20</strong>11 9.85 7.01<br />

January <strong>20</strong>12 9.23 6.36<br />

February <strong>20</strong>12 8.82 8.04<br />

March <strong>20</strong>12 10.25 8.04<br />

April 13, <strong>20</strong>12 9.92 8.76<br />

(1) Source: Infosel and Economatica.<br />

Trading prices of our Ordinary Shares and our ADSs will be influenced by our results of operations, financial condition, cash requirements, future prospects,<br />

economic, financial and other factors and market conditions. See “Item 3. Key Information—Risk Factors—Risk Factors Relating to Economic and Political Developments”. There can<br />

be no assurance that prices of our Ordinary Shares and our ADSs will, in the future, be within the ranges set forth above. As of December 31, <strong>20</strong>11, there were 265,419,360 Ordinary<br />

Shares issued and outstanding. As of April 19, <strong>20</strong>12, approximately 11.3% of the outstanding shares were held in the form of ADSs.<br />

Trading on the Mexican Stock Exchange<br />

Overview<br />

The Mexican Stock Exchange, located in Mexico City, is the only stock exchange in Mexico. Operating continuously since 1907, the Mexican Stock Exchange is<br />

organized as a corporation with variable capital, or sociedad anónima bursátil <strong>de</strong> capital variable. Securities are tra<strong>de</strong>d on the Mexican Stock Exchange from 8:30 am to 3:00 pm Mexico<br />

City time, each business day. Since January 1999, all trading on the Mexican Stock Exchange has been conducted electronically. The Mexican Stock Exchange may impose a number of<br />

measures to promote the or<strong>de</strong>rly and transparent trading price of securities, including the operation of a system of automatic suspension of trading in shares of a particular issuer when<br />

price fluctuations exceed certain limits. The Mexican Stock Exchange may also suspend trading of shares of a particular issuer as a result of the disclosure of a material event, or when<br />

the change in the volume tra<strong>de</strong>d or the share price is not consistent with either the historic performance or publicly available information. The Mexican Stock Exchange may also<br />

suspend trading if it is not disclosed as a material event that the financial statements of a company are subject to scope qualification. The Mexican Stock Exchange may resume trading<br />

of the shares when it <strong>de</strong>ems that the material events have been a<strong>de</strong>quately disclosed to public investors or when it <strong>de</strong>ems that the issuer had a<strong>de</strong>quately explained the reasons for the<br />

changes in the volume tra<strong>de</strong>d or prevailing share price. Un<strong>de</strong>r current regulations, this system applies to the ADSs. However, the Mexican Stock Exchange may take into account any<br />

suspension measures that may or may not have been taken by the New York Stock Exchange in respect of the ADSs, and may resolve not to impose a suspension of trading of our<br />

shares.<br />

Settlement is effected two trading days after a share transaction on the Mexican Stock Exchange. Deferred settlement, even by mutual agreement, is not permitted<br />

without the approval of the CNBV. Most securities tra<strong>de</strong>d on the Mexican Stock Exchange are on <strong>de</strong>posit with S.D. In<strong>de</strong>val, Institución para el Depósito <strong>de</strong> Valores, S.A. <strong>de</strong> C.V., or<br />

In<strong>de</strong>val, a privately owned securities <strong>de</strong>positary that acts as a clearinghouse, <strong>de</strong>positary and custodian, as well as a settlement, transfer and registration agent for Mexican Stock<br />

Exchange transactions, eliminating the need for physical transfer of securities.<br />

Although the Mexican Securities Market Law provi<strong>de</strong>s for the existence of an over-the-counter market, no such market for securities in Mexico currently exists.<br />

99