FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table of Contents<br />

<strong>20</strong>11 <strong>20</strong>10<br />

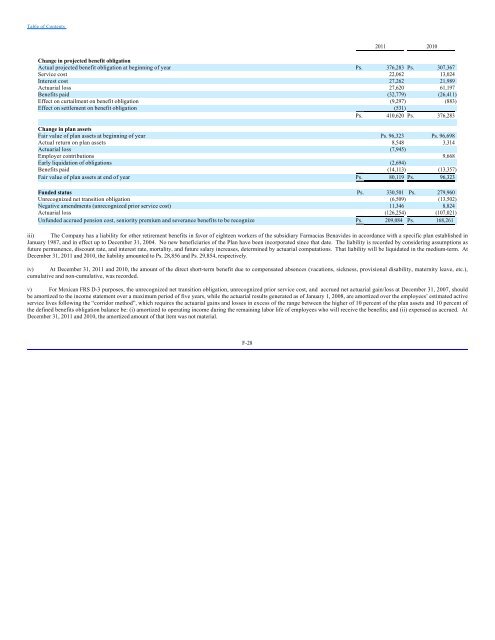

Change in projected benefit obligation<br />

Actual projected benefit obligation at beginning of year Ps. 376,283 Ps. 307,367<br />

Service cost 22,062 13,024<br />

Interest cost 27,262 21,989<br />

Actuarial loss 27,6<strong>20</strong> 61,197<br />

Benefits paid (32,779) (26,411)<br />

Effect on curtailment on benefit obligation (9,297) (883)<br />

Effect on settlement on benefit obligation (531)<br />

Ps. 410,6<strong>20</strong> Ps. 376,283<br />

Change in plan assets<br />

Fair value of plan assets at beginning of year Ps. 96,323 Ps. 96,698<br />

Actual return on plan assets 8,548 3,314<br />

Actuarial loss (7,945)<br />

Employer contributions 9,668<br />

Early liquidation of obligations (2,694)<br />

Benefits paid (14,113) (13,357)<br />

Fair value of plan assets at end of year Ps. 80,119 Ps. 96,323<br />

Fun<strong>de</strong>d status Ps. 330,501 Ps. 279,960<br />

Unrecognized net transition obligation (6,509) (13,502)<br />

Negative amendments (unrecognized prior service cost) 11,346 8,824<br />

Actuarial loss (126,254) (107,021)<br />

Unfun<strong>de</strong>d accrued pension cost, seniority premium and severance benefits to be recognize Ps. <strong>20</strong>9,084 Ps. 168,261<br />

iii) The Company has a liability for other retirement benefits in favor of eighteen workers of the subsidiary Farmacias Benavi<strong>de</strong>s in accordance with a specific plan established in<br />

January 1987, and in effect up to December 31, <strong>20</strong>04. No new beneficiaries of the Plan have been incorporated since that date. The liability is recor<strong>de</strong>d by consi<strong>de</strong>ring assumptions as<br />

future permanence, discount rate, and interest rate, mortality, and future salary increases, <strong>de</strong>termined by actuarial computations. That liability will be liquidated in the medium-term. At<br />

December 31, <strong>20</strong>11 and <strong>20</strong>10, the liability amounted to Ps. 28,856 and Ps. 29,854, respectively.<br />

iv) At December 31, <strong>20</strong>11 and <strong>20</strong>10, the amount of the direct short-term benefit due to compensated absences (vacations, sickness, provisional disability, maternity leave, etc.),<br />

cumulative and non-cumulative, was recor<strong>de</strong>d.<br />

v) For Mexican FRS D-3 purposes, the unrecognized net transition obligation, unrecognized prior service cost, and accrued net actuarial gain/loss at December 31, <strong>20</strong>07, should<br />

be amortized to the income statement over a maximum period of five years, while the actuarial results generated as of January 1, <strong>20</strong>08, are amortized over the employees’ estimated active<br />

service lives following the “corridor method”, which requires the actuarial gains and losses in excess of the range between the higher of 10 percent of the plan assets and 10 percent of<br />

the <strong>de</strong>fined benefits obligation balance be: (i) amortized to operating income during the remaining labor life of employees who will receive the benefits; and (ii) expensed as accrued. At<br />

December 31, <strong>20</strong>11 and <strong>20</strong>10, the amortized amount of that item was not material.<br />

F-28