FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table of Contents<br />

Through December 31, <strong>20</strong>07, stockhol<strong>de</strong>rs’ equity was restated based on the NCPI factor. The stockhol<strong>de</strong>rs’ equity restatement represents the amount necessary to maintain<br />

sharehol<strong>de</strong>rs’ investment in terms of the <strong>20</strong>07 fiscal year purchasing power of the currency.<br />

f) Translation of financial statements of foreign operations<br />

The accounting records of the foreign subsidiaries and associates are maintained in the recording currency of the country where those entities are established. Their financial<br />

statements are prepared in conformity with International Financial Reporting Standards (IFRS) of the International Accounting Standards Board (IASB). Therefore, those financial<br />

statements are adjusted to Mexican FRS prior to their translation and accounting consolidation. The translation is carried out in accordance with Mexican FRS B-15, “Foreign currency<br />

translation” (FRS B-15). Toward that end, those financial statements are <strong>de</strong>termined in their functional currency and restated by applying rate of inflation at which the foreign operation<br />

operates, <strong>de</strong>pending upon whether the information comes from an inflationary or non-inflationary economic environment, in accordance with FRS B-10. Subsequently, they are<br />

translated into the reporting currency as discussed in the following paragraph.<br />

The Group’s foreign operations operate in a non-inflationary economic environment and its functional currencies are the Brazilian real, Chilean peso and Peruvian peso. Accordingly: (i)<br />

monetary and nonmonetary assets and liabilities were translated at the year-end exchange rate published by Banco <strong>de</strong> Mexico, and, the stockhol<strong>de</strong>rs’ equity at the historical exchange<br />

rate; and (ii) revenues and expenses were translated at the average exchange rate for the period. The translation adjustment is inclu<strong>de</strong>d in the “Accumulated translation effect” and<br />

forms part of comprehensive income. Moreover, it is recycled to income at the date of its availability. That line item inclu<strong>de</strong>s, if applicable, foreign exchange fluctuations (subparagraph<br />

s) below).<br />

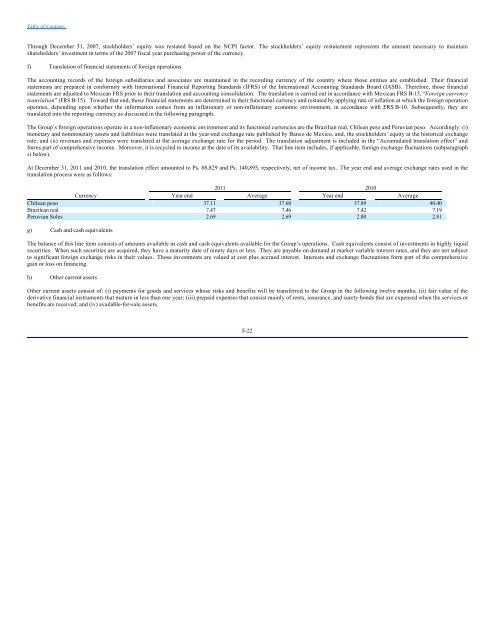

At December 31, <strong>20</strong>11 and <strong>20</strong>10, the translation effect amounted to Ps. 88,829 and Ps. 140,895, respectively, net of income tax. The year end and average exchange rates used in the<br />

translation process were as follows:<br />

<strong>20</strong>11 <strong>20</strong>10<br />

Currency Year end Average Year end Average<br />

Chilean peso 37.11 37.60 37.89 40.40<br />

Brazilean real 7.47 7.46 7.42 7.19<br />

Peruvian Soles 2.69 2.69 2.80 2.81<br />

g) Cash and cash equivalents<br />

The balance of this line item consists of amounts available in cash and cash equivalents available for the Group’s operations. Cash equivalents consist of investments in highly liquid<br />

securities. When such securities are acquired, they have a maturity date of ninety days or less. They are payable on <strong>de</strong>mand at market variable interest rates, and they are not subject<br />

to significant foreign exchange risks in their values. Those investments are valued at cost plus accrued interest. Interests and exchange fluctuations form part of the comprehensive<br />

gain or loss on financing.<br />

h) Other current assets<br />

Other current assets consist of: (i) payments for goods and services whose risks and benefits will be transferred to the Group in the following twelve months; (ii) fair value of the<br />

<strong>de</strong>rivative financial instruments that mature in less than one year; (iii) prepaid expenses that consist mainly of rents, insurance, and surety bonds that are expensed when the services or<br />

benefits are received; and (iv) available-for-sale assets.<br />

F-22