FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table of Contents<br />

ii)<br />

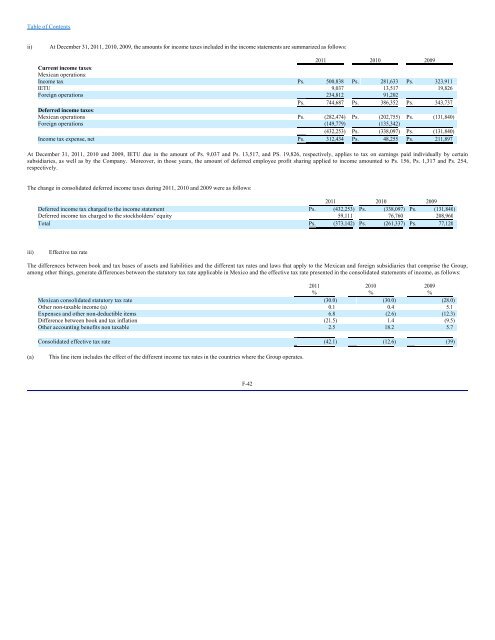

At December 31, <strong>20</strong>11, <strong>20</strong>10, <strong>20</strong>09, the amounts for income taxes inclu<strong>de</strong>d in the income statements are summarized as follows:<br />

<strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09<br />

Current income taxes:<br />

Mexican operations:<br />

Income tax Ps. 500,838 Ps. 281,633 Ps. 323,911<br />

IETU 9,037 13,517 19,826<br />

Foreign operations 234,812 91,<strong>20</strong>2<br />

Ps. 744,687 Ps. 386,352 Ps. 343,737<br />

Deferred income taxes:<br />

Mexican operations Ps. (282,474) Ps. (<strong>20</strong>2,755) Ps. (131,840)<br />

Foreign operations (149,779) (135,342)<br />

(432,253) Ps. (338,097) Ps. (131,840)<br />

Income tax expense, net Ps. 312,434 Ps. 48,255 Ps. 211,897<br />

At December 31, <strong>20</strong>11, <strong>20</strong>10 and <strong>20</strong>09, IETU due in the amount of Ps. 9,037 and Ps. 13,517, and PS. 19,826, respectively, applies to tax on earnings paid individually by certain<br />

subsidiaries, as well as by the Company. Moreover, in those years, the amount of <strong>de</strong>ferred employee profit sharing applied to income amounted to Ps. 156, Ps. 1,317 and Ps. 254,<br />

respectively.<br />

The change in consolidated <strong>de</strong>ferred income taxes during <strong>20</strong>11, <strong>20</strong>10 and <strong>20</strong>09 were as follows:<br />

<strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09<br />

Deferred income tax charged to the income statement Ps. (432,253) Ps. (338,097) Ps. (131,840)<br />

Deferred income tax charged to the stockhol<strong>de</strong>rs’ equity 59,111 76,760 <strong>20</strong>8,960<br />

Total Ps. (373,142) Ps. (261,337) Ps. 77,1<strong>20</strong><br />

iii)<br />

Effective tax rate<br />

The differences between book and tax bases of assets and liabilities and the different tax rates and laws that apply to the Mexican and foreign subsidiaries that comprise the Group,<br />

among other things, generate differences between the statutory tax rate applicable in Mexico and the effective tax rate presented in the consolidated statements of income, as follows:<br />

<strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09<br />

% % %<br />

Mexican consolidated statutory tax rate (30.0) (30.0) (28.0)<br />

Other non-taxable income (a) 0.1 0.4 5.1<br />

Expenses and other non-<strong>de</strong>ductible items 6.8 (2.6) (12.3)<br />

Difference between book and tax inflation (21.5) 1.4 (9.5)<br />

Other accounting benefits non taxable 2.5 18.2 5.7<br />

Consolidated effective tax rate (42.1) (12.6) (39)<br />

(a)<br />

This line item inclu<strong>de</strong>s the effect of the different income tax rates in the countries where the Group operates.<br />

F-42