FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

FORM 20-F Grupo Casa Saba, S.A.B. de C.V.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

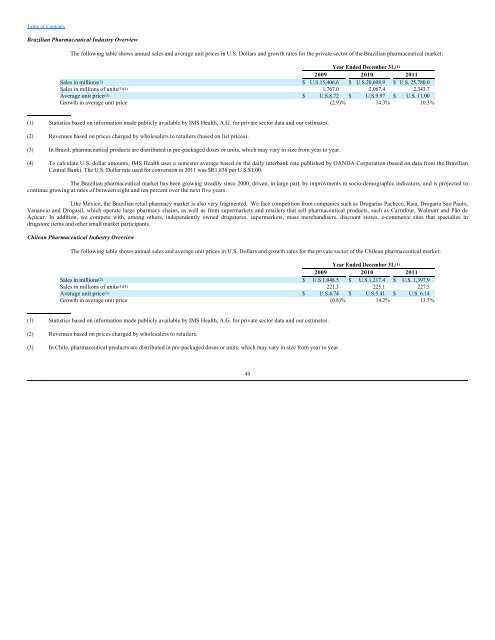

Brazilian Pharmaceutical Industry Overview<br />

The following table shows annual sales and average unit prices in U.S. Dollars and growth rates for the private sector of the Brazilian pharmaceutical market:<br />

Year En<strong>de</strong>d December 31,(1)<br />

<strong>20</strong>09 <strong>20</strong>10 <strong>20</strong>11<br />

Sales in millions(2) $ U.S.15,406.6 $ U.S.<strong>20</strong>,608.9 $ U.S. 25,780.0<br />

Sales in millions of units(3)(4) 1,767.0 2,067.4 2,343.7<br />

Average unit price(3) $ U.S.8.72 $ U.S.9.97 $ U.S. 11.00<br />

Growth in average unit price (2.9)% 14.3% 10.3%<br />

(1) Statistics based on information ma<strong>de</strong> publicly available by IMS Health, A.G. for private sector data and our estimates.<br />

(2) Revenues based on prices charged by wholesalers to retailers (based on list prices).<br />

(3) In Brazil, pharmaceutical products are distributed in pre-packaged doses or units, which may vary in size from year to year.<br />

(4) To calculate U.S. dollar amounts, IMS Health uses a semester average based on the daily interbank rate published by OANDA Corporation (based on data from the Brazilian<br />

Central Bank). The U.S. Dollar rate used for conversion in <strong>20</strong>11 was $R1.838 per U.S.$1.00.<br />

The Brazilian pharmaceutical market has been growing steadily since <strong>20</strong>00, driven, in large part, by improvments in socio-<strong>de</strong>mographic indicators, and is projected to<br />

continue growing at rates of between eight and ten percent over the next five years.<br />

Like Mexico, the Brazilian retail pharmacy market is also very fragmented. We face competition from companies such as Drogarias Pacheco, Raia, Drogaria Sao Paulo,<br />

Venancio and Drogasil, which operate large pharmacy chains, as well as from supermarkets and retailers that sell pharmaceutical products, such as Carrefour, Walmart and Pão <strong>de</strong><br />

Açúcar. In addition, we compete with, among others, in<strong>de</strong>pen<strong>de</strong>ntly owned drugstores, supermarkets, mass merchandisers, discount stores, e-commerce sites that specialize in<br />

drugstore items and other small market participants.<br />

Chilean Pharmaceutical Industry Overview<br />

The following table shows annual sales and average unit prices in U.S. Dollars and growth rates for the private sector of the Chilean pharmaceutical market:<br />

Year En<strong>de</strong>d December 31,(1)<br />

<strong>20</strong>09 <strong>20</strong>10 <strong>20</strong>11<br />

Sales in millions(2) $ U.S.1,048.5 $ U.S.1,217.4 $ U.S. 1,397.9<br />

Sales in millions of units(3)(4) 221.3 225.1 227.5<br />

Average unit price(3) $ U.S.4.74 $ U.S.5.41 $ U.S. 6.14<br />

Growth in average unit price (0.8)% 14.2% 13.5%<br />

(1) Statistics based on information ma<strong>de</strong> publicly available by IMS Health, A.G. for private sector data and our estimates.<br />

(2) Revenues based on prices charged by wholesalers to retailers.<br />

(3) In Chile, pharmaceutical products are distributed in pre-packaged doses or units, which may vary in size from year to year.<br />

49