Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Risk Management<br />

As emphasized in the “V” PLAN, we have positioned risk management as the key<br />

tool to ensure our earning power and to maximize corporate value. <strong>Marubeni</strong> has<br />

implemented an integrated risk management system based on Value at Risk (VaR) as<br />

part of a ceaseless drive to improve the management of risk.<br />

Through the 1990s, <strong>Marubeni</strong> applied a project-by-project<br />

approach to risk management that made risk-return<br />

performance a function of the aggregate of many individual<br />

management decisions. This approach had the disadvantage<br />

that it did not provide adequate control over risk<br />

diversification. Consequently, <strong>Marubeni</strong> was unable to<br />

appropriately respond to the simultaneous and frequent<br />

materialization of risks in specific segments like during the<br />

currency crisis in Asia.<br />

Based on these experiences, <strong>Marubeni</strong> is shifting its focus<br />

to a management method, which uses “portfolio management”<br />

to oversee the risk in group assets as a whole so as<br />

not to appropriate assets unevenly among certain countries,<br />

industries, or clients.<br />

The basis of portfolio management is in quantifying the<br />

risk of assets for the Group as a whole, including those<br />

held by subsidiaries. In order to do this, assets are categorized<br />

by country, industry, credit rating, and projected<br />

recovery date, and by calculating the Value at Risk (VaR),<br />

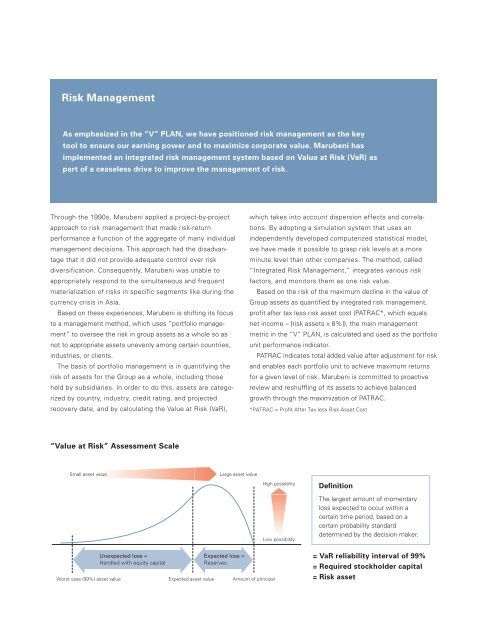

“Value at Risk” Assessment Scale<br />

Small asset value Large asset value<br />

Worst case (99%) asset value<br />

Unexpected loss =<br />

Handled with equity capital<br />

Expected asset value<br />

Expected loss =<br />

Reserves<br />

which takes into account dispersion effects and correlations.<br />

By adopting a simulation system that uses an<br />

independently developed computerized statistical model,<br />

we have made it possible to grasp risk levels at a more<br />

minute level than other companies. The method, called<br />

“Integrated Risk Management,” integrates various risk<br />

factors, and monitors them as one risk value.<br />

Based on the risk of the maximum decline in the value of<br />

Group assets as quantified by integrated risk management,<br />

profit after tax less risk asset cost (PATRAC*, which equals<br />

net income – [risk assets x 8%]), the main management<br />

metric in the “V” PLAN, is calculated and used as the portfolio<br />

unit performance indicator.<br />

PATRAC indicates total added value after adjustment for risk<br />

and enables each portfolio unit to achieve maximum returns<br />

for a given level of risk. <strong>Marubeni</strong> is committed to proactive<br />

review and reshuffling of its assets to achieve balanced<br />

growth through the maximization of PATRAC.<br />

*PATRAC = Profit After Tax less Risk Asset Cost<br />

Amount of principal<br />

High possibility<br />

Low possibility<br />

Definition<br />

The largest amount of momentary<br />

loss expected to occur within a<br />

certain time period, based on a<br />

certain probability standard<br />

determined by the decision maker.<br />

= VaR reliability interval of 99%<br />

= Required stockholder capital<br />

= Risk asset

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)