Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

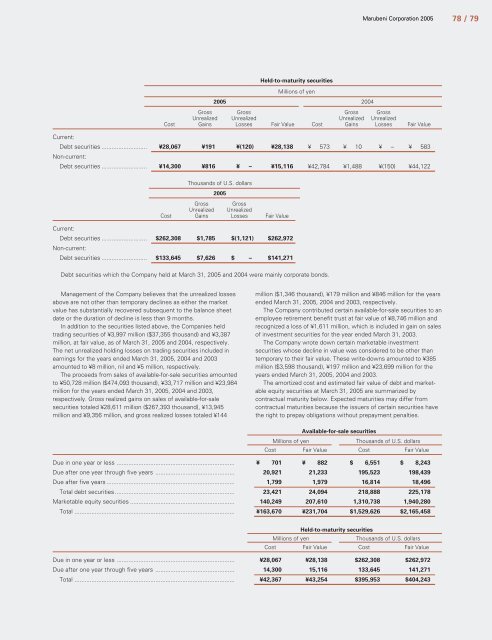

Held-to-maturity securities<br />

Millions of yen<br />

2005 2004<br />

<strong>Marubeni</strong> Corporation 2005 78 / 79<br />

Gross Gross Gross Gross<br />

Unrealized Unrealized Unrealized Unrealized<br />

Cost Gains Losses Fair Value Cost Gains Losses Fair Value<br />

Current:<br />

Debt securities ...........................<br />

Non-current:<br />

¥28,067 ¥191 ¥(120) ¥28,138 ¥ 573 ¥ 10 ¥ – ¥ 583<br />

Debt securities ........................... ¥14,300 ¥816 ¥ – ¥15,116 ¥42,784 ¥1,488 ¥(150) ¥44,122<br />

Thousands of U.S. dollars<br />

2005<br />

Gross Gross<br />

Unrealized Unrealized<br />

Cost Gains Losses Fair Value<br />

Current:<br />

Debt securities ...........................<br />

Non-current:<br />

$262,308 $1,785 $(1,121) $262,972<br />

Debt securities ........................... $133,645 $7,626 $ – $141,271<br />

Debt securities which the Company held at March 31, 2005 and 2004 were mainly corporate bonds.<br />

Management of the Company believes that the unrealized losses<br />

above are not other than temporary declines as either the market<br />

value has substantially recovered subsequent to the balance sheet<br />

date or the duration of decline is less than 9 months.<br />

In addition to the securities listed above, the Companies held<br />

trading securities of ¥3,997 million ($37,355 thousand) and ¥3,387<br />

million, at fair value, as of March 31, 2005 and 2004, respectively.<br />

The net unrealized holding losses on trading securities included in<br />

earnings for the years ended March 31, 2005, 2004 and 2003<br />

amounted to ¥8 million, nil and ¥5 million, respectively.<br />

The proceeds from sales of available-for-sale securities amounted<br />

to ¥50,728 million ($474,093 thousand), ¥33,717 million and ¥23,984<br />

million for the years ended March 31, 2005, 2004 and 2003,<br />

respectively. Gross realized gains on sales of available-for-sale<br />

securities totaled ¥28,611 million ($267,393 thousand), ¥13,945<br />

million and ¥9,356 million, and gross realized losses totaled ¥144<br />

million ($1,346 thousand), ¥179 million and ¥846 million for the years<br />

ended March 31, 2005, 2004 and 2003, respectively.<br />

The Company contributed certain available-for-sale securities to an<br />

employee retirement benefit trust at fair value of ¥8,746 million and<br />

recognized a loss of ¥1,611 million, which is included in gain on sales<br />

of investment securities for the year ended March 31, 2003.<br />

The Company wrote down certain marketable investment<br />

securities whose decline in value was considered to be other than<br />

temporary to their fair value. These write-downs amounted to ¥385<br />

million ($3,598 thousand), ¥197 million and ¥23,699 million for the<br />

years ended March 31, 2005, 2004 and 2003.<br />

The amortized cost and estimated fair value of debt and marketable<br />

equity securities at March 31, 2005 are summarized by<br />

contractual maturity below. Expected maturities may differ from<br />

contractual maturities because the issuers of certain securities have<br />

the right to prepay obligations without prepayment penalties.<br />

Available-for-sale securities<br />

Millions of yen Thousands of U.S. dollars<br />

Cost Fair Value Cost Fair Value<br />

Due in one year or less ...................................................................... ¥ 701 ¥ 882 $ 6,551 $ 8,243<br />

Due after one year through five years ............................................... 20,921 21,233 195,523 198,439<br />

Due after five years ............................................................................ 1,799 1,979 16,814 18,496<br />

Total debt securities ....................................................................... 23,421 24,094 218,888 225,178<br />

Marketable equity securities .............................................................. 140,249 207,610 1,310,738 1,940,280<br />

Total ............................................................................................... ¥163,670 ¥231,704 $1,529,626 $2,165,458<br />

Held-to-maturity securities<br />

Millions of yen Thousands of U.S. dollars<br />

Cost Fair Value Cost Fair Value<br />

Due in one year or less ...................................................................... ¥28,067 ¥28,138 $262,308 $262,972<br />

Due after one year through five years ............................................... 14,300 15,116 133,645 141,271<br />

Total ............................................................................................... ¥42,367 ¥43,254 $395,953 $404,243

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)