Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

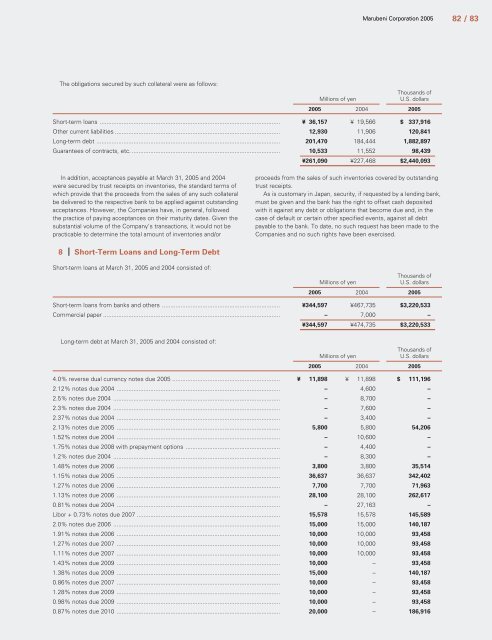

The obligations secured by such collateral were as follows:<br />

<strong>Marubeni</strong> Corporation 2005 82 / 83<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

2005 2004 2005<br />

Short-term loans ........................................................................................................... ¥ 36,157 ¥ 19,566 $ 337,916<br />

Other current liabilities .................................................................................................. 12,930 11,906 120,841<br />

Long-term debt ............................................................................................................. 201,470 184,444 1,882,897<br />

Guarantees of contracts, etc. ........................................................................................ 10,533 11,552 98,439<br />

In addition, acceptances payable at March 31, 2005 and 2004<br />

were secured by trust receipts on inventories, the standard terms of<br />

which provide that the proceeds from the sales of any such collateral<br />

be delivered to the respective bank to be applied against outstanding<br />

acceptances. However, the Companies have, in general, followed<br />

the practice of paying acceptances on their maturity dates. Given the<br />

substantial volume of the Company’s transactions, it would not be<br />

practicable to determine the total amount of inventories and/or<br />

8 Short-Term Loans and Long-Term Debt<br />

Short-term loans at March 31, 2005 and 2004 consisted of:<br />

¥261,090 ¥227,468 $2,440,093<br />

proceeds from the sales of such inventories covered by outstanding<br />

trust receipts.<br />

As is customary in Japan, security, if requested by a lending bank,<br />

must be given and the bank has the right to offset cash deposited<br />

with it against any debt or obligations that become due and, in the<br />

case of default or certain other specified events, against all debt<br />

payable to the bank. To date, no such request has been made to the<br />

Companies and no such rights have been exercised.<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

2005 2004 2005<br />

Short-term loans from banks and others ...................................................................... ¥344,597 ¥467,735 $3,220,533<br />

Commercial paper ......................................................................................................... – 7,000 –<br />

Long-term debt at March 31, 2005 and 2004 consisted of:<br />

¥344,597 ¥474,735 $3,220,533<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

2005 2004 2005<br />

4.0% reverse dual currency notes due 2005 ................................................................ ¥ 11,898 ¥ 11,898 $ 111,196<br />

2.12% notes due 2004 ................................................................................................. – 4,600 –<br />

2.5% notes due 2004 ................................................................................................... – 8,700 –<br />

2.3% notes due 2004 ................................................................................................... – 7,600 –<br />

2.37% notes due 2004 ................................................................................................. – 3,400 –<br />

2.13% notes due 2005 ................................................................................................. 5,800 5,800 54,206<br />

1.52% notes due 2004 ................................................................................................. – 10,600 –<br />

1.75% notes due 2008 with prepayment options ........................................................ – 4,400 –<br />

1.2% notes due 2004 ................................................................................................... – 8,300 –<br />

1.48% notes due 2006 ................................................................................................. 3,800 3,800 35,514<br />

1.15% notes due 2005 ................................................................................................. 36,637 36,637 342,402<br />

1.27% notes due 2006 ................................................................................................. 7,700 7,700 71,963<br />

1.13% notes due 2006 ................................................................................................. 28,100 28,100 262,617<br />

0.81% notes due 2004 ................................................................................................. – 27,163 –<br />

Libor + 0.73% notes due 2007 ..................................................................................... 15,578 15,578 145,589<br />

2.0% notes due 2006 ................................................................................................... 15,000 15,000 140,187<br />

1.91% notes due 2006 ................................................................................................. 10,000 10,000 93,458<br />

1.27% notes due 2007 ................................................................................................. 10,000 10,000 93,458<br />

1.11% notes due 2007 ................................................................................................. 10,000 10,000 93,458<br />

1.43% notes due 2009 ................................................................................................. 10,000 – 93,458<br />

1.38% notes due 2009 ................................................................................................. 15,000 – 140,187<br />

0.86% notes due 2007 ................................................................................................. 10,000 – 93,458<br />

1.28% notes due 2009 ................................................................................................. 10,000 – 93,458<br />

0.98% notes due 2009 ................................................................................................. 10,000 – 93,458<br />

0.87% notes due 2010 ................................................................................................. 20,000 – 186,916

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)