Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

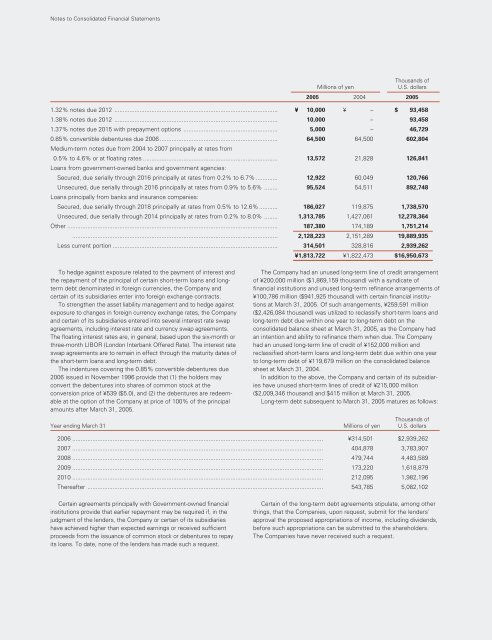

Notes to Consolidated Financial Statements<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

2005 2004 2005<br />

1.32% notes due 2012 ................................................................................................. ¥ 10,000 ¥ – $ 93,458<br />

1.38% notes due 2012 ................................................................................................. 10,000 – 93,458<br />

1.37% notes due 2015 with prepayment options ........................................................ 5,000 – 46,729<br />

0.85% convertible debentures due 2006 ......................................................................<br />

Medium-term notes due from 2004 to 2007 principally at rates from<br />

64,500 64,500 602,804<br />

0.5% to 4.6% or at floating rates ................................................................................<br />

Loans from government-owned banks and government agencies:<br />

13,572 21,828 126,841<br />

Secured, due serially through 2016 principally at rates from 0.2% to 6.7% ............. 12,922 60,049 120,766<br />

Unsecured, due serially through 2016 principally at rates from 0.9% to 5.6% ........<br />

Loans principally from banks and insurance companies:<br />

95,524 54,511 892,748<br />

Secured, due serially through 2018 principally at rates from 0.5% to 12.6% ........... 186,027 119,875 1,738,570<br />

Unsecured, due serially through 2014 principally at rates from 0.2% to 8.0% ........ 1,313,785 1,427,061 12,278,364<br />

Other ............................................................................................................................. 187,380 174,189 1,751,214<br />

.......................................................................................................................... 2,128,223 2,151,289 19,889,935<br />

Less current portion .................................................................................................. 314,501 328,816 2,939,262<br />

To hedge against exposure related to the payment of interest and<br />

the repayment of the principal of certain short-term loans and longterm<br />

debt denominated in foreign currencies, the Company and<br />

certain of its subsidiaries enter into foreign exchange contracts.<br />

To strengthen the asset liability management and to hedge against<br />

exposure to changes in foreign currency exchange rates, the Company<br />

and certain of its subsidiaries entered into several interest rate swap<br />

agreements, including interest rate and currency swap agreements.<br />

The floating interest rates are, in general, based upon the six-month or<br />

three-month LIBOR (London Interbank Offered Rate). The interest rate<br />

swap agreements are to remain in effect through the maturity dates of<br />

the short-term loans and long-term debt.<br />

The indentures covering the 0.85% convertible debentures due<br />

2006 issued in November 1996 provide that (1) the holders may<br />

convert the debentures into shares of common stock at the<br />

conversion price of ¥539 ($5.0), and (2) the debentures are redeemable<br />

at the option of the Company at price of 100% of the principal<br />

amounts after March 31, 2005.<br />

¥1,813,722 ¥1,822,473 $16,950,673<br />

The Company had an unused long-term line of credit arrangement<br />

of ¥200,000 million ($1,869,159 thousand) with a syndicate of<br />

financial institutions and unused long-term refinance arrangements of<br />

¥100,786 million ($941,925 thousand) with certain financial institutions<br />

at March 31, 2005. Of such arrangements, ¥259,591 million<br />

($2,426,084 thousand) was utilized to reclassify short-term loans and<br />

long-term debt due within one year to long-term debt on the<br />

consolidated balance sheet at March 31, 2005, as the Company had<br />

an intention and ability to refinance them when due. The Company<br />

had an unused long-term line of credit of ¥152,000 million and<br />

reclassified short-term loans and long-term debt due within one year<br />

to long-term debt of ¥119,679 million on the consolidated balance<br />

sheet at March 31, 2004.<br />

In addition to the above, the Company and certain of its subsidiaries<br />

have unused short-term lines of credit of ¥215,000 million<br />

($2,009,346 thousand) and $415 million at March 31, 2005.<br />

Long-term debt subsequent to March 31, 2005 matures as follows:<br />

Thousands of<br />

Year ending March 31 Millions of yen U.S. dollars<br />

2006 ..................................................................................................................................................... ¥314,501 $2,939,262<br />

2007 ..................................................................................................................................................... 404,878 3,783,907<br />

2008 ..................................................................................................................................................... 479,744 4,483,589<br />

2009 ..................................................................................................................................................... 173,220 1,618,879<br />

2010 ..................................................................................................................................................... 212,095 1,982,196<br />

Thereafter ............................................................................................................................................ 543,785 5,082,102<br />

Certain agreements principally with Government-owned financial<br />

institutions provide that earlier repayment may be required if, in the<br />

judgment of the lenders, the Company or certain of its subsidiaries<br />

have achieved higher than expected earnings or received sufficient<br />

proceeds from the issuance of common stock or debentures to repay<br />

its loans. To date, none of the lenders has made such a request.<br />

Certain of the long-term debt agreements stipulate, among other<br />

things, that the Companies, upon request, submit for the lenders’<br />

approval the proposed appropriations of income, including dividends,<br />

before such appropriations can be submitted to the shareholders.<br />

The Companies have never received such a request.

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)