Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to Consolidated Financial Statements<br />

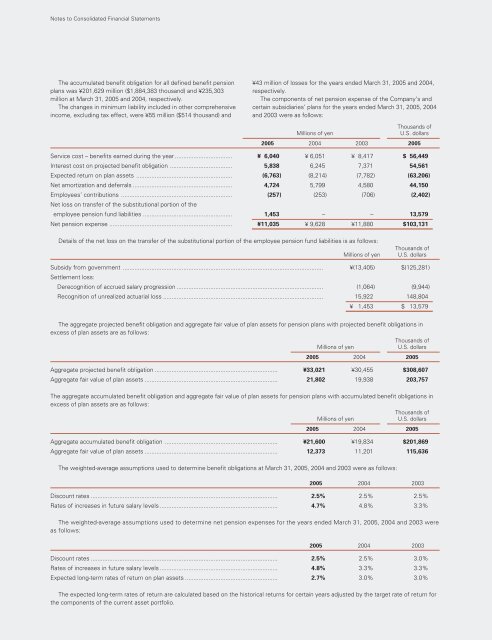

The accumulated benefit obligation for all defined benefit pension<br />

plans was ¥201,629 million ($1,884,383 thousand) and ¥235,303<br />

million at March 31, 2005 and 2004, respectively.<br />

The changes in minimum liability included in other comprehensive<br />

income, excluding tax effect, were ¥55 million ($514 thousand) and<br />

¥43 million of losses for the years ended March 31, 2005 and 2004,<br />

respectively.<br />

The components of net pension expense of the Company’s and<br />

certain subsidiaries’ plans for the years ended March 31, 2005, 2004<br />

and 2003 were as follows:<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

2005 2004 2003 2005<br />

Service cost – benefits earned during the year .................................. ¥ 6,040 ¥ 6,051 ¥ 8,417 $ 56,449<br />

Interest cost on projected benefit obligation ..................................... 5,838 6,245 7,371 54,561<br />

Expected return on plan assets ......................................................... (6,763) (8,214) (7,782) (63,206)<br />

Net amortization and deferrals ........................................................... 4,724 5,799 4,580 44,150<br />

Employees’ contributions ..................................................................<br />

Net loss on transfer of the substitutional portion of the<br />

(257) (253) (706) (2,402)<br />

employee pension fund liabilities ..................................................... 1,453 – – 13,579<br />

Net pension expense ......................................................................... ¥11,035 ¥ 9,628 ¥11,880 $103,131<br />

Details of the net loss on the transfer of the substitutional portion of the employee pension fund liabilities is as follows:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

Subsidy from government .......................................................................................................................<br />

Settlement loss:<br />

¥(13,405) $(125,281)<br />

Derecognition of accrued salary progression ....................................................................................... (1,064) (9,944)<br />

Recognition of unrealized actuarial loss ............................................................................................... 15,922 148,804<br />

¥ 1,453 $ 13,579<br />

The aggregate projected benefit obligation and aggregate fair value of plan assets for pension plans with projected benefit obligations in<br />

excess of plan assets are as follows:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

2005 2004 2005<br />

Aggregate projected benefit obligation ......................................................................... ¥33,021 ¥30,455 $308,607<br />

Aggregate fair value of plan assets ............................................................................... 21,802 19,938 203,757<br />

The aggregate accumulated benefit obligation and aggregate fair value of plan assets for pension plans with accumulated benefit obligations in<br />

excess of plan assets are as follows:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

2005 2004 2005<br />

Aggregate accumulated benefit obligation ................................................................... ¥21,600 ¥19,834 $201,869<br />

Aggregate fair value of plan assets ............................................................................... 12,373 11,201 115,636<br />

The weighted-average assumptions used to determine benefit obligations at March 31, 2005, 2004 and 2003 were as follows:<br />

2005 2004 2003<br />

Discount rates ............................................................................................................... 2.5% 2.5% 2.5%<br />

Rates of increases in future salary levels ...................................................................... 4.7% 4.8% 3.3%<br />

The weighted-average assumptions used to determine net pension expenses for the years ended March 31, 2005, 2004 and 2003 were<br />

as follows:<br />

2005 2004 2003<br />

Discount rates ............................................................................................................... 2.5% 2.5% 3.0%<br />

Rates of increases in future salary levels ...................................................................... 4.8% 3.3% 3.3%<br />

Expected long-term rates of return on plan assets ....................................................... 2.7% 3.0% 3.0%<br />

The expected long-term rates of return are calculated based on the historical returns for certain years adjusted by the target rate of return for<br />

the components of the current asset portfolio.

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)