Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12 Preferred Stock<br />

The Company is authorized to issue 100 million shares of Class I<br />

Preferred Stock and 100 million shares of Class II Preferred Stock.<br />

Both classes of preferred stock are non-voting and have equal<br />

preference with the Company’s common stock for the payment of<br />

dividends and the distribution of assets in the event of a liquidation<br />

or dissolution of the Company. However, during a period that no<br />

preferred dividends are paid preferred shareholders have a voting<br />

right per share until preferred dividends are declared. Preferred<br />

dividends are non-cumulative and non-participating. Preferred<br />

shareholders are entitled to a liquidation distribution at ¥1,000 ($9.35)<br />

per share and do not have the right to participate in any further<br />

liquidation distributions. The Company may repurchase and hold any<br />

classes of preferred stocks, and retire them out of earnings available<br />

for distribution to the shareholders.<br />

Class I Preferred Stock<br />

Class I Preferred Stock is convertible into common stock at the<br />

option of preferred shareholders during a conversion period. Class I<br />

Preferred Stock will be mandatorily converted into common stock on<br />

the date immediately following the closing date of the conversion<br />

period. At the time of issuance, the Board of Directors will determine<br />

the issue price, annual dividend (not exceed ¥100 per share), and<br />

conversion terms, including a conversion period.<br />

On December 16, 2003, the Company issued 75.5 million shares<br />

of Class I Preferred Stock at ¥1,000 per share or ¥75,500 million in<br />

aggregate. The Company allocated ¥37,750 million to preferred stock<br />

with the remainder, net of issuance costs, recognized as capital<br />

13 Other Comprehensive Income (Loss)<br />

<strong>Marubeni</strong> Corporation 2005 88 / 89<br />

surplus based on the JCC and the decision of the Board of Directors<br />

of the Company. The annual dividend is ¥20 ($0.19) per share. At the<br />

option of the shareholders, Class I Preferred Stock is convertible into<br />

common stock during the period from September 1, 2006 to<br />

December 12, 2013 at the conversion price, which is initially the<br />

average market closing price of the common stock of the Company<br />

traded on the Tokyo Stock Exchange (the “TSE”) for the 30 business<br />

days starting from the 45th business day prior to the starting day of<br />

the conversion period, but not less than ¥50 ($0.47). The conversion<br />

price will then be reset annually on September 1 of each year from<br />

2007 to 2013 if there is a decline in the market price of the<br />

Company’s common stock, but not less than 70% of the initial<br />

conversion price or ¥50 ($0.47), whichever higher. Class I Preferred<br />

Stock shares which are not converted at the option of the shareholders<br />

will be mandatorily converted into common stock on December<br />

13, 2013, at the conversion price determined based on the average<br />

market closing price of the common stock traded on the TSE for the<br />

30 business days starting from the 45th business day prior to the<br />

date of mandatory conversion.<br />

Class II Preferred Stock<br />

Class II Preferred Stock is redeemable at the option of the Company.<br />

At the time of issuance, the Board of Directors will determine the<br />

issue price, annual dividend (not exceed ¥100 per share), and<br />

redemption terms, including a redemption price.<br />

No shares of the Class II Preferred Stock were issued and<br />

outstanding at March 31, 2005.<br />

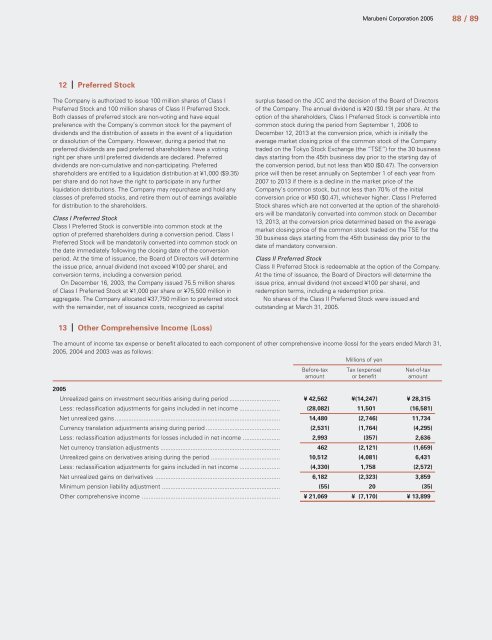

The amount of income tax expense or benefit allocated to each component of other comprehensive income (loss) for the years ended March 31,<br />

2005, 2004 and 2003 was as follows:<br />

Millions of yen<br />

Before-tax Tax (expense) Net-of-tax<br />

amount or benefit amount<br />

2005<br />

Unrealized gains on investment securities arising during period .............................. ¥ 42,562 ¥(14,247) ¥ 28,315<br />

Less: reclassification adjustments for gains included in net income ........................ (28,082) 11,501 (16,581)<br />

Net unrealized gains .................................................................................................. 14,480 (2,746) 11,734<br />

Currency translation adjustments arising during period ............................................ (2,531) (1,764) (4,295)<br />

Less: reclassification adjustments for losses included in net income ...................... 2,993 (357) 2,636<br />

Net currency translation adjustments ....................................................................... 462 (2,121) (1,659)<br />

Unrealized gains on derivatives arising during the period ......................................... 10,512 (4,081) 6,431<br />

Less: reclassification adjustments for gains included in net income ........................ (4,330) 1,758 (2,572)<br />

Net unrealized gains on derivatives .......................................................................... 6,182 (2,323) 3,859<br />

Minimum pension liability adjustment ...................................................................... (55) 20 (35)<br />

Other comprehensive income .................................................................................. ¥ 21,069 ¥ (7,170) ¥ 13,899

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)