Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Marubeni</strong> Corporation 2005 96 / 97<br />

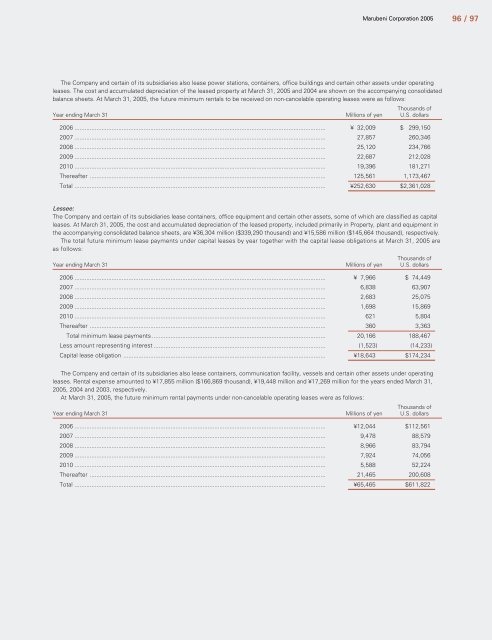

The Company and certain of its subsidiaries also lease power stations, containers, office buildings and certain other assets under operating<br />

leases. The cost and accumulated depreciation of the leased property at March 31, 2005 and 2004 are shown on the accompanying consolidated<br />

balance sheets. At March 31, 2005, the future minimum rentals to be received on non-cancelable operating leases were as follows:<br />

Thousands of<br />

Year ending March 31 Millions of yen U.S. dollars<br />

2006 ..................................................................................................................................................... ¥ 32,009 $ 299,150<br />

2007 ..................................................................................................................................................... 27,857 260,346<br />

2008 ..................................................................................................................................................... 25,120 234,766<br />

2009 ..................................................................................................................................................... 22,687 212,028<br />

2010 ..................................................................................................................................................... 19,396 181,271<br />

Thereafter ............................................................................................................................................ 125,561 1,173,467<br />

Total ..................................................................................................................................................... ¥252,630 $2,361,028<br />

Lessee:<br />

The Company and certain of its subsidiaries lease containers, office equipment and certain other assets, some of which are classified as capital<br />

leases. At March 31, 2005, the cost and accumulated depreciation of the leased property, included primarily in Property, plant and equipment in<br />

the accompanying consolidated balance sheets, are ¥36,304 million ($339,290 thousand) and ¥15,586 million ($145,664 thousand), respectively.<br />

The total future minimum lease payments under capital leases by year together with the capital lease obligations at March 31, 2005 are<br />

as follows:<br />

Thousands of<br />

Year ending March 31 Millions of yen U.S. dollars<br />

2006 ..................................................................................................................................................... ¥ 7,966 $ 74,449<br />

2007 ..................................................................................................................................................... 6,838 63,907<br />

2008 ..................................................................................................................................................... 2,683 25,075<br />

2009 ..................................................................................................................................................... 1,698 15,869<br />

2010 ..................................................................................................................................................... 621 5,804<br />

Thereafter ............................................................................................................................................ 360 3,363<br />

Total minimum lease payments ....................................................................................................... 20,166 188,467<br />

Less amount representing interest ...................................................................................................... (1,523) (14,233)<br />

Capital lease obligation ........................................................................................................................ ¥18,643 $174,234<br />

The Company and certain of its subsidiaries also lease containers, communication facility, vessels and certain other assets under operating<br />

leases. Rental expense amounted to ¥17,855 million ($166,869 thousand), ¥19,448 million and ¥17,269 million for the years ended March 31,<br />

2005, 2004 and 2003, respectively.<br />

At March 31, 2005, the future minimum rental payments under non-cancelable operating leases were as follows:<br />

Thousands of<br />

Year ending March 31 Millions of yen U.S. dollars<br />

2006 ..................................................................................................................................................... ¥12,044 $112,561<br />

2007 ..................................................................................................................................................... 9,478 88,579<br />

2008 ..................................................................................................................................................... 8,966 83,794<br />

2009 ..................................................................................................................................................... 7,924 74,056<br />

2010 ..................................................................................................................................................... 5,588 52,224<br />

Thereafter ............................................................................................................................................ 21,465 200,608<br />

Total ..................................................................................................................................................... ¥65,465 $611,822

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)