Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

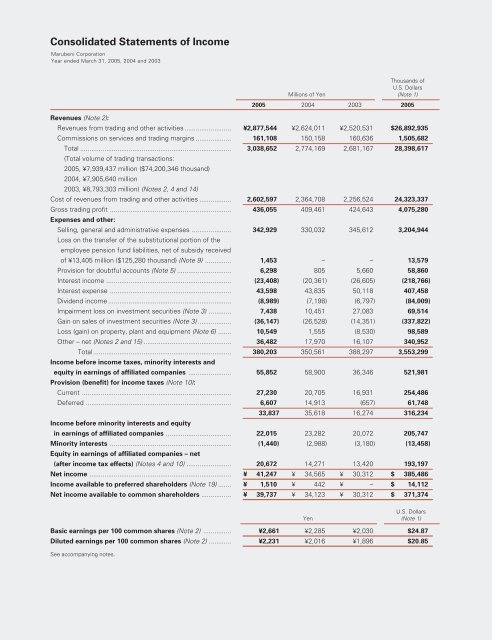

Consolidated Statements of Income<br />

<strong>Marubeni</strong> Corporation<br />

Year ended March 31, 2005, 2004 and 2003<br />

Millions of Yen<br />

Thousands of<br />

U.S. Dollars<br />

(Note 1)<br />

2005 2004 2003 2005<br />

Revenues (Note 2):<br />

Revenues from trading and other activities ......................... ¥2,877,544 ¥2,624,011 ¥2,520,531 $26,892,935<br />

Commissions on services and trading margins ................... 161,108 150,158 160,636 1,505,682<br />

Total .................................................................................<br />

(Total volume of trading transactions:<br />

2005, ¥7,939,437 million ($74,200,346 thousand)<br />

2004, ¥7,905,640 million<br />

2003, ¥8,793,303 million) (Notes 2, 4 and 14)<br />

3,038,652 2,774,169 2,681,167 28,398,617<br />

Cost of revenues from trading and other activities ................. 2,602,597 2,364,708 2,256,524 24,323,337<br />

Gross trading profit .................................................................<br />

Expenses and other:<br />

436,055 409,461 424,643 4,075,280<br />

Selling, general and administrative expenses .....................<br />

Loss on the transfer of the substitutional portion of the<br />

employee pension fund liabilities, net of subsidy received<br />

342,929 330,032 345,612 3,204,944<br />

of ¥13,405 million ($125,280 thousand) (Note 9) .............. 1,453 – – 13,579<br />

Provision for doubtful accounts (Note 5) ............................. 6,298 805 5,660 58,860<br />

Interest income ................................................................... (23,408) (20,361) (26,605) (218,766)<br />

Interest expense ................................................................. 43,598 43,835 50,118 407,458<br />

Dividend income .................................................................. (8,989) (7,198) (6,797) (84,009)<br />

Impairment loss on investment securities (Note 3) ............ 7,438 10,451 27,083 69,514<br />

Gain on sales of investment securities (Note 3) .................. (36,147) (26,528) (14,351) (337,822)<br />

Loss (gain) on property, plant and equipment (Note 6) ....... 10,549 1,555 (8,530) 98,589<br />

Other – net (Notes 2 and 15) ............................................... 36,482 17,970 16,107 340,952<br />

Total ..........................................................................<br />

Income before income taxes, minority interests and<br />

380,203 350,561 388,297 3,553,299<br />

equity in earnings of affiliated companies .......................<br />

Provision (benefit) for income taxes (Note 10):<br />

55,852 58,900 36,346 521,981<br />

Current ................................................................................ 27,230 20,705 16,931 254,486<br />

Deferred .............................................................................. 6,607 14,913 (657) 61,748<br />

Income before minority interests and equity<br />

33,837 35,618 16,274 316,234<br />

in earnings of affiliated companies ................................... 22,015 23,282 20,072 205,747<br />

Minority interests .................................................................<br />

Equity in earnings of affiliated companies – net<br />

(1,440) (2,988) (3,180) (13,458)<br />

(after income tax effects) (Notes 4 and 10) ........................ 20,672 14,271 13,420 193,197<br />

Net income ............................................................................ ¥ 41,247 ¥ 34,565 ¥ 30,312 $ 385,486<br />

Income available to preferred shareholders (Note 19) ....... ¥ 1,510 ¥ 442 ¥ – $ 14,112<br />

Net income available to common shareholders ................ ¥ 39,737 ¥ 34,123 ¥ 30,312 $ 371,374<br />

U.S. Dollars<br />

Yen (Note 1)<br />

Basic earnings per 100 common shares (Note 2) ............... ¥2,661 ¥2,285 ¥2,030 $24.87<br />

Diluted earnings per 100 common shares (Note 2) ............ ¥2,231 ¥2,016 ¥1,896 $20.85<br />

See accompanying notes.

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)