Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

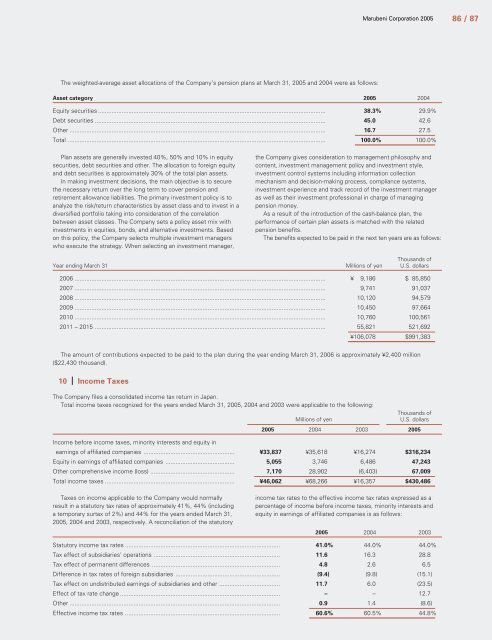

The weighted-average asset allocations of the Company’s pension plans at March 31, 2005 and 2004 were as follows:<br />

<strong>Marubeni</strong> Corporation 2005 86 / 87<br />

Asset category 2005 2004<br />

Equity securities ....................................................................................................................................... 38.3% 29.9%<br />

Debt securities ......................................................................................................................................... 45.0 42.6<br />

Other ........................................................................................................................................................ 16.7 27.5<br />

Total ......................................................................................................................................................... 100.0% 100.0%<br />

Plan assets are generally invested 40%, 50% and 10% in equity<br />

securities, debt securities and other. The allocation to foreign equity<br />

and debt securities is approximately 30% of the total plan assets.<br />

In making investment decisions, the main objective is to secure<br />

the necessary return over the long term to cover pension and<br />

retirement allowance liabilities. The primary investment policy is to<br />

analyze the risk/return characteristics by asset class and to invest in a<br />

diversified portfolio taking into consideration of the correlation<br />

between asset classes. The Company sets a policy asset mix with<br />

investments in equities, bonds, and alternative investments. Based<br />

on this policy, the Company selects multiple investment managers<br />

who execute the strategy. When selecting an investment manager,<br />

the Company gives consideration to management philosophy and<br />

content, investment management policy and investment style,<br />

investment control systems including information collection<br />

mechanism and decision-making process, compliance systems,<br />

investment experience and track record of the investment manager<br />

as well as their investment professional in charge of managing<br />

pension money.<br />

As a result of the introduction of the cash-balance plan, the<br />

performance of certain plan assets is matched with the related<br />

pension benefits.<br />

The benefits expected to be paid in the next ten years are as follows:<br />

Thousands of<br />

Year ending March 31 Millions of yen U.S. dollars<br />

2006 ..................................................................................................................................................... ¥ 9,186 $ 85,850<br />

2007 ..................................................................................................................................................... 9,741 91,037<br />

2008 ..................................................................................................................................................... 10,120 94,579<br />

2009 ..................................................................................................................................................... 10,450 97,664<br />

2010 ..................................................................................................................................................... 10,760 100,561<br />

2011 – 2015 ......................................................................................................................................... 55,821 521,692<br />

¥106,078 $991,383<br />

The amount of contributions expected to be paid to the plan during the year ending March 31, 2006 is approximately ¥2,400 million<br />

($22,430 thousand).<br />

10 Income Taxes<br />

The Company files a consolidated income tax return in Japan.<br />

Total income taxes recognized for the years ended March 31, 2005, 2004 and 2003 were applicable to the following:<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

2005 2004 2003 2005<br />

Income before income taxes, minority interests and equity in<br />

earnings of affiliated companies ...................................................... ¥33,837 ¥35,618 ¥16,274 $316,234<br />

Equity in earnings of affiliated companies ......................................... 5,055 3,746 6,486 47,243<br />

Other comprehensive income (loss) .................................................. 7,170 28,902 (6,403) 67,009<br />

Total income taxes ............................................................................. ¥46,062 ¥68,266 ¥16,357 $430,486<br />

Taxes on income applicable to the Company would normally<br />

result in a statutory tax rates of approximately 41%, 44% (including<br />

a temporary surtax of 2%) and 44% for the years ended March 31,<br />

2005, 2004 and 2003, respectively. A reconciliation of the statutory<br />

income tax rates to the effective income tax rates expressed as a<br />

percentage of income before income taxes, minority interests and<br />

equity in earnings of affiliated companies is as follows:<br />

2005 2004 2003<br />

Statutory income tax rates ............................................................................................ 41.0% 44.0% 44.0%<br />

Tax effect of subsidiaries’ operations ........................................................................... 11.6 16.3 28.8<br />

Tax effect of permanent differences ............................................................................ 4.8 2.6 6.5<br />

Difference in tax rates of foreign subsidiaries .............................................................. (9.4) (9.8) (15.1)<br />

Tax effect on undistributed earnings of subsidiaries and other .................................... 11.7 6.0 (23.5)<br />

Effect of tax rate change ............................................................................................... – – 12.7<br />

Other ............................................................................................................................. 0.9 1.4 (8.6)<br />

Effective income tax rates ............................................................................................ 60.6% 60.5% 44.8%

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)