Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Marubeni</strong> Corporation 2005 70 / 71<br />

Millions of Yen<br />

Thousands of<br />

U.S. Dollars<br />

(Note 1)<br />

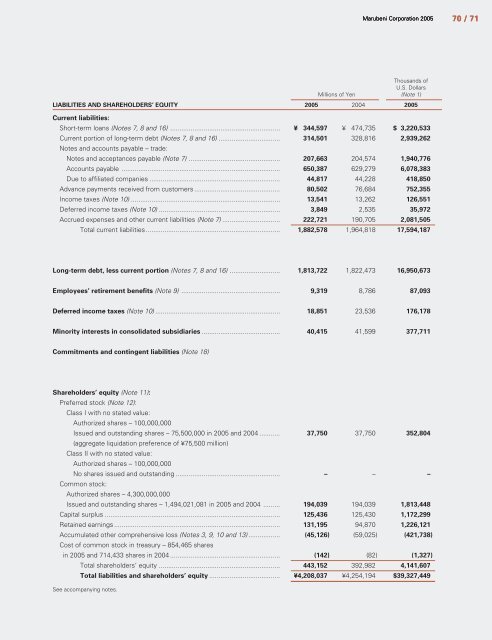

LIABILITIES AND SHAREHOLDERS’ EQUITY 2005 2004 2005<br />

Current liabilities:<br />

Short-term loans (Notes 7, 8 and 16) ........................................................... ¥ 344,597 ¥ 474,735 $ 3,220,533<br />

Current portion of long-term debt (Notes 7, 8 and 16) .................................<br />

Notes and accounts payable – trade:<br />

314,501 328,816 2,939,262<br />

Notes and acceptances payable (Note 7) ................................................. 207,663 204,574 1,940,776<br />

Accounts payable ..................................................................................... 650,387 629,279 6,078,383<br />

Due to affiliated companies ...................................................................... 44,817 44,228 418,850<br />

Advance payments received from customers .............................................. 80,502 76,684 752,355<br />

Income taxes (Note 10) ................................................................................ 13,541 13,262 126,551<br />

Deferred income taxes (Note 10) ................................................................. 3,849 2,535 35,972<br />

Accrued expenses and other current liabilities (Note 7) ............................... 222,721 190,705 2,081,505<br />

Total current liabilities ........................................................................ 1,882,578 1,964,818 17,594,187<br />

Long-term debt, less current portion (Notes 7, 8 and 16) ........................... 1,813,722 1,822,473 16,950,673<br />

Employees’ retirement benefits (Note 9) ..................................................... 9,319 8,786 87,093<br />

Deferred income taxes (Note 10) ................................................................... 18,851 23,536 176,178<br />

Minority interests in consolidated subsidiaries .......................................... 40,415 41,599 377,711<br />

Commitments and contingent liabilities (Note 18)<br />

Shareholders’ equity (Note 11):<br />

Preferred stock (Note 12):<br />

Class I with no stated value:<br />

Authorized shares – 100,000,000<br />

Issued and outstanding shares – 75,500,000 in 2005 and 2004 ...........<br />

(aggregate liquidation preference of ¥75,500 million)<br />

Class II with no stated value:<br />

Authorized shares – 100,000,000<br />

37,750 37,750 352,804<br />

No shares issued and outstanding ........................................................<br />

Common stock:<br />

Authorized shares – 4,300,000,000<br />

– – –<br />

Issued and outstanding shares – 1,494,021,081 in 2005 and 2004 ......... 194,039 194,039 1,813,448<br />

Capital surplus .............................................................................................. 125,436 125,430 1,172,299<br />

Retained earnings ......................................................................................... 131,195 94,870 1,226,121<br />

Accumulated other comprehensive loss (Notes 3, 9, 10 and 13) .................<br />

Cost of common stock in treasury – 854,465 shares<br />

(45,126) (59,025) (421,738)<br />

in 2005 and 714,433 shares in 2004 ........................................................... (142) (82) (1,327)<br />

Total shareholders’ equity ................................................................. 443,152 392,982 4,141,607<br />

Total liabilities and shareholders’ equity ...................................... ¥4,208,037 ¥4,254,194 $39,327,449<br />

See accompanying notes.

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)