Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

9 Employees’ Retirement Benefits<br />

The Company and certain of its subsidiaries have unfunded lumpsum<br />

retirement plans which, in general, cover all employees other<br />

than directors. In addition, the Company and certain of its subsidiaries<br />

have contributory and non-contributory funded pension plans with<br />

independent trustees covering eligible employees. Under the terms<br />

of the lump-sum retirement plans, eligible employees are entitled<br />

under most circumstances, upon mandatory retirement or earlier<br />

voluntary severance, to indemnities based on their compensation as<br />

of the date of severance and years of service.<br />

Effective April 1, 2003, the Company amended its welfare<br />

pension plan to introduce a cash balance plan and to reduce benefits<br />

of certain eligible people, and received approval from the Japanese<br />

government on June 5, 2003.<br />

On April 15, 2003 and May 1, 2004, the <strong>Marubeni</strong> Welfare<br />

Pension Fund received approval from the Japanese government to<br />

transfer the future and past benefit obligations related to the<br />

substitutional portion for the government-defined benefit prescribed<br />

by the Welfare Pension Insurance Law of Japan, respectively. On<br />

August 25, 2005 the Company transferred them to the government.<br />

According to the consensus reached by the Emerging Issue Task<br />

Force on Issue No. 03-2, Accounting for the Transfer to the Japanese<br />

<strong>Marubeni</strong> Corporation 2005 84 / 85<br />

Government of the Substitutional Portion of Employee Pension Fund<br />

Liabilities, and Statement of Financial Accounting Standards No. 88,<br />

Employers’ Accounting for Settlements and Curtailments of Defined<br />

Benefit Pension Plans and for Termination Benefits, the Company<br />

accounted for the entire process as a settlement upon completion of<br />

the transfer to the Japanese government of the substitutional portion<br />

of the future and past benefit obligations and the related plan asset.<br />

During the year ended March 31, 2003, the Company contributed<br />

¥22,246 million to a trust which was established to provide pension<br />

benefits and to maintain sound funding status, and is legally<br />

segregated from the Company. During the years ended March 31,<br />

2005 and 2004, the Company withdrew cash of ¥15,000 million<br />

($140,187 thousand) and ¥5,000 million from the trust, respectively,<br />

since the plan assets exceeded the benefit obligations due to an<br />

increase in fair value of plan assets and the transfer of the above<br />

benefit obligations.<br />

The measurement date used to determine pension benefit<br />

obligations and plan assets was mainly March 31.<br />

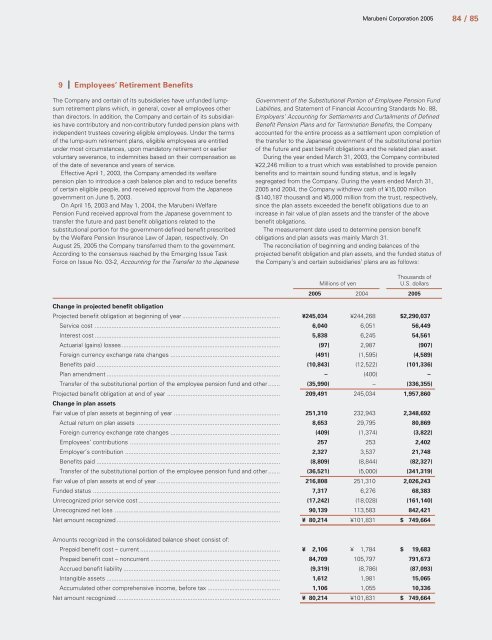

The reconciliation of beginning and ending balances of the<br />

projected benefit obligation and plan assets, and the funded status of<br />

the Company’s and certain subsidiaries’ plans are as follows:<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

2005 2004 2005<br />

Change in projected benefit obligation<br />

Projected benefit obligation at beginning of year .......................................................... ¥245,034 ¥244,268 $2,290,037<br />

Service cost .............................................................................................................. 6,040 6,051 56,449<br />

Interest cost .............................................................................................................. 5,838 6,245 54,561<br />

Actuarial (gains) losses .............................................................................................. (97) 2,987 (907)<br />

Foreign currency exchange rate changes ................................................................. (491) (1,595) (4,589)<br />

Benefits paid ............................................................................................................. (10,843) (12,522) (101,336)<br />

Plan amendment ....................................................................................................... – (400) –<br />

Transfer of the substitutional portion of the employee pension fund and other ....... (35,990) – (336,355)<br />

Projected benefit obligation at end of year ...................................................................<br />

Change in plan assets<br />

209,491 245,034 1,957,860<br />

Fair value of plan assets at beginning of year ............................................................... 251,310 232,943 2,348,692<br />

Actual return on plan assets ..................................................................................... 8,653 29,795 80,869<br />

Foreign currency exchange rate changes ................................................................. (409) (1,374) (3,822)<br />

Employees’ contributions ......................................................................................... 257 253 2,402<br />

Employer’s contribution ............................................................................................ 2,327 3,537 21,748<br />

Benefits paid ............................................................................................................. (8,809) (8,844) (82,327)<br />

Transfer of the substitutional portion of the employee pension fund and other ....... (36,521) (5,000) (341,319)<br />

Fair value of plan assets at end of year ......................................................................... 216,808 251,310 2,026,243<br />

Funded status ............................................................................................................... 7,317 6,276 68,383<br />

Unrecognized prior service cost .................................................................................... (17,242) (18,028) (161,140)<br />

Unrecognized net loss .................................................................................................. 90,139 113,583 842,421<br />

Net amount recognized ................................................................................................. ¥ 80,214 ¥101,831 $ 749,664<br />

Amounts recognized in the consolidated balance sheet consist of:<br />

Prepaid benefit cost – current ................................................................................... ¥ 2,106 ¥ 1,784 $ 19,683<br />

Prepaid benefit cost – noncurrent ............................................................................. 84,709 105,797 791,673<br />

Accrued benefit liability ............................................................................................. (9,319) (8,786) (87,093)<br />

Intangible assets ....................................................................................................... 1,612 1,981 15,065<br />

Accumulated other comprehensive income, before tax ........................................... 1,106 1,055 10,336<br />

Net amount recognized ................................................................................................. ¥ 80,214 ¥101,831 $ 749,664

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)