Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

Trust Recovery Growth Vitalization - Marubeni

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to Consolidated Financial Statements<br />

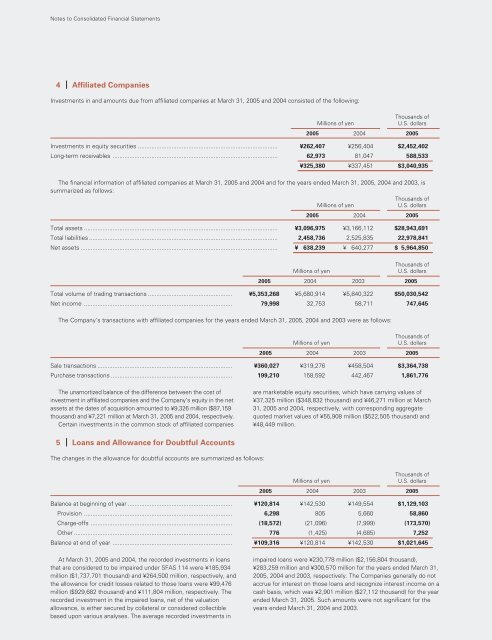

4 Affiliated Companies<br />

Investments in and amounts due from affiliated companies at March 31, 2005 and 2004 consisted of the following:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

2005 2004 2005<br />

Investments in equity securities ................................................................................... ¥262,407 ¥256,404 $2,452,402<br />

Long-term receivables .................................................................................................. 62,973 81,047 588,533<br />

¥325,380 ¥337,451 $3,040,935<br />

The financial information of affiliated companies at March 31, 2005 and 2004 and for the years ended March 31, 2005, 2004 and 2003, is<br />

summarized as follows:<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

2005 2004 2005<br />

Total assets ................................................................................................................... ¥3,096,975 ¥3,166,112 $28,943,691<br />

Total liabilities ................................................................................................................ 2,458,736 2,525,835 22,978,841<br />

Net assets ..................................................................................................................... ¥ 638,239 ¥ 640,277 $ 5,964,850<br />

Thousands of<br />

Millions of yen U.S. dollars<br />

2005 2004 2003 2005<br />

Total volume of trading transactions .................................................. ¥5,353,268 ¥5,680,914 ¥5,840,322 $50,030,542<br />

Net income ........................................................................................ 79,998 32,753 58,711 747,645<br />

The Company’s transactions with affiliated companies for the years ended March 31, 2005, 2004 and 2003 were as follows:<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

2005 2004 2003 2005<br />

Sale transactions ................................................................................ ¥360,027 ¥319,276 ¥458,504 $3,364,738<br />

Purchase transactions ........................................................................ 199,210 158,592 442,467 1,861,776<br />

The unamortized balance of the difference between the cost of<br />

investment in affiliated companies and the Company’s equity in the net<br />

assets at the dates of acquisition amounted to ¥9,326 million ($87,159<br />

thousand) and ¥7,221 million at March 31, 2005 and 2004, respectively.<br />

Certain investments in the common stock of affiliated companies<br />

5 Loans and Allowance for Doubtful Accounts<br />

The changes in the allowance for doubtful accounts are summarized as follows:<br />

are marketable equity securities, which have carrying values of<br />

¥37,325 million ($348,832 thousand) and ¥46,271 million at March<br />

31, 2005 and 2004, respectively, with corresponding aggregate<br />

quoted market values of ¥55,908 million ($522,505 thousand) and<br />

¥48,449 million.<br />

Millions of yen<br />

Thousands of<br />

U.S. dollars<br />

2005 2004 2003 2005<br />

Balance at beginning of year .............................................................. ¥120,814 ¥142,530 ¥149,554 $1,129,103<br />

Provision ........................................................................................ 6,298 805 5,660 58,860<br />

Charge-offs .................................................................................... (18,572) (21,096) (7,999) (173,570)<br />

Other .............................................................................................. 776 (1,425) (4,685) 7,252<br />

Balance at end of year ....................................................................... ¥109,316 ¥120,814 ¥142,530 $1,021,645<br />

At March 31, 2005 and 2004, the recorded investments in loans<br />

that are considered to be impaired under SFAS 114 were ¥185,934<br />

million ($1,737,701 thousand) and ¥264,500 million, respectively, and<br />

the allowance for credit losses related to those loans were ¥99,476<br />

million ($929,682 thousand) and ¥111,804 million, respectively. The<br />

recorded investment in the impaired loans, net of the valuation<br />

allowance, is either secured by collateral or considered collectible<br />

based upon various analyses. The average recorded investments in<br />

impaired loans were ¥230,778 million ($2,156,804 thousand),<br />

¥283,259 million and ¥300,570 million for the years ended March 31,<br />

2005, 2004 and 2003, respectively. The Companies generally do not<br />

accrue for interest on those loans and recognize interest income on a<br />

cash basis, which was ¥2,901 million ($27,112 thousand) for the year<br />

ended March 31, 2005. Such amounts were not significant for the<br />

years ended March 31, 2004 and 2003.

![[Chapter 2] Driving Growth: Expansion Under SG-12 - Marubeni](https://img.yumpu.com/4161147/1/190x248/chapter-2-driving-growth-expansion-under-sg-12-marubeni.jpg?quality=85)

![[Chapter 4] Delivering Growth - Marubeni](https://img.yumpu.com/3464783/1/190x248/chapter-4-delivering-growth-marubeni.jpg?quality=85)