Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TRAVIS PERKINS ANNUAL REPORT AND ACCOUNTS 2012<br />

8. Share-based payments continued<br />

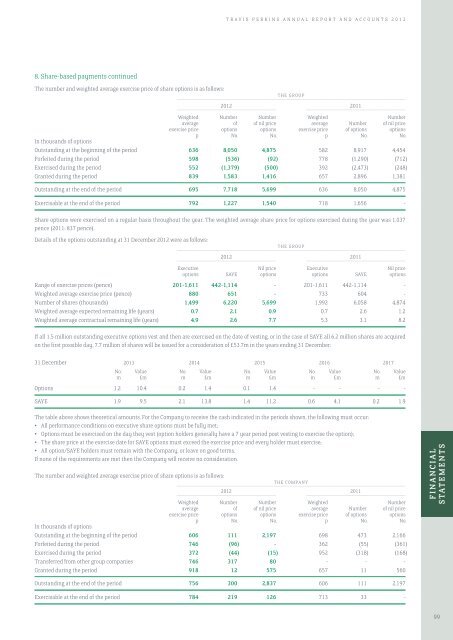

The number <strong>and</strong> weighted average exercise price of share options is as follows:<br />

THE GROUP<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

2012 2011<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

Weighted Number Number Weighted Number<br />

average of of nil price average Number of nil price<br />

exercise price options options exercise price of options options<br />

In thous<strong>and</strong>s of options<br />

p No. No. p No. No.<br />

Outst<strong>and</strong>ing at the beginning of the period 636 8,050 4,875 582 8,917 4,454<br />

Forfeited during the period 598 (536) (92) 778 (1,290) (712)<br />

Exercised during the period 552 (1,379) (500) 392 (2,473) (248)<br />

Granted during the period 839 1,583 1,416 657 2,896 1,381<br />

Outst<strong>and</strong>ing at the end of the period 695 7,718 5,699 636 8,050 4,875<br />

Exercisable at the end of the period 792 1,227 1,540 718 1,656 -<br />

Share options were exercised on a regular basis throughout the year. The weighted average share price for options exercised during the year was 1,037<br />

pence (2011: 837 pence).<br />

Details of the options outst<strong>and</strong>ing at 31 December 2012 were as follows:<br />

THE GROUP<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

2012 2011<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

Executive Nil price Executive Nil price<br />

options SAYE options options SAYE options<br />

Range of exercise prices (pence) 201-1,611 442-1,114 - 201-1,611 442-1,114 -<br />

Weighted average exercise price (pence) 880 651 - 733 604 -<br />

Number of shares (thous<strong>and</strong>s) 1,499 6,220 5,699 1,992 6,058 4,874<br />

Weighted average expected remaining life (years) 0.7 2.1 0.9 0.7 2.6 1.2<br />

Weighted average contractual remaining life (years) 4.9 2.6 7.7 5.3 3.1 8.2<br />

If all 1.5 million outst<strong>and</strong>ing executive options vest <strong>and</strong> then are exercised on the date of vesting, or in the case of SAYE all 6.2 million shares are acquired<br />

on the first possible day, 7.7 million of shares will be issued for a consideration of £53.7m in the years ending 31 December:<br />

31 December 2013 2014 2015 2016 2017<br />

No. Value No. Value No. Value No. Value No. Value<br />

m £m m £m m £m m £m m £m<br />

Options 1.2 10.4 0.2 1.4 0.1 1.4 - - - -<br />

SAYE 1.9 9.5 2.1 13.8 1.4 11.2 0.6 4.1 0.2 1.9<br />

The table above shows theoretical amounts. For the Company to receive the cash indicated in the periods shown, the following must occur:<br />

• All performance conditions on executive share options must be fully met;<br />

• Options must be exercised on the day they vest (option holders generally have a 7 year period post vesting to exercise the option);<br />

• The share price at the exercise date for SAYE options must exceed the exercise price <strong>and</strong> every holder must exercise;<br />

• All option/SAYE holders must remain with the Company, or leave on good terms.<br />

If none of the requirements are met then the Company will receive no consideration.<br />

The number <strong>and</strong> weighted average exercise price of share options is as follows:<br />

THE COMPANY<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

2012 2011<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

Weighted Number Number Weighted Number<br />

average of of nil price average Number of nil price<br />

exercise price options options exercise price of options options<br />

In thous<strong>and</strong>s of options<br />

p No. No. p No. No.<br />

Outst<strong>and</strong>ing at the beginning of the period 606 111 2,197 698 473 2,166<br />

Forfeited during the period 746 (96) - 362 (55) (361)<br />

Exercised during the period 372 (44) (15) 952 (318) (168)<br />

Transferred from other group companies 746 317 80 - - -<br />

Granted during the period 918 12 575 657 11 560<br />

FINANCIAL<br />

STATEMENTS<br />

Outst<strong>and</strong>ing at the end of the period 756 300 2,837 606 111 2,197<br />

Exercisable at the end of the period 784 219 126 713 33 -<br />

99