Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

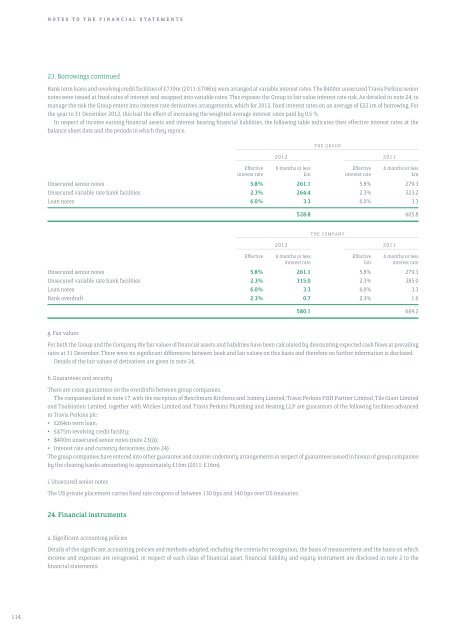

23. Borrowings continued<br />

Bank term loans <strong>and</strong> revolving credit facilities of £739m (2011: £798m) were arranged at variable interest rates. The $400m unsecured Travis Perkins senior<br />

notes were issued at fixed rates of interest <strong>and</strong> swapped into variable rates. This exposes the Group to fair value interest rate risk. As detailed in note 24, to<br />

manage the risk the Group enters into interest rate derivatives arrangements, which for 2012, fixed interest rates on an average of £221m of borrowing. For<br />

the year to 31 December 2012, this had the effect of increasing the weighted average interest rates paid by 0.5 %.<br />

In respect of income earning financial assets <strong>and</strong> interest bearing financial liabilities, the following table indicates their effective interest rates at the<br />

balance sheet date <strong>and</strong> the periods in which they reprice.<br />

THE GROUP<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

2012 2011<br />

––––––––––––––––––––––––––––––––––––––––––––––––– –––––––––––––––––––––––––––––––––––––––––––––––––<br />

Effective 6 months or less Effective 6 months or less<br />

interest rate £m interest rate £m<br />

Unsecured senior notes 5.8% 261.1 5.8% 279.3<br />

Unsecured variable rate bank facilities 2.3% 264.4 2.3% 323.2<br />

Loan notes 6.0% 3.3 6.0% 3.3<br />

528.8 605.8<br />

THE COMPANY<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

2012 2011<br />

––––––––––––––––––––––––––––––––––––––––––––––––– –––––––––––––––––––––––––––––––––––––––––––––––––<br />

Effective 6 months or less Effective 6 months or less<br />

interest rate £m interest rate<br />

Unsecured senior notes 5.8% 261.1 5.8% 279.3<br />

Unsecured variable rate bank facilities 2.3% 315.0 2.3% 385.0<br />

Loan notes 6.0% 3.3 6.0% 3.3<br />

Bank overdraft 2.3% 0.7 2.3% 1.6<br />

580.1 669.2<br />

g. Fair values<br />

For both the Group <strong>and</strong> the Company the fair values of financial assets <strong>and</strong> liabilities have been calculated by discounting expected cash flows at prevailing<br />

rates at 31 December. There were no significant differences between book <strong>and</strong> fair values on this basis <strong>and</strong> therefore no further information is disclosed.<br />

Details of the fair values of derivatives are given in note 24.<br />

h. Guarantees <strong>and</strong> security<br />

There are cross guarantees on the overdrafts between group companies.<br />

The companies listed in note 17, with the exception of Benchmarx Kitchens <strong>and</strong> Joinery Limited, Travis Perkins P&H Partner Limited, Tile Giant Limited<br />

<strong>and</strong> Toolstation Limited, together with Wickes Limited <strong>and</strong> Travis Perkins Plumbing <strong>and</strong> Heating LLP are guarantors of the following facilities advanced<br />

to Travis Perkins plc:<br />

• £264m term loan;<br />

• £475m revolving credit facility;<br />

• $400m unsecured senior notes (note 23(i));<br />

• Interest rate <strong>and</strong> currency derivatives, (note 24).<br />

The group companies have entered into other guarantee <strong>and</strong> counter-indemnity arrangements in respect of guarantees issued in favour of group companies<br />

by the clearing banks amounting to approximately £16m (2011: £16m).<br />

i. Unsecured senior notes<br />

The US private placement carries fixed rate coupons of between 130 bps <strong>and</strong> 140 bps over US treasuries.<br />

24. Financial instruments<br />

a. Significant accounting policies<br />

Details of the significant accounting policies <strong>and</strong> methods adopted, including the criteria for recognition, the basis of measurement <strong>and</strong> the basis on which<br />

income <strong>and</strong> expenses are recognised, in respect of each class of financial asset, financial liability <strong>and</strong> equity instrument are disclosed in note 2 to the<br />

financial statements.<br />

114