Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

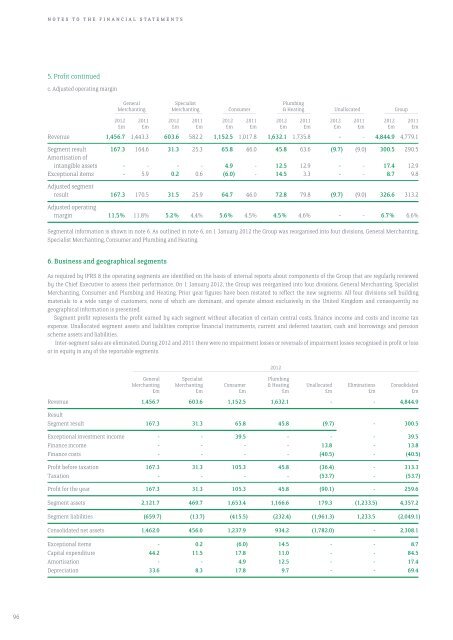

5. Profit continued<br />

c. Adjusted operating margin<br />

General Specialist Plumbing<br />

merchanting Merchanting Consumer & Heating Unallocated Group<br />

–––––––––––––––––––––– –––––––––––––––––––––– –––––––––––––––––––––– –––––––––––––––––––––– –––––––––––––––––––––– ––––––––––––––––––––––<br />

2012 2011 2012 2011 2012 2011 2012 2011 2012 2011 2012 2011<br />

£m £m £m £m £m £m £m £m £m £m £m £m<br />

Revenue 1,456.7 1,443.3 603.6 582.2 1,152.5 1,017.8 1,632.1 1,735.8 - - 4,844.9 4,779.1<br />

Segment result 167.3 164.6 31.3 25.3 65.8 46.0 45.8 63.6 (9.7) (9.0) 300.5 290.5<br />

Amortisation of<br />

intangible assets - - - - 4.9 - 12.5 12.9 - - 17.4 12.9<br />

Exceptional items - 5.9 0.2 0.6 (6.0) - 14.5 3.3 - - 8.7 9.8<br />

Adjusted segment<br />

result 167.3 170.5 31.5 25.9 64.7 46.0 72.8 79.8 (9.7) (9.0) 326.6 313.2<br />

Adjusted operating<br />

margin 11.5% 11.8% 5.2% 4.4% 5.6% 4.5% 4.5% 4.6% - - 6.7% 6.6%<br />

Segmental information is shown in note 6. As outlined in note 6, on 1 January 2012 the Group was reorganised into four divisions, General Merchanting,<br />

Specialist Merchanting, Consumer <strong>and</strong> Plumbing <strong>and</strong> Heating.<br />

6. Business <strong>and</strong> geographical segments<br />

As required by IFRS 8 the operating segments are identified on the basis of internal reports about components of the Group that are regularly reviewed<br />

by the Chief Executive to assess their performance. On 1 January 2012, the Group was reorganised into four divisions, General Merchanting, Specialist<br />

Merchanting, Consumer <strong>and</strong> Plumbing <strong>and</strong> Heating. Prior year figures have been restated to reflect the new segments. All four divisions sell building<br />

materials to a wide range of customers, none of which are dominant, <strong>and</strong> operate almost exclusively in the United Kingdom <strong>and</strong> consequently no<br />

geographical information is presented.<br />

Segment profit represents the profit earned by each segment without allocation of certain central costs, finance income <strong>and</strong> costs <strong>and</strong> income tax<br />

expense. Unallocated segment assets <strong>and</strong> liabilities comprise financial instruments, current <strong>and</strong> deferred taxation, cash <strong>and</strong> borrowings <strong>and</strong> pension<br />

scheme assets <strong>and</strong> liabilities.<br />

Inter-segment sales are eliminated. During 2012 <strong>and</strong> 2011 there were no impairment losses or reversals of impairment losses recognised in profit or loss<br />

or in equity in any of the reportable segments.<br />

2012<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

General Specialist Plumbing<br />

M merchanting Merchanting Consumer & Heating Unallocated Eliminations Consolidated<br />

£m £m £m £m £m £m £m<br />

Revenue 1,456.7 603.6 1,152.5 1,632.1 - - 4,844.9<br />

Result<br />

Segment result 167.3 31.3 65.8 45.8 (9.7) - 300.5<br />

Exceptional investment income - - 39.5 - - - 39.5<br />

Finance income - - - - 13.8 - 13.8<br />

Finance costs - - - - (40.5) - (40.5)<br />

Profit before taxation 167.3 31.3 105.3 45.8 (36.4) - 313.3<br />

Taxation - - - - (53.7) - (53.7)<br />

Profit for the year 167.3 31.3 105.3 45.8 (90.1) - 259.6<br />

Segment assets 2,121.7 469.7 1,653.4 1,166.6 179.3 (1,233.5) 4,357.2<br />

Segment liabilities (659.7) (13.7) (415.5) (232.4) (1,961.3) 1,233.5 (2,049.1)<br />

Consolidated net assets 1,462.0 456.0 1,237.9 934.2 (1,782.0) - 2,308.1<br />

Exceptional items - 0.2 (6.0) 14.5 - - 8.7<br />

Capital expenditure 44.2 11.5 17.8 11.0 - - 84.5<br />

Amortisation - - 4.9 12.5 - - 17.4<br />

Depreciation 33.6 8.3 17.8 9.7 - - 69.4<br />

96