Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Directors’ Remuneration <strong>Report</strong><br />

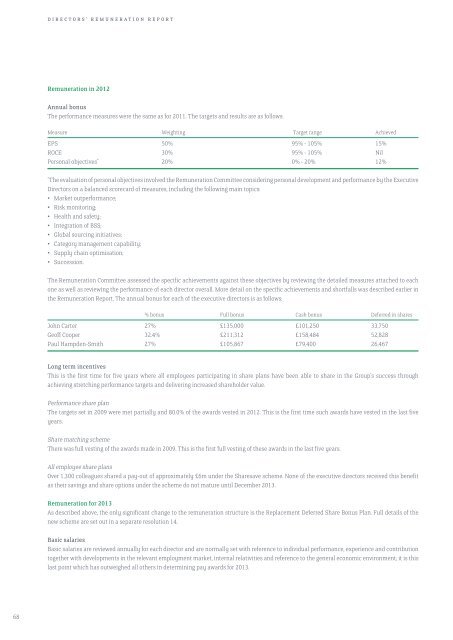

Remuneration in 2012<br />

<strong>Annual</strong> bonus<br />

The performance measures were the same as for 2011. The targets <strong>and</strong> results are as follows:<br />

Measure Weighting Target range Achieved<br />

EPS 50% 95% - 105% 15%<br />

ROCE 30% 95% - 105% Nil<br />

Personal objectives * 20% 0% - 20% 12%<br />

*<br />

The evaluation of personal objectives involved the Remuneration Committee considering personal development <strong>and</strong> performance by the Executive<br />

Directors on a balanced scorecard of measures, including the following main topics:<br />

• Market outperformance;<br />

• Risk monitoring;<br />

• Health <strong>and</strong> safety;<br />

• Integration of BSS;<br />

• Global sourcing initiatives;<br />

• Category management capability;<br />

• Supply chain optimisation;<br />

• Succession.<br />

The Remuneration Committee assessed the specific achievements against these objectives by reviewing the detailed measures attached to each<br />

one as well as reviewing the performance of each director overall. More detail on the specific achievements <strong>and</strong> shortfalls was described earlier in<br />

the Remuneration <strong>Report</strong>. The annual bonus for each of the executive directors is as follows:<br />

% bonus Full bonus cash bonus Deferred in shares<br />

John Carter 27% £135,000 £101,250 33,750<br />

Geoff Cooper 32.4% £211,312 £158,484 52,828<br />

Paul Hampden-Smith 27% £105,867 £79,400 26,467<br />

Long term incentives<br />

This is the first time for five years where all employees participating in share plans have been able to share in the Group’s success through<br />

achieving stretching performance targets <strong>and</strong> delivering increased shareholder value.<br />

Performance share plan<br />

The targets set in 2009 were met partially <strong>and</strong> 80.0% of the awards vested in 2012. This is the first time such awards have vested in the last five<br />

years.<br />

Share matching scheme<br />

There was full vesting of the awards made in 2009. This is the first full vesting of these awards in the last five years.<br />

All employee share plans<br />

Over 1,300 colleagues shared a pay-out of approximately £6m under the Sharesave scheme. None of the executive directors received this benefit<br />

as their savings <strong>and</strong> share options under the scheme do not mature until December 2013.<br />

Remuneration for 2013<br />

As described above, the only significant change to the remuneration structure is the Replacement Deferred Share Bonus Plan. Full details of the<br />

new scheme are set out in a separate resolution 14.<br />

Basic salaries<br />

Basic salaries are reviewed annually for each director <strong>and</strong> are normally set with reference to individual performance, experience <strong>and</strong> contribution<br />

together with developments in the relevant employment market, internal relativities <strong>and</strong> reference to the general economic environment; it is this<br />

last point which has outweighed all others in determining pay awards for 2013.<br />

68