Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TRAVIS PERKINS ANNUAL REPORT AND ACCOUNTS 2012<br />

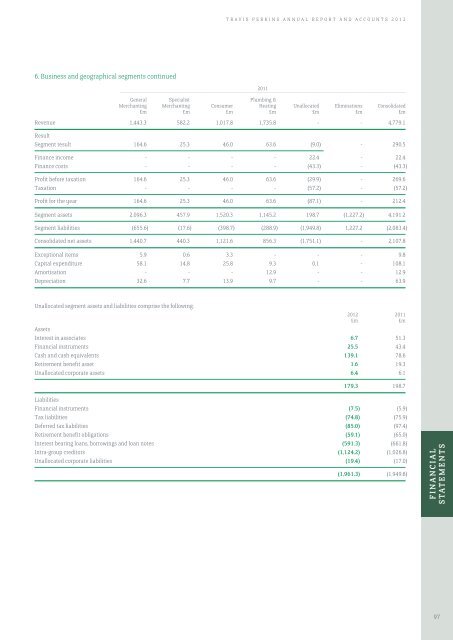

6. Business <strong>and</strong> geographical segments continued<br />

2011<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

General Specialist Plumbing &<br />

M merchanting Merchanting Consumer Heating Unallocated Eliminations Consolidated<br />

£m £m £m £m £m £m £m<br />

Revenue 1,443.3 582.2 1,017.8 1,735.8 - - 4,779.1<br />

Result<br />

Segment result 164.6 25.3 46.0 63.6 (9.0) - 290.5<br />

Finance income - - - - 22.4 - 22.4<br />

Finance costs - - - - (43.3) - (43.3)<br />

Profit before taxation 164.6 25.3 46.0 63.6 (29.9) - 269.6<br />

Taxation - - - - (57.2) - (57.2)<br />

Profit for the year 164.6 25.3 46.0 63.6 (87.1) - 212.4<br />

Segment assets 2,096.3 457.9 1,520.3 1,145.2 198.7 (1,227.2) 4,191.2<br />

Segment liabilities (655.6) (17.6) (398.7) (288.9) (1,949.8) 1,227.2 (2,083.4)<br />

Consolidated net assets 1,440.7 440.3 1,121.6 856.3 (1,751.1) - 2,107.8<br />

Exceptional items 5.9 0.6 3.3 - - - 9.8<br />

Capital expenditure 58.1 14.8 25.8 9.3 0.1 - 108.1<br />

Amortisation - - - 12.9 - - 12.9<br />

Depreciation 32.6 7.7 13.9 9.7 - - 63.9<br />

Unallocated segment assets <strong>and</strong> liabilities comprise the following:<br />

2012 2011<br />

£m £m<br />

Assets<br />

Interest in associates 6.7 51.3<br />

Financial instruments 25.5 43.4<br />

Cash <strong>and</strong> cash equivalents 139.1 78.6<br />

Retirement benefit asset 1.6 19.3<br />

Unallocated corporate assets 6.4 6.1<br />

179.3 198.7<br />

Liabilities<br />

Financial instruments (7.5) (5.9)<br />

Tax liabilities (74.8) (75.9)<br />

Deferred tax liabilities (85.0) (97.4)<br />

Retirement benefit obligations (59.1) (65.0)<br />

Interest bearing loans, borrowings <strong>and</strong> loan notes (591.3) (661.8)<br />

Intra-group creditors (1,124.2) (1,026.8)<br />

Unallocated corporate liabilities (19.4) (17.0)<br />

(1,961.3) (1,949.8)<br />

FINANCIAL<br />

STATEMENTS<br />

97