Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TRAVIS PERKINS ANNUAL REPORT AND ACCOUNTS 2012<br />

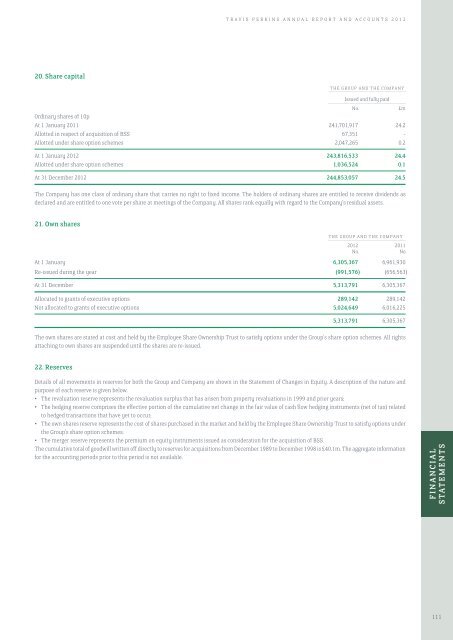

20. Share capital<br />

THE GROUP AND THE COMPANY<br />

–––––––––––––––––––––––––––––––––––––––––––––––––––<br />

Issued <strong>and</strong> fully paid<br />

–––––––––––––––––––––––––––––––––––––––––––––––––––<br />

No. £m<br />

Ordinary shares of 10p<br />

At 1 January 2011 241,701,917 24.2<br />

Allotted in respect of acquisition of BSS 67,351 -<br />

Allotted under share option schemes 2,047,265 0.2<br />

At 1 January 2012 243,816,533 24.4<br />

Allotted under share option schemes 1,036,524 0.1<br />

At 31 December 2012 244,853,057 24.5<br />

The Company has one class of ordinary share that carries no right to fixed income. The holders of ordinary shares are entitled to receive dividends as<br />

declared <strong>and</strong> are entitled to one vote per share at meetings of the Company. All shares rank equally with regard to the Company’s residual assets.<br />

21. Own shares<br />

THE GROUP AND THE COMPANY<br />

–––––––––––––––––––––––––––––––––––––––––––––––––––<br />

2012 2011<br />

No.<br />

No.<br />

At 1 January 6,305,367 6,961,930<br />

Re-issued during the year (991,576) (656,563)<br />

At 31 December 5,313,791 6,305,367<br />

Allocated to grants of executive options 289,142 289,142<br />

Not allocated to grants of executive options 5,024,649 6,016,225<br />

5,313,791 6,305,367<br />

The own shares are stated at cost <strong>and</strong> held by the Employee Share Ownership Trust to satisfy options under the Group’s share option schemes. All rights<br />

attaching to own shares are suspended until the shares are re-issued.<br />

22. Reserves<br />

Details of all movements in reserves for both the Group <strong>and</strong> Company are shown in the Statement of Changes in Equity. A description of the nature <strong>and</strong><br />

purpose of each reserve is given below.<br />

• The revaluation reserve represents the revaluation surplus that has arisen from property revaluations in 1999 <strong>and</strong> prior years;<br />

• The hedging reserve comprises the effective portion of the cumulative net change in the fair value of cash flow hedging instruments (net of tax) related<br />

to hedged transactions that have yet to occur;<br />

• The own shares reserve represents the cost of shares purchased in the market <strong>and</strong> held by the Employee Share Ownership Trust to satisfy options under<br />

the Group’s share option schemes;<br />

• The merger reserve represents the premium on equity instruments issued as consideration for the acquisition of BSS.<br />

The cumulative total of goodwill written off directly to reserves for acquisitions from December 1989 to December 1998 is £40.1m. The aggregate information<br />

for the accounting periods prior to this period is not available.<br />

FINANCIAL<br />

STATEMENTS<br />

111