Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TRAVIS PERKINS ANNUAL REPORT AND ACCOUNTS 2012<br />

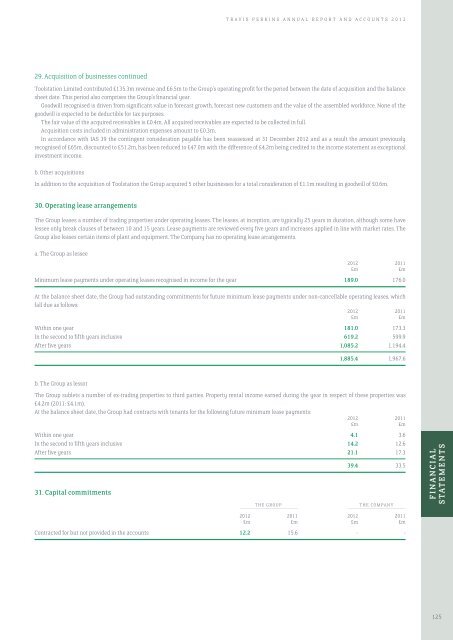

29. Acquisition of businesses continued<br />

Toolstation Limited contributed £135.3m revenue <strong>and</strong> £6.5m to the Group’s operating profit for the period between the date of acquisition <strong>and</strong> the balance<br />

sheet date. This period also comprises the Group’s financial year.<br />

Goodwill recognised is driven from significant value in forecast growth, forecast new customers <strong>and</strong> the value of the assembled workforce. None of the<br />

goodwill is expected to be deductible for tax purposes.<br />

The fair value of the acquired receivables is £0.4m. All acquired receivables are expected to be collected in full.<br />

Acquisition costs included in administration expenses amount to £0.3m.<br />

In accordance with IAS 39 the contingent consideration payable has been reassessed at 31 December 2012 <strong>and</strong> as a result the amount previously<br />

recognised of £65m, discounted to £51.2m, has been reduced to £47.0m with the difference of £4.2m being credited to the income statement as exceptional<br />

investment income.<br />

b. Other acquisitions<br />

In addition to the acquisition of Toolstation the Group acquired 5 other businesses for a total consideration of £1.1m resulting in goodwill of £0.6m.<br />

30. Operating lease arrangements<br />

The Group leases a number of trading properties under operating leases. The leases, at inception, are typically 25 years in duration, although some have<br />

lessee only break clauses of between 10 <strong>and</strong> 15 years. Lease payments are reviewed every five years <strong>and</strong> increases applied in line with market rates. The<br />

Group also leases certain items of plant <strong>and</strong> equipment. The Company has no operating lease arrangements.<br />

a. The Group as lessee<br />

2012 2011<br />

£m £m<br />

Minimum lease payments under operating leases recognised in income for the year 189.0 176.0<br />

At the balance sheet date, the Group had outst<strong>and</strong>ing commitments for future minimum lease payments under non-cancellable operating leases, which<br />

fall due as follows:<br />

2012 2011<br />

£m £m<br />

Within one year 181.0 173.3<br />

In the second to fifth years inclusive 619.2 599.9<br />

After five years 1,085.2 1,194.4<br />

1,885.4 1,967.6<br />

b. The Group as lessor<br />

The Group sublets a number of ex-trading properties to third parties. Property rental income earned during the year in respect of these properties was<br />

£4.2m (2011: £4.1m).<br />

At the balance sheet date, the Group had contracts with tenants for the following future minimum lease payments:<br />

2012 2011<br />

£m £m<br />

Within one year 4.1 3.6<br />

In the second to fifth years inclusive 14.2 12.6<br />

After five years 21.1 17.3<br />

31. Capital commitments<br />

THE GROUP<br />

39.4 33.5<br />

THE COMPANY<br />

–––––––––––––––––––––––––––––––––––––– ––––––––––––––––––––––––––––––––––––––<br />

2012 2011 2012 2011<br />

£m £m £m £m<br />

Contracted for but not provided in the accounts 12.2 15.6 - -<br />

FINANCIAL<br />

STATEMENTS<br />

125