Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TRAVIS PERKINS ANNUAL REPORT AND ACCOUNTS 2012<br />

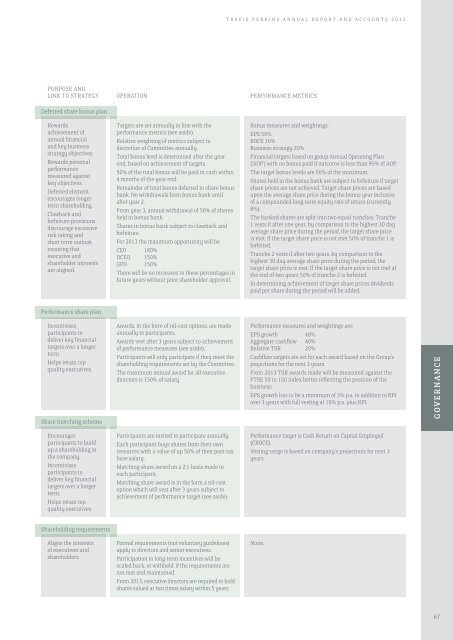

Purpose <strong>and</strong><br />

link to strategy Operation Performance metrics<br />

Deferred share bonus plan<br />

Rewards<br />

achievement of<br />

annual financial<br />

<strong>and</strong> key business<br />

strategy objectives.<br />

Rewards personal<br />

performance<br />

measured against<br />

key objectives.<br />

Deferred element<br />

encourages longer<br />

term shareholding.<br />

Clawback <strong>and</strong><br />

forfeiture provisions<br />

discourage excessive<br />

risk taking <strong>and</strong><br />

short term outlook<br />

ensuring that<br />

executive <strong>and</strong><br />

shareholder interests<br />

are aligned.<br />

Targets are set annually in line with the<br />

performance metrics (see aside).<br />

Relative weighting of metrics subject to<br />

discretion of Committee annually.<br />

Total bonus level is determined after the year<br />

end, based on achievement of targets.<br />

50% of the total bonus will be paid in cash within<br />

4 months of the year end.<br />

Remainder of total bonus deferred in share bonus<br />

bank. No withdrawals from bonus bank until<br />

after year 2.<br />

From year 3, annual withdrawal of 50% of shares<br />

held in bonus bank.<br />

Shares in bonus bank subject to clawback <strong>and</strong><br />

forfeiture.<br />

For 2013 the maximum opportunity will be<br />

CEO 180%<br />

DCEO 150%<br />

GFD 150%<br />

There will be no increases to these percentages in<br />

future years without prior shareholder approval.<br />

Bonus measures <strong>and</strong> weightings:<br />

EPS 50%<br />

ROCE 30%<br />

Business strategy 20%<br />

Financial targets based on group <strong>Annual</strong> Operating Plan<br />

(‘AOP’) with no bonus paid if outcome is less than 95% of AOP.<br />

The target bonus levels are 50% of the maximum.<br />

Shares held in the bonus bank are subject to forfeiture if target<br />

share prices are not achieved. Target share prices are based<br />

upon the average share price during the bonus year inclusive<br />

of a compounded long-term equity rate of return (currently<br />

8%).<br />

The banked shares are split into two equal tranches. Tranche<br />

1 vests if after one year, by comparison to the highest 30 day<br />

average share price during the period, the target share price<br />

is met. If the target share price is not met 50% of tranche 1 is<br />

forfeited.<br />

Tranche 2 vests if after two years, by comparison to the<br />

highest 30 day average share price during the period, the<br />

target share price is met. If the target share price is not met at<br />

the end of two years 50% of tranche 2 is forfeited.<br />

In determining achievement of target share prices dividends<br />

paid per share during the period will be added.<br />

Performance share plan<br />

Incentivises<br />

participants to<br />

deliver key financial<br />

targets over a longer<br />

term.<br />

Helps retain top<br />

quality executives.<br />

Share matching scheme<br />

Awards, in the form of nil-cost options, are made<br />

annually to participants.<br />

Awards vest after 3 years subject to achievement<br />

of performance measures (see aside).<br />

Participants will only participate if they meet the<br />

shareholding requirements set by the Committee.<br />

The maximum annual award for all executive<br />

directors is 150% of salary.<br />

Performance measures <strong>and</strong> weightings are:<br />

EPS growth 40%<br />

Aggregate cashflow 40%<br />

Relative TSR 20%<br />

Cashflow targets are set for each award based on the Group’s<br />

projections for the next 3 years.<br />

From 2013 TSR awards made will be measured against the<br />

FTSE 50 to 150 index better reflecting the position of the<br />

business.<br />

EPS growth has to be a minimum of 3% p.a. in addition to RPI<br />

over 3 years with full vesting at 10% p.a. plus RPI.<br />

GOVERNANCE<br />

Encourages<br />

participants to build<br />

up a shareholding in<br />

the company.<br />

Incentivises<br />

participants to<br />

deliver key financial<br />

targets over a longer<br />

term.<br />

Helps retain top<br />

quality executives.<br />

Participants are invited to participate annually.<br />

Each participant buys shares from their own<br />

resources with a value of up 50% of their post-tax<br />

base salary.<br />

Matching share award on a 2:1 basis made to<br />

each participant.<br />

Matching share award is in the form a nil-cost<br />

option which will vest after 3 years subject to<br />

achievement of performance target (see aside).<br />

Performance target is Cash Return on Capital Employed<br />

(CROCE).<br />

Vesting range is based on company’s projections for next 3<br />

years.<br />

Shareholding requirements<br />

Aligns the interests<br />

of executives <strong>and</strong><br />

shareholders.<br />

Formal requirements (not voluntary guidelines)<br />

apply to directors <strong>and</strong> senior executives.<br />

Participation in long-term incentives will be<br />

scaled back, or withheld, if the requirements are<br />

not met <strong>and</strong> maintained.<br />

From 2013, executive directors are required to hold<br />

shares valued at two times salary within 5 years.<br />

None.<br />

67