Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TRAVIS PERKINS ANNUAL REPORT AND ACCOUNTS 2012<br />

In addition, Tony Buffin has a service contract which will take effect from 8 April 2013.<br />

It is the Company’s policy to allow each executive director to hold one non-executive directorship in another company (<strong>and</strong> to retain the fee<br />

payable).<br />

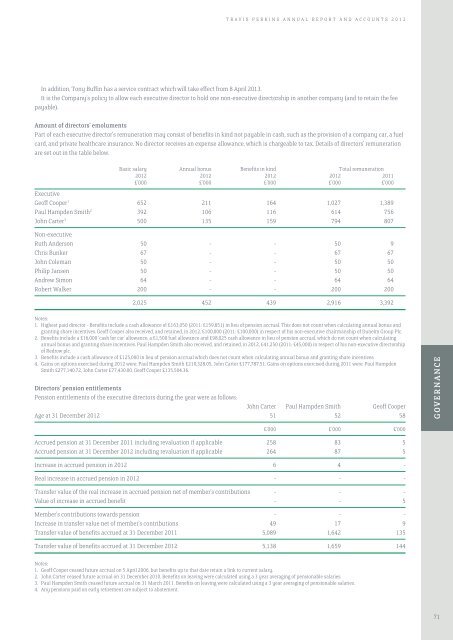

Amount of directors’ emoluments<br />

Part of each executive director’s remuneration may consist of benefits in kind not payable in cash, such as the provision of a company car, a fuel<br />

card, <strong>and</strong> private healthcare insurance. No director receives an expense allowance, which is chargeable to tax. Details of directors’ remuneration<br />

are set out in the table below.<br />

B basic salary <strong>Annual</strong> bonus Benefits in kind Total remuneration<br />

2012 2012 2012 2012 2011<br />

£’000 £’000 £’000 £’000 £’000<br />

Executive<br />

Geoff Cooper 1 652 211 164 1,027 1,389<br />

Paul Hampden Smith 2 392 106 116 614 756<br />

John Carter 3 500 135 159 794 807<br />

Non-executive<br />

Ruth Anderson 50 - - 50 9<br />

Chris Bunker 67 - - 67 67<br />

John Coleman 50 - - 50 50<br />

Philip Jansen 50 - - 50 50<br />

Andrew Simon 64 - - 64 64<br />

Robert Walker 200 - - 200 200<br />

2,025 452 439 2,916 3,392<br />

Notes:<br />

1. Highest paid director - Benefits include a cash allowance of £163,050 (2011: £159,851) in lieu of pension accrual. This does not count when calculating annual bonus <strong>and</strong><br />

granting share incentives. Geoff Cooper also received, <strong>and</strong> retained, in 2012, £100,000 (2011: £100,000) in respect of his non-executive chairmanship of Dunelm Group Plc.<br />

2. Benefits include a £16,000 ‘cash for car’ allowance, a £1,500 fuel allowance <strong>and</strong> £98,025 cash allowance in lieu of pension accrual, which do not count when calculating<br />

annual bonus <strong>and</strong> granting share incentives. Paul Hampden Smith also received, <strong>and</strong> retained, in 2012, £41,250 (2011: £45,000) in respect of his non-executive directorship<br />

of Redrow plc.<br />

3. Benefits include a cash allowance of £125,000 in lieu of pension accrual which does not count when calculating annual bonus <strong>and</strong> granting share incentives.<br />

4. Gains on options exercised during 2012 were: Paul Hampden Smith £210,328.05, John Carter £177,787.51. Gains on options exercised during 2011 were: Paul Hampden<br />

Smith £277,140.72, John Carter £77,430.00, Geoff Cooper £135,504.36.<br />

Directors’ pension entitlements<br />

Pension entitlements of the executive directors during the year were as follows:<br />

John Carter Paul Hampden Smith Geoff Cooper<br />

Age at 31 December 2012 51 52 58<br />

GOVERNANCE<br />

£’000 £’000 £’000<br />

Accrued pension at 31 December 2011 including revaluation if applicable 258 83 5<br />

Accrued pension at 31 December 2012 including revaluation if applicable 264 87 5<br />

Increase in accrued pension in 2012 6 4 -<br />

Real increase in accrued pension in 2012 - - -<br />

Transfer value of the real increase in accrued pension net of member’s contributions - - -<br />

Value of increase in accrued benefit - - 5<br />

Member’s contributions towards pension - - -<br />

Increase in transfer value net of member’s contributions 49 17 9<br />

Transfer value of benefits accrued at 31 December 2011 5,089 1,642 135<br />

Transfer value of benefits accrued at 31 December 2012 5,138 1,659 144<br />

Notes:<br />

1. Geoff Cooper ceased future accrual on 5 April 2006, but benefits up to that date retain a link to current salary.<br />

2. John Carter ceased future accrual on 31 December 2010. Benefits on leaving were calculated using a 3 year averaging of pensionable salaries.<br />

3. Paul Hampden Smith ceased future accrual on 31 March 2011. Benefits on leaving were calculated using a 3 year averaging of pensionable salaries.<br />

4. Any pensions paid on early retirement are subject to abatement.<br />

71