Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

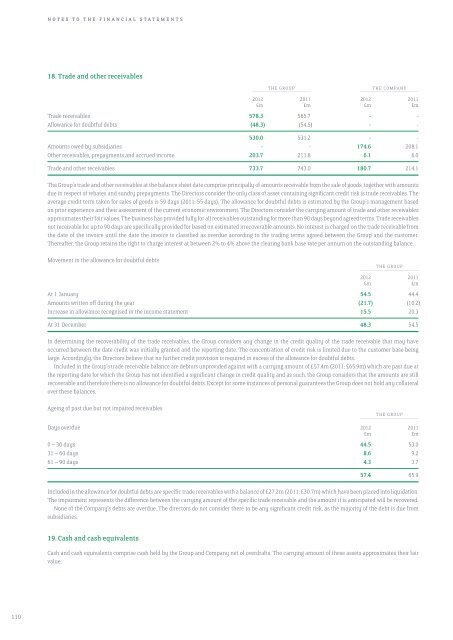

18. Trade <strong>and</strong> other receivables<br />

THE GROUP<br />

THE COMPANY<br />

–––––––––––––––––––––––––––––––––––––– ––––––––––––––––––––––––––––––––––––––<br />

2012 2011 2012 2011<br />

£m £m £m £m<br />

Trade receivables 578.3 585.7 - -<br />

Allowance for doubtful debts (48.3) (54.5) - -<br />

530.0 531.2 - -<br />

Amounts owed by subsidiaries - - 174.6 208.1<br />

Other receivables, prepayments <strong>and</strong> accrued income 203.7 211.8 6.1 6.0<br />

Trade <strong>and</strong> other receivables 733.7 743.0 180.7 214.1<br />

The Group’s trade <strong>and</strong> other receivables at the balance sheet date comprise principally of amounts receivable from the sale of goods, together with amounts<br />

due in respect of rebates <strong>and</strong> sundry prepayments. The Directors consider the only class of asset containing significant credit risk is trade receivables. The<br />

average credit term taken for sales of goods is 59 days (2011: 55 days). The allowance for doubtful debts is estimated by the Group’s management based<br />

on prior experience <strong>and</strong> their assessment of the current economic environment. The Directors consider the carrying amount of trade <strong>and</strong> other receivables<br />

approximates their fair values. The business has provided fully for all receivables outst<strong>and</strong>ing for more than 90 days beyond agreed terms. Trade receivables<br />

not receivable for up to 90 days are specifically provided for based on estimated irrecoverable amounts. No interest is charged on the trade receivable from<br />

the date of the invoice until the date the invoice is classified as overdue according to the trading terms agreed between the Group <strong>and</strong> the customer.<br />

Thereafter, the Group retains the right to charge interest at between 2% to 4% above the clearing bank base rate per annum on the outst<strong>and</strong>ing balance.<br />

Movement in the allowance for doubtful debts<br />

THE GROUP<br />

––––––––––––––––––––––––––––––––––––––<br />

2012 2011<br />

£m £m<br />

At 1 January 54.5 44.4<br />

Amounts written off during the year (21.7) (10.2)<br />

Increase in allowance recognised in the income statement 15.5 20.3<br />

At 31 December 48.3 54.5<br />

In determining the recoverability of the trade receivables, the Group considers any change in the credit quality of the trade receivable that may have<br />

occurred between the date credit was initially granted <strong>and</strong> the reporting date. The concentration of credit risk is limited due to the customer base being<br />

large. Accordingly, the Directors believe that no further credit provision is required in excess of the allowance for doubtful debts.<br />

Included in the Group’s trade receivable balance are debtors unprovided against with a carrying amount of £57.4m (2011: £65.9m) which are past due at<br />

the reporting date for which the Group has not identified a significant change in credit quality <strong>and</strong> as such, the Group considers that the amounts are still<br />

recoverable <strong>and</strong> therefore there is no allowance for doubtful debts. Except for some instances of personal guarantees the Group does not hold any collateral<br />

over these balances.<br />

Ageing of past due but not impaired receivables<br />

THE GROUP<br />

––––––––––––––––––––––––––––––––––––––<br />

Days overdue 2012 2011<br />

£m £m<br />

0 – 30 days 44.5 53.0<br />

31 – 60 days 8.6 9.2<br />

61 – 90 days 4.3 3.7<br />

57.4 65.9<br />

Included in the allowance for doubtful debts are specific trade receivables with a balance of £27.2m (2011: £30.7m) which have been placed into liquidation.<br />

The impairment represents the difference between the carrying amount of the specific trade receivable <strong>and</strong> the amount it is anticipated will be recovered.<br />

None of the Company’s debts are overdue. The directors do not consider there to be any significant credit risk, as the majority of the debt is due from<br />

subsidiaries.<br />

19. Cash <strong>and</strong> cash equivalents<br />

Cash <strong>and</strong> cash equivalents comprise cash held by the Group <strong>and</strong> Company net of overdrafts. The carrying amount of these assets approximates their fair<br />

value.<br />

110