Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

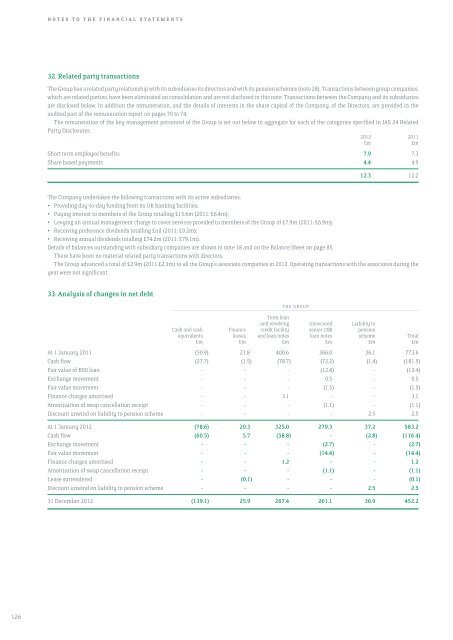

32. Related party transactions<br />

The Group has a related party relationship with its subsidiaries its directors <strong>and</strong> with its pension schemes (note 28). Transactions between group companies,<br />

which are related parties, have been eliminated on consolidation <strong>and</strong> are not disclosed in this note. Transactions between the Company <strong>and</strong> its subsidiaries<br />

are disclosed below. In addition the remuneration, <strong>and</strong> the details of interests in the share capital of the Company, of the Directors, are provided in the<br />

audited part of the remuneration report on pages 70 to 74.<br />

The remuneration of the key management personnel of the Group is set out below in aggregate for each of the categories specified in IAS 24 Related<br />

Party Disclosures.<br />

2012 2011<br />

£m £m<br />

Short term employee benefits 7.9 7.3<br />

Share based payments 4.4 4.9<br />

12.3 12.2<br />

The Company undertakes the following transactions with its active subsidiaries:<br />

• Providing day-to-day funding from its UK banking facilities;<br />

• Paying interest to members of the Group totalling £15.6m (2011: £6.4m);<br />

• Levying an annual management charge to cover services provided to members of the Group of £7.9m (2011: £6.9m);<br />

• Receiving preference dividends totalling £nil (2011: £9.2m);<br />

• Receiving annual dividends totalling £74.2m (2011: £79.1m).<br />

Details of balances outst<strong>and</strong>ing with subsidiary companies are shown in note 18 <strong>and</strong> on the Balance Sheet on page 85.<br />

There have been no material related party transactions with directors.<br />

The Group advanced a total of £2.9m (2011:£2.3m) to all the Group’s associate companies in 2012. Operating transactions with the associates during the<br />

year were not significant.<br />

33. Analysis of changes in net debt<br />

THE GROUP<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

Term loan<br />

<strong>and</strong> revolving Unsecured Liability to<br />

cash <strong>and</strong> cash Finance credit facility senior US$ pension<br />

equivalents leases <strong>and</strong> loan notes loan notes scheme Total<br />

£m £m £m £m £m £m<br />

At 1 January 2011 (50.9) 21.8 400.6 366.0 36.1 773.6<br />

Cash flow (27.7) (1.5) (78.7) (72.2) (1.4) (181.5)<br />

Fair value of BSS loan - - - (12.4) - (12.4)<br />

Exchange movement - - - 0.5 - 0.5<br />

Fair value movement - - - (1.5) - (1.5)<br />

Finance charges amortised - - 3.1 - - 3.1<br />

Amortisation of swap cancellation receipt - - - (1.1) - (1.1)<br />

Discount unwind on liability to pension scheme - - - - 2.5 2.5<br />

At 1 January 2012 (78.6) 20.3 325.0 279.3 37.2 583.2<br />

Cash flow (60.5) 5.7 (58.8) - (2.8) (116.4)<br />

Exchange movement - - - (2.7) - (2.7)<br />

Fair value movement - - - (14.4) - (14.4)<br />

Finance charges amortised - - 1.2 - - 1.2<br />

Amortisation of swap cancellation receipt - - - (1.1) - (1.1)<br />

Lease surrendered - (0.1) - - - (0.1)<br />

Discount unwind on liability to pension scheme - - - - 2.5 2.5<br />

31 December 2012 (139.1) 25.9 267.4 261.1 36.9 452.2<br />

126