Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

Annual Report and Accounts - Hemscott IR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

T R A V I S P E R K I N S A N N U A L R E P O R T A N D A C C O U N T S 2 0 1 2<br />

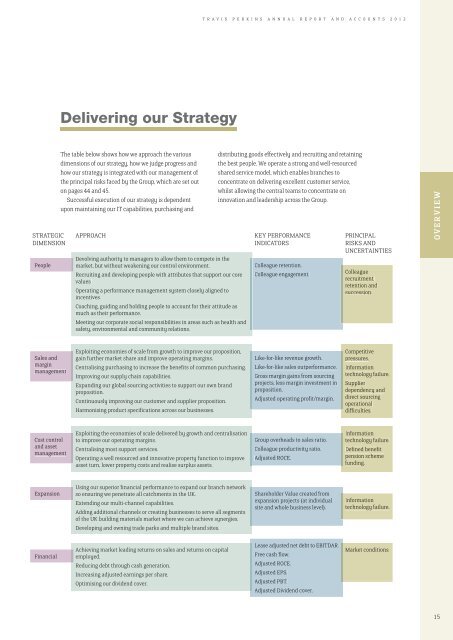

Delivering our Strategy<br />

STRATEGIC<br />

DIMENSION<br />

People<br />

The table below shows how we approach the various<br />

dimensions of our strategy, how we judge progress <strong>and</strong><br />

how our strategy is integrated with our management of<br />

the principal risks faced by the Group, which are set out<br />

on pages 44 <strong>and</strong> 45.<br />

Successful execution of our strategy is dependent<br />

upon maintaining our IT capabilities, purchasing <strong>and</strong><br />

APPROACH<br />

Devolving authority to managers to allow them to compete in the<br />

market, but without weakening our control environment.<br />

Recruiting <strong>and</strong> developing people with attributes that support our core<br />

values.<br />

Operating a performance management system closely aligned to<br />

incentives.<br />

Coaching, guiding <strong>and</strong> holding people to account for their attitude as<br />

much as their performance.<br />

Meeting our corporate social responsibilities in areas such as health <strong>and</strong><br />

safety, environmental <strong>and</strong> community relations.<br />

distributing goods effectively <strong>and</strong> recruiting <strong>and</strong> retaining<br />

the best people. We operate a strong <strong>and</strong> well-resourced<br />

shared service model, which enables branches to<br />

concentrate on delivering excellent customer service,<br />

whilst allowing the central teams to concentrate on<br />

innovation <strong>and</strong> leadership across the Group.<br />

KEY PERFORMANCE<br />

INDICATORS<br />

Colleague retention.<br />

Colleague engagement.<br />

PRINCIPAL<br />

RISKS AND<br />

UNCERTAINTIES<br />

Colleague<br />

recruitment,<br />

retention <strong>and</strong><br />

succession.<br />

OVERVIEW<br />

Sales <strong>and</strong><br />

margin<br />

management<br />

Exploiting economies of scale from growth to improve our proposition,<br />

gain further market share <strong>and</strong> improve operating margins.<br />

Centralising purchasing to increase the benefits of common purchasing.<br />

Improving our supply chain capabilities.<br />

Exp<strong>and</strong>ing our global sourcing activities to support our own br<strong>and</strong><br />

proposition.<br />

Continuously improving our customer <strong>and</strong> supplier proposition.<br />

Harmonising product specifications across our businesses.<br />

Like-for-like revenue growth.<br />

Like-for-like sales outperformance.<br />

Gross margin gains from sourcing<br />

projects, less margin investment in<br />

proposition.<br />

Adjusted operating profit/margin.<br />

Competitive<br />

pressures.<br />

Information<br />

technology failure.<br />

Supplier<br />

dependency <strong>and</strong><br />

direct sourcing<br />

operational<br />

difficulties.<br />

Cost control<br />

<strong>and</strong> asset<br />

management<br />

Exploiting the economies of scale delivered by growth <strong>and</strong> centralisation<br />

to improve our operating margins.<br />

Centralising most support services.<br />

Operating a well resourced <strong>and</strong> innovative property function to improve<br />

asset turn, lower property costs <strong>and</strong> realise surplus assets.<br />

Group overheads to sales ratio.<br />

Colleague productivity ratio.<br />

Adjusted ROCE.<br />

Information<br />

technology failure.<br />

Defined benefit<br />

pension scheme<br />

funding.<br />

Expansion<br />

Using our superior financial performance to exp<strong>and</strong> our branch network<br />

so ensuring we penetrate all catchments in the UK.<br />

Extending our multi-channel capabilities.<br />

Adding additional channels or creating businesses to serve all segments<br />

of the UK building materials market where we can achieve synergies.<br />

Shareholder Value created from<br />

expansion projects (at individual<br />

site <strong>and</strong> whole business level).<br />

Information<br />

technology failure.<br />

Developing <strong>and</strong> owning trade parks <strong>and</strong> multiple br<strong>and</strong> sites.<br />

Financial<br />

Achieving market leading returns on sales <strong>and</strong> returns on capital<br />

employed.<br />

Reducing debt through cash generation.<br />

Increasing adjusted earnings per share.<br />

Optimising our dividend cover.<br />

Lease adjusted net debt to EBITDAR.<br />

Free cash flow.<br />

Adjusted ROCE.<br />

Adjusted EPS.<br />

Adjusted PBT.<br />

Adjusted Dividend cover.<br />

Market conditions.<br />

15