REGIONAL COOPERATION AND ECONOMIC INTEGRATION

REGIONAL COOPERATION AND ECONOMIC INTEGRATION

REGIONAL COOPERATION AND ECONOMIC INTEGRATION

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FDI FLOWS IN SOUTH EASTERN EUROPE<br />

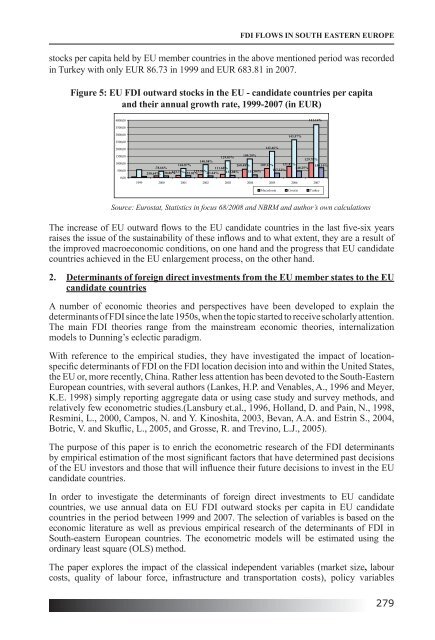

stocks per capita held by EU member countries in the above mentioned period was recorded<br />

in Turkey with only EUR 86.73 in 1999 and EUR 683.81 in 2007.<br />

Figure 5: EU FDI outward stocks in the EU - candidate countries per capita<br />

and their annual growth rate, 1999-2007 (in EUR)<br />

4000,00<br />

141.14%<br />

3500,00<br />

3000,00<br />

2500,00<br />

2000,00<br />

142.46%<br />

143.57%<br />

1500,00<br />

1000,00<br />

500,00<br />

0,00<br />

109.29%<br />

129.83%<br />

129.78%<br />

140.58%<br />

121.82%<br />

146.87%<br />

260.48% 109.12%<br />

150.10%<br />

-78.66%<br />

111.60%<br />

140.25%<br />

167.22%<br />

125.59%<br />

123.73%<br />

133.88% 118.04%<br />

250.64%. 138.86% 125.01% -81.64%<br />

1999 2000 2001 2002 2003 2004 2005 2006 2007<br />

Macedonia Croatia Turkey<br />

Source: Eurostat, Statistics in focus 68/2008 and NBRM and author’s own calculations<br />

The increase of EU outward flows to the EU candidate countries in the last five-six years<br />

raises the issue of the sustainability of these inflows and to what extent, they are a result of<br />

the improved macroeconomic conditions, on one hand and the progress that EU candidate<br />

countries achieved in the EU enlargement process, on the other hand.<br />

2. Determinants of foreign direct investments from the EU member states to the EU<br />

candidate countries<br />

A number of economic theories and perspectives have been developed to explain the<br />

determinants of FDI since the late 1950s, when the topic started to receive scholarly attention.<br />

The main FDI theories range from the mainstream economic theories, internalization<br />

models to Dunning’s eclectic paradigm.<br />

With reference to the empirical studies, they have investigated the impact of locationspecific<br />

determinants of FDI on the FDI location decision into and within the United States,<br />

the EU or, more recently, China. Rather less attention has been devoted to the South-Eastern<br />

European countries, with several authors (Lankes, H.P. and Venables, A., 1996 and Meyer,<br />

K.E. 1998) simply reporting aggregate data or using case study and survey methods, and<br />

relatively few econometric studies.(Lansbury et.al., 1996, Holland, D. and Pain, N., 1998,<br />

Resmini, L., 2000, Campos, N. and Y. Kinoshita, 2003, Bevan, A.A. and Estrin S., 2004,<br />

Botric, V. and Skuflic, L., 2005, and Grosse, R. and Trevino, L.J., 2005).<br />

The purpose of this paper is to enrich the econometric research of the FDI determinants<br />

by empirical estimation of the most significant factors that have determined past decisions<br />

of the EU investors and those that will influence their future decisions to invest in the EU<br />

candidate countries.<br />

In order to investigate the determinants of foreign direct investments to EU candidate<br />

countries, we use annual data on EU FDI outward stocks per capita in EU candidate<br />

countries in the period between 1999 and 2007. The selection of variables is based on the<br />

economic literature as well as previous empirical research of the determinants of FDI in<br />

South-eastern European countries. The econometric models will be estimated using the<br />

ordinary least square (OLS) method.<br />

The paper explores the impact of the classical independent variables (market size, labour<br />

costs, quality of labour force, infrastructure and transportation costs), policy variables<br />

279