E N S W - United Nations Development Programme

E N S W - United Nations Development Programme

E N S W - United Nations Development Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

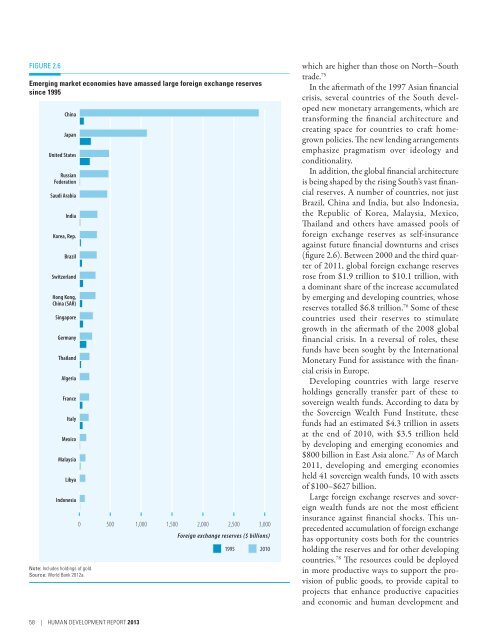

Figure 2.6<br />

Emerging market economies have amassed large foreign exchange reserves<br />

since 1995<br />

China<br />

Japan<br />

<strong>United</strong> States<br />

Russian<br />

Federation<br />

Saudi Arabia<br />

India<br />

Korea, Rep.<br />

Brazil<br />

Switzerland<br />

Hong Kong,<br />

China (SAR)<br />

Singapore<br />

Germany<br />

Thailand<br />

Algeria<br />

France<br />

Italy<br />

Mexico<br />

Malaysia<br />

Libya<br />

Indonesia<br />

Note: Includes holdings of gold.<br />

Source: World Bank 2012a.<br />

0 500 1,000 1,500 2,000 2,500 3,000<br />

Foreign exchange reserves ($ billions)<br />

1995<br />

2010<br />

which are higher than those on North–South<br />

trade. 75<br />

In the aftermath of the 1997 Asian financial<br />

crisis, several countries of the South developed<br />

new monetary arrangements, which are<br />

transforming the financial architecture and<br />

creating space for countries to craft homegrown<br />

policies. The new lending arrangements<br />

emphasize pragmatism over ideology and<br />

conditionality.<br />

In addition, the global financial architecture<br />

is being shaped by the rising South’s vast financial<br />

reserves. A number of countries, not just<br />

Brazil, China and India, but also Indonesia,<br />

the Republic of Korea, Malaysia, Mexico,<br />

Thailand and others have amassed pools of<br />

foreign exchange reserves as self-insurance<br />

against future financial downturns and crises<br />

(figure 2.6). Between 2000 and the third quarter<br />

of 2011, global foreign exchange reserves<br />

rose from $1.9 trillion to $10.1 trillion, with<br />

a dominant share of the increase accumulated<br />

by emerging and developing countries, whose<br />

reserves totalled $6.8 trillion. 76 Some of these<br />

countries used their reserves to stimulate<br />

growth in the aftermath of the 2008 global<br />

financial crisis. In a reversal of roles, these<br />

funds have been sought by the International<br />

Monetary Fund for assistance with the financial<br />

crisis in Europe.<br />

Developing countries with large reserve<br />

holdings generally transfer part of these to<br />

sovereign wealth funds. According to data by<br />

the Sovereign Wealth Fund Institute, these<br />

funds had an estimated $4.3 trillion in assets<br />

at the end of 2010, with $3.5 trillion held<br />

by developing and emerging economies and<br />

$800 billion in East Asia alone. 77 As of March<br />

2011, developing and emerging economies<br />

held 41 sovereign wealth funds, 10 with assets<br />

of $100–$627 billion.<br />

Large foreign exchange reserves and sovereign<br />

wealth funds are not the most efficient<br />

insurance against financial shocks. This unprecedented<br />

accumulation of foreign exchange<br />

has opportunity costs both for the countries<br />

holding the reserves and for other developing<br />

countries. 78 The resources could be deployed<br />

in more productive ways to support the provision<br />

of public goods, to provide capital to<br />

projects that enhance productive capacities<br />

and economic and human development and<br />

58 | HUMAN DevELOPMENT REPORT 2013